U.S. Bitcoin ETFs have recorded 8 consecutive days of inflows, showing investor confidence remains strong despite ongoing tensions in the Middle East.

As early market hysteria about the Israel-Iran crisis abated, spot BTC ETFs saw inflows for the eighth day.

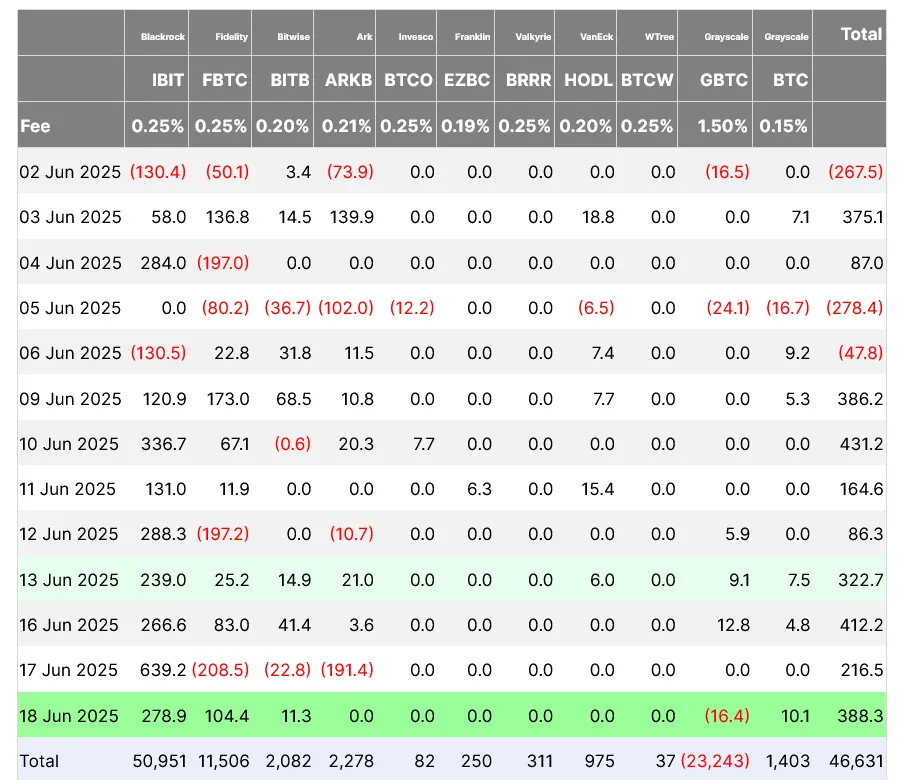

Despite early market fear from the Israel-Iran crisis, US-based spot BTC exchange-traded funds saw $388.3 million in inflows on Wednesday, marking eight days in a row of new capital.

According to data from Farside Investors, the Fidelity Wise Origin Bitcoin Fund (FBTC) and BlackRock’s iShares Bitcoin Trust (IBIT) saw the most inflows, with $104.4 million and $278.9 million, respectively.

Crypto analytics outfit Santiment stated in a June 18 X post that the robust influx on June 18 indicates that institutional confidence is still high, as BTC at $104,984 remained stable at the $105,000 level amid fresh Iran-Israel tensions that initially shook the markets.

“Despite the initial panic, Bitcoin has remained in the $104K-$105K range, aided by consistent ETF inflows and a lack of follow-through in military actions, mirroring the typical ‘risk-off, then stabilize’ pattern seen in previous geopolitical crises.”

The trend, according to Santiment, is quite similar to how the price of BTC responded to Russia’s invasion of Ukraine in February 2022 and the Israel-Palestine dispute in October 2023, when it dropped by 7% before leveling off a few days later.

The Bitcoin ETFs offered by ARK Invest, Invesco, Franklin Templeton, Valkyrie, VanEck, and WisdomTree did not record inflows on June 18, with the Bitwise Bitcoin ETF (BITB) being the only other product to see an inflow of $11.3 million.

The only items in the red were Grayscale’s Bitcoin offerings.

The asset manager’s low-cost Grayscale Bitcoin Mini Trust experienced outflows of $10.1 million, while the Grayscale Bitcoin Trust ETF (GBTC) lost $16.4 million.

Bitcoin ETF inflows are booming.

Inflows into the spot Bitcoin ETFs have accelerated recently after a sluggish start to 2025, reaching an astounding $11.2 billion since April 17.

Since then, the price of Bitcoin has increased from below $85,000 to $104,950 in just eight days of outflows.

The 11 Bitcoin products have received about $46.3 billion, with Fidelity’s FBTC and BlackRock’s IBIT leading the pack with $50.6 billion and $11.5 billion, respectively.

The total includes outflows from Grayscale’s GBTC totaling $23.2 billion.

Ether ETFs are performing as expected.

Before breaking its 19-day inflow streak on June 13, the US spot Ether ETF, ETH$2,523 ETFs witnessed three days in a row with new inflows between June 16 and 18, including more than $19.1 million on Wednesday.

According to Farside Investor data, BlackRock’s iShares Ethereum Trust ETF (ETHA) is in the lead with $5.28 billion in net outflows overall.

Since May 20, BlackRock’s ETHA has seen inflows on all trading days but two, and since May 7, there hasn’t been an outflow.

Strong flows coincide with the Securities and Exchange Commission’s Crypto Task Force’s recent clarification that protocol-level staking is not a securities transaction, which may pave the way for future Ether ETFs with staking capabilities. The task force has also adopted a more cooperative stance with industry participants.