With the Department of Justice’s approval, the United States government liquidated $6.7 billion in Silk Road Bitcoin that had been confiscated.

The United States government has seized a substantial 69,370 Bitcoins, valued at $6.7 billion, from the popular darknet marketplace Silk Road. The Bitcoins were subsequently dumped. The US Department of Justice (DoJ) has approved the resolution of the protracted dispute regarding Battle Born Investments’ BTC claims. This has prompted investors to speculate whether another BTC price crash below $90,000 is imminent, as the asset experienced a dip below $93,000 earlier today.

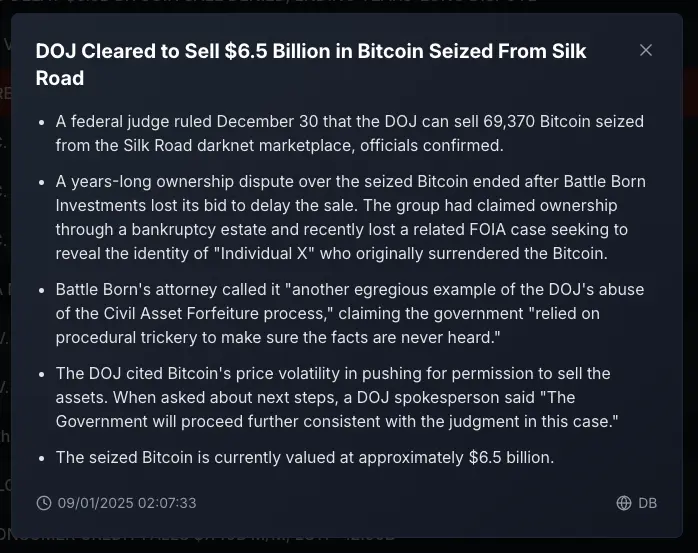

The United States Department of Justice (DOJ) has granted the government permission to sell 69,370 Bitcoins that were confiscated from the Silk Road darknet, as previously reported by DB News. The US government was permitted to liquidate the assets due to the volatility of Bitcoin prices, as stated by the Department of Justice.

As per Arkham Intelligence’s data, the balance in the US government wallet decreased to zero from $6.7 billion on January 8, hours after the reports were reported.

Intriguingly, the selloff occurred just 10 days before Donald Trump’s inauguration at the White House on January 20. Although the Trump team has been contemplating the establishment of a strategic Bitcoin reserve, the Biden government has made a hasty decision to liquidate Bitcoin.

Intriguingly, this ruling from the federal judge was rendered shortly after the new administration assumed control of the office two weeks ago. The decision, rendered on December 30, was rendered subsequent to resolving a protracted ownership dispute with Battle Born Investments. The investment firm was unsuccessful in acquiring ownership of BTC through a bankruptcy estate.

Their attorney has characterized the decision as “another egregious example of the DOJ’s abuse of the Civil Asset Forfeiture process,” Battle Born’s legal team has strongly criticized it. They contend that the government implemented “procedural rules to ensure that the facts were never disclosed.”

Is it imminent that the price of Bitcoin falls below $90,000?

Intense selling pressure erodes all the weekly gains in the Bitcoin price following the rejection at the $100,000 level. The BTC price is trading at $93,915.9, representing a 2.47% decline, with a market capitalization of $1.86 trillion.

Furthermore, the derivatives market is not exhibiting any strength in the BTC price, as the Bitcoin funding rates have declined significantly. ShayanBTC, an analyst at CryptoQuant, observed:

“In the recent Bitcoin rally, Funding Rates showed a sharp increase midway through the upward trend, suggesting a delayed influx of demand. However, after Bitcoin faced rejection at the $108K resistance, Funding Rates declined significantly”.

Conversely, short-term traders transition to exchanges at a loss, anticipating a panic selling event. According to the on-chain data, short-term holders have recently transferred 23,200 units to the exchange at a loss.

Top leaders persist in their optimism

Nevertheless, prominent figures like Robert Kiyosaki maintain a positive outlook on Bitcoin. He composed the following:

“BITCOIN crashing. Great news. I continue buying Bitcoin because Bitcoin crashing means Bitcoin is on sale. Remember “Buy low….and HODL.” Less than 2 million more Bitcoins to be mined”.

Bitcoin has historically been volatile in January following the halving year. In contrast, Arthur Hayes, the former CEO of BitMEX, anticipates that a $612 billion liquidity infusion in Q1 2025 will propel Bitcoin to new heights.

As the United States government sold Bitcoins, President Nayib Bukele of El Salvador suggested that the country may add more to its portfolio. He stated, “We may all have the opportunity to purchase Bitcoin at a discounted price.”