The approval of spot Ether ETFs has opened a Pandora’s box for another altcoin ETF, which could include Solana, XRP, Chainlink, or Dogecoin amidst US election

The potential for an additional altcoin exchange-traded fund (ETF) in the United States may be contingent upon the political developments expected to occur following the forthcoming 2024 U.S. presidential election.

This is even though the U.S. Securities and Exchange Commission (SEC) has authorized fund administrators to list Ether (ETH).

Even though SEC Chair Gary Gensler acknowledged that the Ether ETFs will require time to be launched, speculation regarding the next crypto ETF has already commenced, with Solana’s SOL being a prime example.

Ophelia Snyder, co-founder and president of 21. co, a sponsor and subadviser for ARK Invest’s spot Ether ETF, stated to Cointelegraph that expectations for new altcoin ETFs should be reasonable despite the enthusiasm for more crypto ETFs.

“It is improbable that the approval of ETH will lead to a significant number of approvals.”

Nevertheless, Bitcoin BTC, at its current price.

Ether ETFs are an example of the high demand for altcoin ETFs from institutional investors, which might force ETF issuers to submit applications.

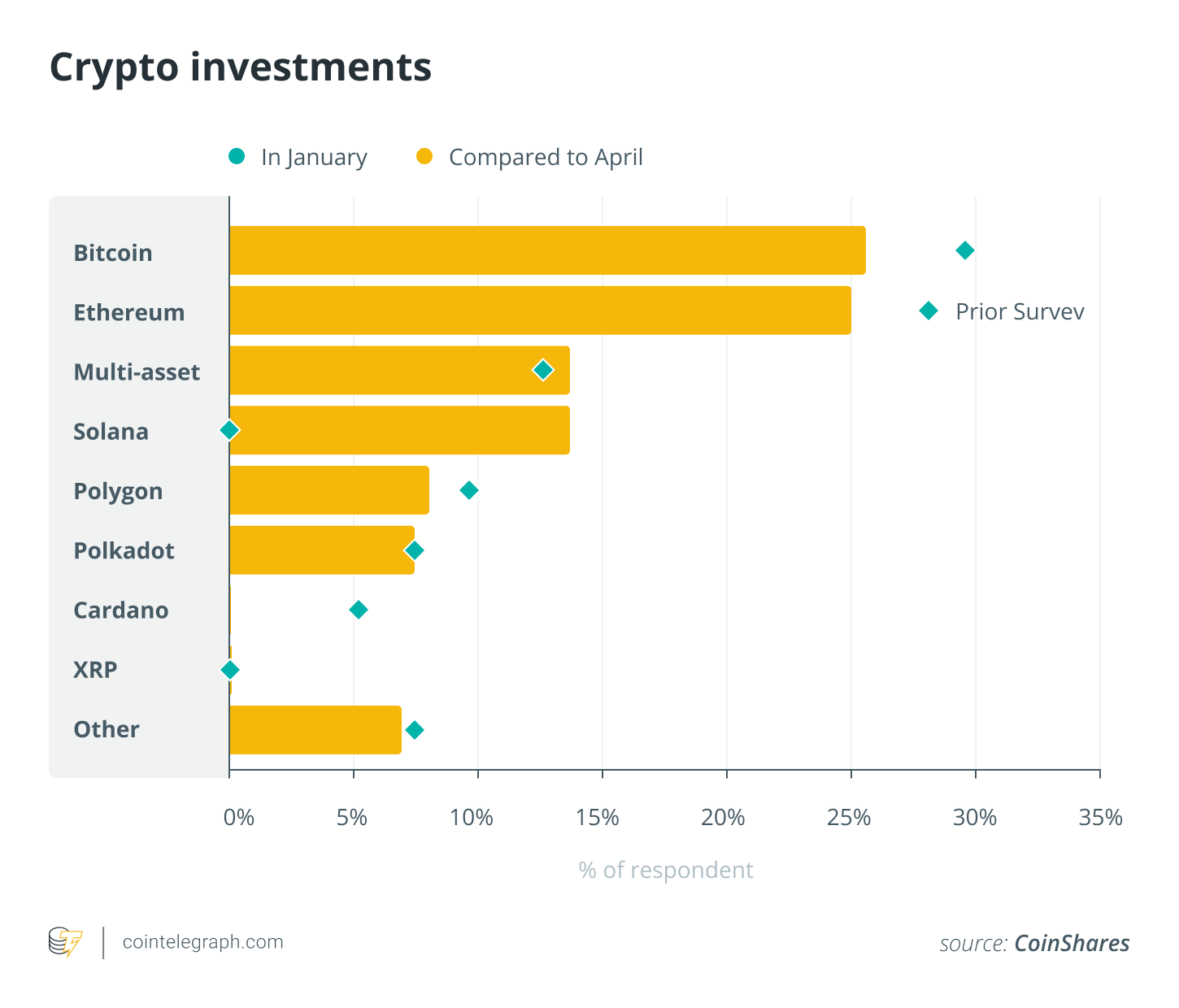

In an April report, coinShares, an alternative asset manager specializing in digital assets, discovered that hedge funds and wealth managers have substantially increased their holdings of altcoins, particularly Solana.

Snyder emphasized the substantial interest in 21. co’s Solana exchange traded-product (ETP) on European exchanges, noting that it has nearly $990 million in assets under management.

The SEC needs to consider the inclusion of alternative cryptocurrencies in future exchange-traded funds (ETFs). For the commission, the decision to approve spot Ether ETFs was already tough to stomach.

The SEC may find it even more challenging to approve an altcoin ETF; however, numerous variables could alter this.

The upcoming U.S. elections may stimulate the ratification of altcoin ETFs

Location Bitcoin, Ether, and altcoin ETFs are available globally. Nevertheless, regulators in the United States are considerably more stringent. Snyder observed that the SEC does not consider foreign altcoin ETFs significant, as “U.S. regulators have a propensity not to rely on foreign regulators.”

Eric Balchunas, an analyst at Bloomberg ETF, informed Cointelegraph that the SEC adheres to a specific timeline for authorizing ETFs. If the agency were to comply with this timeline once more, it could take years for another altcoin ETF to receive approval from the agency.

One critical component that enabled the SEC to examine market integrity was using Chicago Mercantile Exchange (CME) data to compare correlations with spot prices on exchanges like Kraken and Coinbase.

Joshua de Vos, the research director at crypto data firm CCData, explained to Cointelegraph that the analysis utilized a 32-month sample, necessitating a substantial duration of the asset on the CME.

