US spot Bitcoin ETFs faced a record $672 million in outflows following a crypto market sell-off after the FOMC meeting, ending weeks of net inflows.

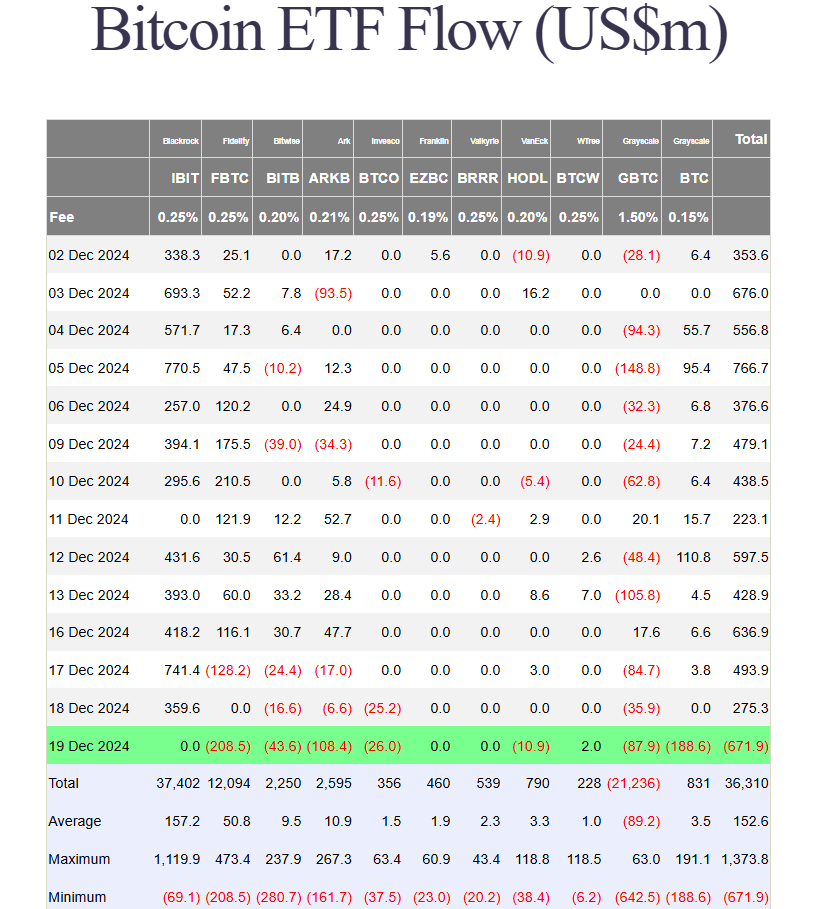

Following the FOMC meeting, the crypto market experienced a significant sell-off, resulting in the largest-ever single-day outflow for US spot Bitcoin ETFs. Approximately $672 million exited these funds on Thursday, marking the conclusion of a period of net inflows that commenced in late November, as per Farside Investors data.

The withdrawal was so significant that it surpassed the previous record of nearly $564 million, which was established on May 1. That day, the group of spot Bitcoin ETFs experienced withdrawals of nearly $564 million after Bitcoin plummeted by 10% to $60,000 in one week.

The exodus was spearheaded by Fidelity’s Bitcoin Fund (FBTC), which experienced $208.5 million in outflows. Grayscale’s Bitcoin Mini Trust (BTC) experienced its lowest point since its inception, with over $188 million in net outflows.

ARK Invest’s Bitcoin ETF (ARKB) and Grayscale’s Bitcoin Trust (GBTC) also experienced substantial withdrawals, with ARKB losing $108 million and GBTC losing roughly $88 million. In the interim, Bitwise, Invesco, and Valkyrie collectively suffered a $80 million loss in the management of three competing ETFs.

Zero flows were registered for the day by BlackRock’s iShares Bitcoin Trust (IBIT), which logged $1.9 billion in net inflows this week and was a significant contributor to the group’s recent strong performance.

WisdomTree’s Bitcoin Fund (BTCW) was the solitary beneficiary, attracting $2 million in new investments.

According to CoinGecko data, Bitcoin’s price plummeted below $96,000 during the market downturn and is presently trading at approximately $97,000, a 4% decrease in the past 24 hours. On Thursday, Crypto Briefing reported that leveraged liquidations totaling $1 billion were initiated as a result of the significant decline in all assets.

The market saw turbulence subsequent to the Federal Reserve’s hawkish messaging following its rate cut decision. On Wednesday, the Federal Reserve implemented a 25-basis-point rate reduction; however, it indicated that there would be fewer cuts in 2025.

The Crypto Fear and avarice Index continues to indicate a trend of avarice sentiment at 74, despite the persistence of price volatility, a mere one point decrease from yesterday.