US crypto funds hit a new record with four straight weeks of inflows, reflecting rising institutional demand and renewed market confidence.

The total assets in worldwide crypto funds have increased to $169 billion due to ongoing inflows, which is only 2.5% less than the record of $173.3 billion established in the final week of January.

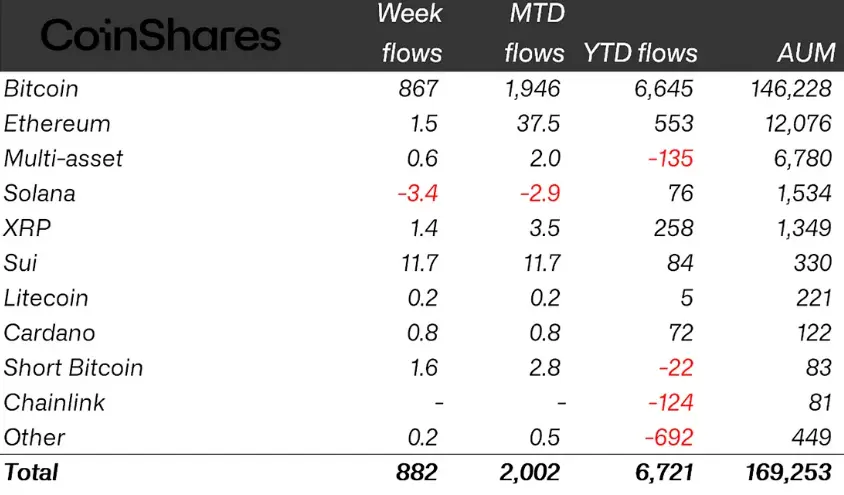

As global crypto funds got closer to all-time high asset levels, cryptocurrency investment products continued to see strong inflows last week, drawing $882 million.

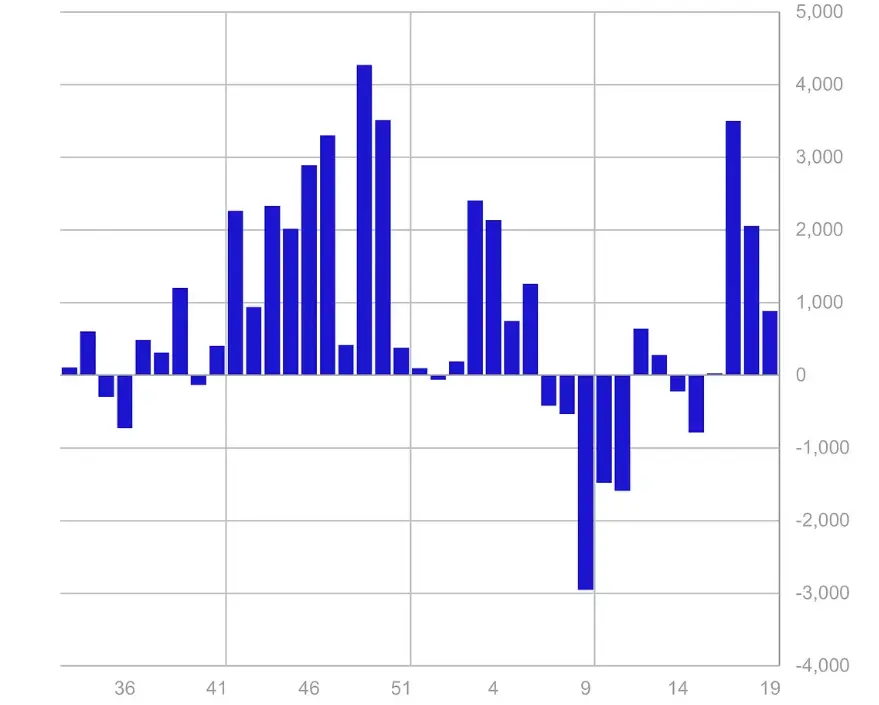

According to data from the European crypto investment business CoinShares, inflows into global crypto exchange-traded products (ETPs) totaled $6.3 billion during the past four weeks, or 93% of all inflows so far this year.