To monitor the price behavior of a crypto asset, Balchunas stated that they would “probably follow the same process” with the current U.S. regulatory administrators, which requires active futures trading on the CME.

Futures altcoin ETFs have yet to be listed in the United States, which implies that the U.S. market may experience a lengthy delay before a spot altcoin ETF is introduced. Nevertheless, Balchunas stated, “The U.S. election is a significant variable.”

The upcoming U.S. elections may significantly impact the future of altcoin ETFs on Nov. 5, 2024, as U.S. crypto regulation is expected to become a political issue. In response to President Joe Biden’s somewhat anti-crypto posture toward U.S. crypto regulation, Donald Trump introduced himself as a pro-crypto candidate.

The outcomes have the potential to alter the trajectory of altcoin ETFs significantly. Balchunas observed:

“In my opinion, other coins could be converted into exchange-traded funds (ETFs) if Trump is elected.”

Balchunas further stated that if Trump were to emerge victorious, he could adopt a “very liberal stance on crypto and support it with everything,” as he has previously stated. In that event, Balchunas noted that Trump could appoint “a new SEC commissioner who is indifferent” to the process that the SEC has followed in the past few years, in which the availability of futures data was a critical component of the spot ETF approval process.

Balchunas also anticipates that Trump’s victory may encourage ETF issuers to submit applications for new crypto ETFs in masses: “I believe that people will experiment with a variety of ETFs if Trump wins.”

Conversely, Balchunas thinks that “it is improbable that an altcoin ETF will be established if Democrats remain in power,” even if Biden replaces Gensler with another Democrat as SEC chair.

The upcoming presidential election results significantly influence the likelihood of an altcoin ETF in the United States. The possibility of an altcoin ETF in 2024 could be higher, as the elected president would assume office in January 2025.

In addition to the forthcoming U.S. elections, it is generally anticipated that specific criteria will be satisfied to secure approval for an ETF: It must provide a robust level of liquidity, decentralization, resistance to price manipulation, and, if feasible, a precise classification from regulatory agencies. Are altcoins prepared to satisfy these prerequisites?

Price manipulation in alternative cryptocurrency markets

Bitcoin and Ether have a significantly larger market capitalization than other alternatives. As Balchunas noted, this is a concern for ETFs, as “the smaller the market, the greater the likelihood of price manipulation.”

De Vos of CCData concluded that the altcoin market is susceptible to market manipulation due to its present state of nascentity.

