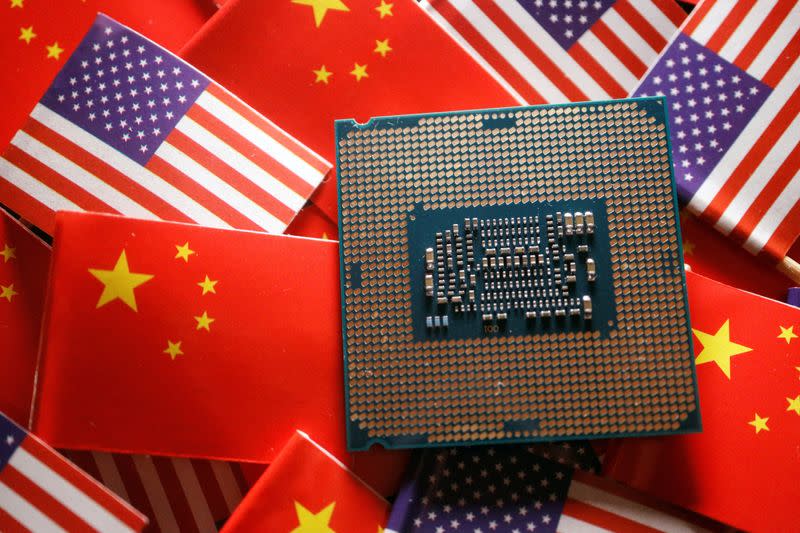

On Monday, the Biden administration said it was finishing up rules limiting U.S. investments in China that could put U.S. national security at risk in artificial intelligence and other technology

The rules were put forward by the U.S. Treasury in June and were made official by an order signed by President Joe Biden in August 2023. They apply to three main areas: chips and microelectronics, quantum information technologies, and some AI systems.

The new rules start on January 2 and will be overseen by the Office of Global Transactions, which the Treasury just formed.

The Treasury said the “narrow set of technologies is core to the next generation of military, cybersecurity, surveillance, and intelligence applications.”

A top Treasury official named Paul Rosen said that the rule applies to technologies like “next-generation fighter jets or cutting-edge computer systems that break codes.”

He said, “U.S. investments, including the intangible benefits like managerial assistance and access to investment and talent networks that often accompany such capital flows, must not be used to help countries of concern develop their military, intelligence, and cyber capabilities.”

It is part of a larger effort to stop U.S. know-how from helping the Chinese make advanced technologies and take over world markets.

Early this year, Gina Raimondo, the secretary of commerce, said that the rules were necessary to stop China from creating technologies that could be used in war.

The new rules have an exception that lets the U.S. invest in widely traded securities. However, officials said that the U.S. already has the power to stop buying and selling securities of certain Chinese companies because of an earlier executive order.

Major American index providers have been criticized by the House Select Committee on China for putting billions of dollars from U.S. investors into stocks of Chinese companies that the U.S. thinks are helping China build its weapons.