According to CoinShares’ head of research, James Butterfill, total YTD inflows are at $6.7 billion, approaching the $7.3 billion reported in early February.

In a May 12 fund flows update, Butterfill said that due to robust investor demand, cryptocurrency exchange-traded funds (ETFs) in the US had seen cumulative net inflows of $62.9 billion since their introduction in January 2024, surpassing the previous high of $61.6 billion achieved in February.

AUM as a whole approaches a record of $173 billion.

According to CoinShares data, the ongoing inflow trend has reduced the total assets under management (AUM) in global crypto funds to $169 billion, barely 2.5% less than the record of $173.3 billion achieved in the final week of January.

However, the most recent $882 million in inflows marked a significant slowdown compared to the $2 billion recorded in the first week of May and the $3.4 billion recorded in the final week of April.

With $867 million in inflows over the last week,Bitcoin (BTC), priced at $103,900, led the market. Year-to-date inflows have reached $6.6 billion, and AUM has increased to $146 billion.

The $1.5 million inflows into (ETH) investment products priced at $2,541 were less notable, although the assets under management (AUM) increased slightly to $12 billion.

Sui ETPs saw $11.7 million in inflows last week, making SuiSUI$4.06 the altcoin with the most gain.

Solana Sol The only altcoin to experience outflows last week was $174.52, which saw $3.4 million in total, bringing the month-to-date outflows to $2.9 million.

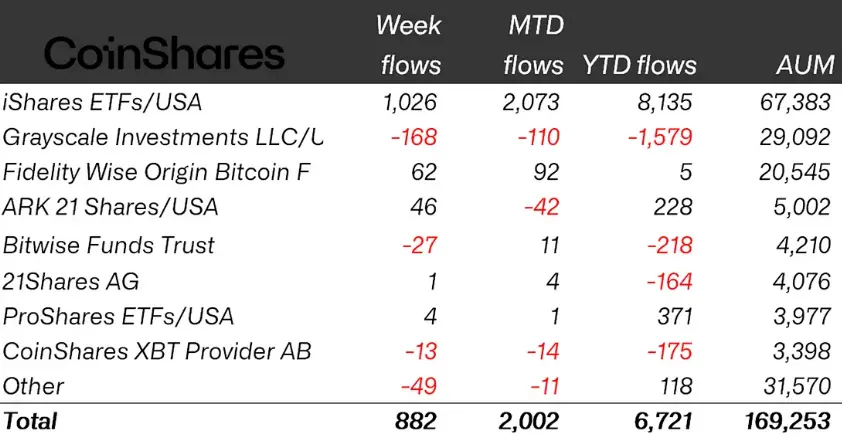

CoinShares reports that BlackRock’s iShares products had $1 billion in inflows last week, indicating that crypto fund inflows were again heavily focused on these products.

BlackRock has received $8.1 billion in inflows this year, far more than the industry average of $6.7 billion.

Bitwise and Grayscale saw further withdrawals, losing $27 million and $168 million the previous week, respectively. ARK and Fidelity reported inflows of $46 million and $62 million, respectively, reversing earlier negative patterns.

Economic factors and an increase in the money supply drive the bullish trend.

The upward trend in the cryptocurrency ETP sector coincided with a surge in the markets, as on May 8, Bitcoin recovered $100,000 for the first time since January.

According to CoinGecko data, the global cryptocurrency market value rose to almost $3.5 trillion with the improving sentiment of investors, an 11% drop from the record high of $3.9 trillion recorded in mid-December 2024.

“We think several factors, including a global increase in the M2 money supply, stagflationary risks in the US, and several US states approving Bitcoin as a strategic reserve asset, are driving the sharp increase in both prices and inflows,” noted Butterfill of CoinShares.

At the time of writing, Bitcoin was trading at $104,407, a little lower than its historic high of almost $106,000 on December 17, 2024.