Nevertheless, price manipulation may not be as significant an obstacle as some individuals may believe.

De Vos observed that spot Bitcoin ETFs were previously rejected numerous times due to concerns regarding market manipulation, but the SEC ultimately “reluctantly” approved them.

Balchunas stated that ETFs were capable of accommodating certain types of price manipulation:

“The mere presence of a small amount of price manipulation or a significant amount of price volatility does not preclude the ownership of an exchange-traded fund (ETF).”

For instance, he stated that GameStop is the largest holding of a few active ETFs. Even though GameStop’s stock price has been manipulated, the ETFs are still operating.

Are ETFs capable of supporting a crypto asset with minimal liquidity?

Another problem is that the volume of altcoin markets is lower than that of Bitcoin or Ether, which results in a lack of liquidity.

Sebastian Heine, the chief risk and compliance officer of Northstake, an institutional staking partner, stated to Cointelegraph that he thinks an altcoin must have a substantial daily trading volume and a large market capitalization to be eligible for an ETF.

Nevertheless, Balchunas elucidated the mechanism by which an ETF can exist without significant liquidity. He observed that subprime bond ETFs exist, and even the largest ones do not trade daily. Consequently, it is reasonable to question why an altcoin ETF is unavailable, given the existence of subprime bond ETFs.

Although exchange-traded funds (ETFs) can have limited liquidity, this can be a problem.

Balchunas clarified that the primary concern in a market with limited liquidity is the emergence of premiums and discounts. This is not advantageous for the ETF, as it may provide a price different from the actual asset. Market managers could assist in preventing these arbitrage gaps at this juncture.

Alexis Sirkia, the co-founder of market maker GSR and current co-founder and chairman of Yellow, stated to Cointelegraph that market makers should be able to guarantee liquidity in the most mature altcoin markets, including Solana.

Furthermore, introducing an ETF would “attract market makers from other markets, resulting in an overall enhancement of the market and liquidity.”

More than lower liquidity metrics may be required for a distinctive ETF in the case of altcoins with lesser markets. Consequently, it may be advantageous to accumulate a collection of Altcoins.

According to Justin d’Anethan, the director of business development at Keyrock, a market maker, combining numerous altcoins to create a sustainable ETF will be necessary. He thinks there may be an “Ethereum layer-2 ETF or a memecoins ETF” in the future.

Nevertheless, investors do not prioritize collections of altcoins. Snyder stated that 21. co has observed a “greater demand for single asset trackers” than for the altcoin baskets that are currently available. She also clarified that it is doubtful that an ETF with a basket of altcoins will be created, as ETF wrappers in the United States will likely necessitate “additional regulatory engagement.”

Will a Solana ETF be implemented?

According to Snyder, Solana is the most promising candidate for the upcoming altcoin ETF due to its superior market capitalization compared to other altcoins. Nevertheless, Solana needs help with centralization.

De Vos clarified that the scoring metrics employed for their crypto ESG Benchmark index assessed decentralized metrics, such as the Nakamoto coefficient, the percentage of coins in the top 10 Solana wallets, and the governance system.

Solana needs to rank within the top 10 of CCData’s decentralization rankings.

De Vos stated that the top 10 Solana holders are responsible for 7.29% of the supply and are instrumental in price action.

The high concentration of wealth among a limited number of wallets is not exclusively a problem for Solana; it is a common issue for altcoins. According to data from CCData, the top 10 wallets possess 5.58% of XRP.

tickers down $0.50

, 4.88% of Stellar Lumens (XLM)

tickers down $0.100

and 3.90% of Chainlink’s LINK

tickers down $15.97

.

Basel Ismail, the CEO of Blockcircle, an investment analytics company, disclosed to Cointelegraph that a small group of Solana enterprise validators provides the most support. If they collaborate, they could potentially undermine the network.

Ismail also observed that Solana has experienced numerous disruptions, resulting in the cessation of trading without indicating when the blockchain will be operational again. He stated that this matter must be resolved before considering any ETF.

Solana ETF will encounter substantial obstacles if the current regulators remain in place following the impending elections. De Vos stated that the SEC has explicitly designated Solana as a security, rendering it highly unlikely that a spot ETF will be authorized once there is a clear understanding of their treatment.

Solana possesses the market capitalization and volume necessary to support an ETF; however, it may require enhancements to its fundamentals to circumvent current U.S. regulatory mandates and become a viable ETF alternative, as is the case with other altcoins.