Despite a 40% trading drop, crypto ETPs saw $185M inflows. Bitcoin led with $148M; Ethereum gained $34.5M after ETF approval.

CoinShares’ weekly report states that global digital asset investment products had inflows for the fourth week, totaling $185 million.

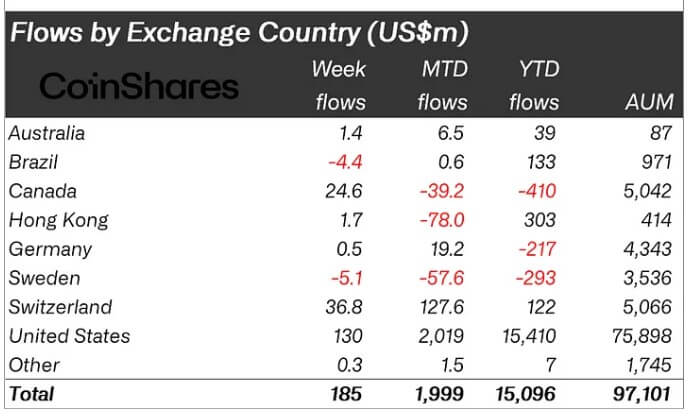

According to the report, these inflows caused May’s total to reach $2 billion, marking the first time that inflows for the year have exceeded $15 billion. However, trading volume fell from $13 billion the week before to $8 billion.

US leads in Crypto

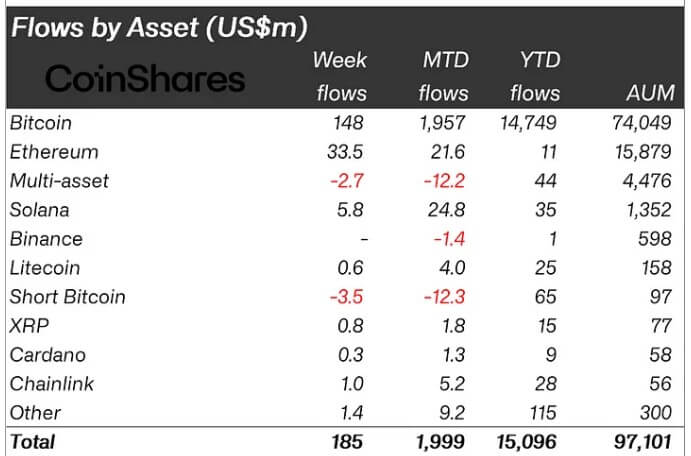

Since Bitcoin is still the key driver of the flows into cryptocurrency investment products, investors’ interest in BTC is still mainly favorable. The leading digital asset had inflows of $148 million over the previous week, while short BTC products experienced outflows of $3.5 million.

Even though Grayscale’s GBTC saw an outflow of $260 million, the US remained the leader in the region with inflows of $130 million. Spot Bitcoin ETFs from Fidelity and BlackRock saw large inflows totaling $475 million.

Switzerland, meanwhile, received $36 million in inflows, its second-highest sum of the year. Despite a net monthly outflow of $39 million, Canada contributed $25 million in inflows, rebounding from the previous weeks’ outflows.

Surprisingly, Hong Kong managed to reverse its pattern of outflows, with small inflows of $1.7 million recorded last week.

Approval of the Ethereum ETF changes investor attitudes.

Ethereum-related cryptocurrency assets, however, have received inflows for the second week running, with investors investing $34.5 million in these financial instruments. With $36 million in inflows last week, ETH experienced its best levels since March.

The Securities and Exchange Commission’s (SEC) decision to approve the 19b-4 registrations of multiple spot Ethereum ETF products was credited by CoinShares as the reason for this turnaround. Before this permission, ETH had a $200 million run of withdrawals during ten weeks.

According to several experts, the Ethereum ETFs may start trading as early as July; however, according to Bloomberg ETF analyst James Seyffart, there is no firm date for the launch because the financial regulator still needs to approve the issuers’ S-1 files.

Positive attitudes surrounding Ethereum, however, also encouraged purchases in other large-cap altcoins, such as Solana, which witnessed $5.8 million in inflows. There were few inflows of less than $1 million in assets such as Chainlink, XRP, and Litecoin.