The US Treasury uses artificial intelligence (AI) and machine learning to sort through data to find and stop check fraud worth billions of dollars.

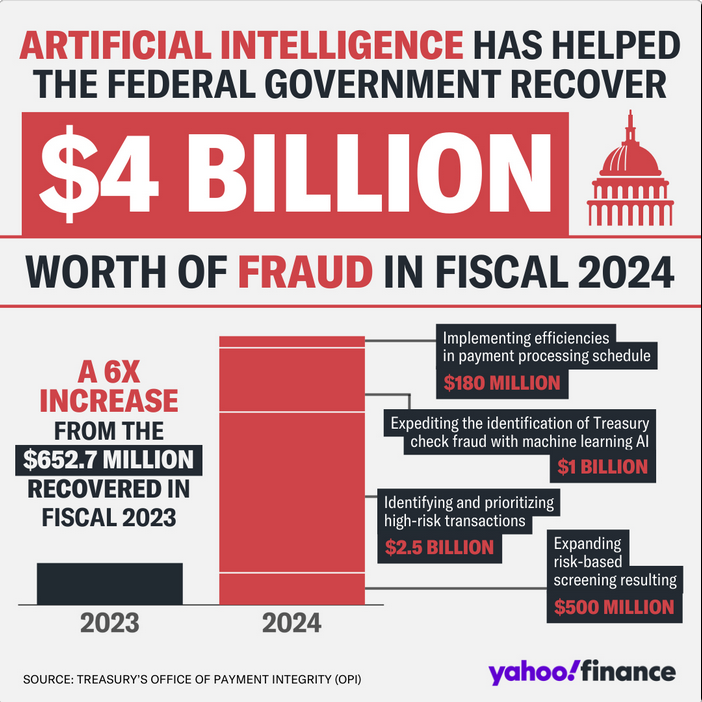

According to the US Department of Treasury, $4 billion in “fraud and improper payments” were recovered in the 2024 fiscal year using artificial intelligence to sort through data.

On October 17, the US Treasury announced that it had recovered nearly four times as much fraud thanks to its use of AI compared to the previous fiscal year when it had recovered $652.7 million.

In late 2022, the US Treasury began employing machine learning AI. This technology specializes in analyzing massive volumes of data and making covert choices and predictions based on what it has learned.

Renata Miskell, a Treasury official, told CNN that “leveraging data has upped our game in fraud detection and prevention,” calling it “really transformative.”

“Fraudsters are really good at hiding. They’re trying to secretly game the system. AI and leveraging data helps us find those hidden patterns and anomalies and work to prevent them.”

The organization “takes seriously our responsibility to serve as effective stewards of taxpayer money,” according to Wally Adeyemo, deputy secretary of the Treasury.

According to Juniper Research, by 2028, online payment fraud is predicted to exceed $362 billion.

The Treasury processes 1.4 billion payments yearly, totaling $6.9 trillion. The Treasury announced in May that it would increase the application of AI to improve law enforcement and regulatory measures taken by the government to combat financial crimes.

More than one US department is utilizing AI. The Internal Revenue Service claimed in September 2023 to have used artificial intelligence (AI) to find tax evaders by looking through intricate and sizable returns from law firms and hedge funds.