Latest data shows US PPI inflation at 2.4%, above forecast, dampening investor sentiment due to its potential impact on the Bitcoin rally.

According to the most recent US PPI data, inflation increased from 1.9% in September to 2.4%.

This is the first time in eight months that the US CPI inflation number has shown an increase in the inflationary figure.

Additionally, the Fed’s decision about its monetary stimulus plan depends on this type of data, which feeds market fears.

However, Bitcoin has continued its upward trend and reached a new all-time high of $93,000 despite the CPI inflation data that was hotter than expected.

The US PPI showed 2.4% inflation

The US PPI inflation rate was 0.2% in October, the highest since August 2024, according to the Labor Department’s most recent data, which showed no change from the previous month.

Inflation was 2.4% year over year (YoY), which was higher than the 1.9% rate in September.

In contrast to the previous month’s 0.1%, the Core Producer Price Index, which does not include the prices of food and energy, increased from 0.2% to 0.3%.

According to the report, core inflation increased from 3% in September to 3.1% in October on a year-over-year basis, exceeding market estimates of 2.8%.

However, market concern regarding the US Fed’s next policy rate plan move has been further heightened by the hotter-than-expected US PPI inflation report.

Notably, the most recent US CPI inflation data likewise showed a bullish outlook for the Fed’s impending rate-cut choices.

Will Altcoins or Bitcoin Rise?

Even though yesterday’s US CPI inflation data was stronger than expected, Bitcoin has seen a significant gain.

Following suit, the leading altcoins saw a spike as investors seemed to have dismissed worries about inflation.

A lot of market participants also stated that investors are now paying more attention to Trump’s victory than to macroeconomic developments.

The US Federal Reserve may, however, take a hawkish stance in the future as a result of the growing inflationary pressure.

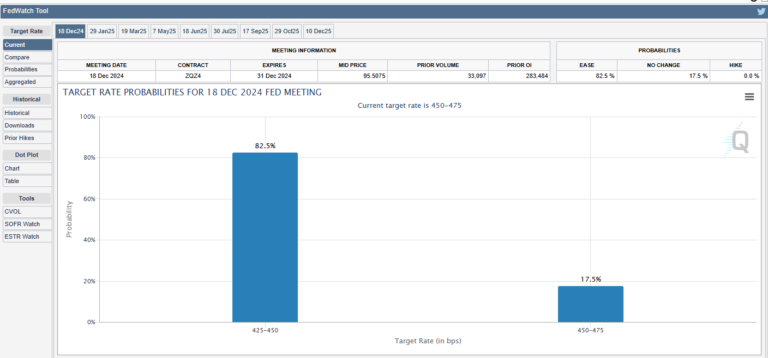

But the CME FedWatch Tool now shows an 82.5% chance of another 25 basis point Fed rate cut in December, up from yesterday’s 60% prediction.

That being said, attention is now turning to Fed Chair Jerome Powell’s speech later today.

The price of bitcoin went up around 2% today, trading at about $91,000, and its number of transactions increased by 18% to $118 billion.

The flagship cryptocurrency reached an all-time high of $93,434.36 in the recent day, demonstrating the increasing investor confidence.

In addition, market optimism has been sparked by renowned trader Peter Brandt’s prediction that Bitcoin will reach $327K in the next few days.