Federal agencies are being questioned by Senators Elizabeth Warren and Bill Cassidy over their technological ability to stop cryptocurrency payments used in the selling of child abuse materials.

In the U.S., there is a campaign to stop people from using cryptocurrency to purchase and sell child sexual abuse material (CSAM).

Senators Elizabeth Warren and Bill Cassidy of the United States want to make sure that government organizations are adequately prepared to investigate cryptocurrency transactions connected to the selling of child abuse content.

The Department of Justice (DOJ) and Department of Homeland Security (DHS) were asked to disclose their present technological capabilities as part of this endeavor to terminate CSAM.

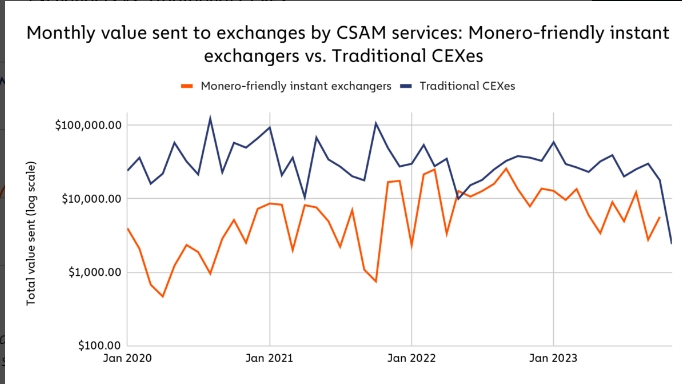

Throughout the research, the senators referenced a January 2024 Chainalysis analysis that indicated a rise in the use of cryptocurrencies in the CSAM black market.

Chainalysis discovered that vendors of child abuse goods are using “mixers” and “privacy coins,” such as Monero XMR tickers down to $123, to launder their income and avoid detection by law enforcement.

The U.S. senators wrote to Attorney General Merrick Garland and Secretary of Homeland Security Alejandro Mayorkas to request information about the DOJ’s and DHS’s present capacity to detect and prosecute these offenses.

“It is difficult for law enforcement techniques and current Anti-Money Laundering (AML) regulations to detect and prevent these crimes effectively.”

Three of the six questions in the letter were designed to assess the independent conclusions reached by the federal agencies regarding the connection between CSAM and Bitcoin. The remainder highlighted the necessity for further instruments to track down and prosecute purchasers and sellers.

By May 10, the senators wanted an answer to the queries.

The cryptocurrency exchange KuCoin and two of its founders were indicted due to the DOJ’s present technological ability to investigate Bitcoin transactions.

The Bank Secrecy Act, or BSA, was violated, and the DOJ accused KuCoin and its two founders on March 26 of “conspiring to operate an unlicensed money transmitting business.”

“The defendants allowed KuCoin to operate in the shadows of the financial markets and be used as a haven for illicit money laundering by failing to implement even basic Anti-Money Laundering policies.”

KuCoin received more than $5 billion and transmitted more than $4 billion in “suspicious and criminal funds,” according to the Justice Department.