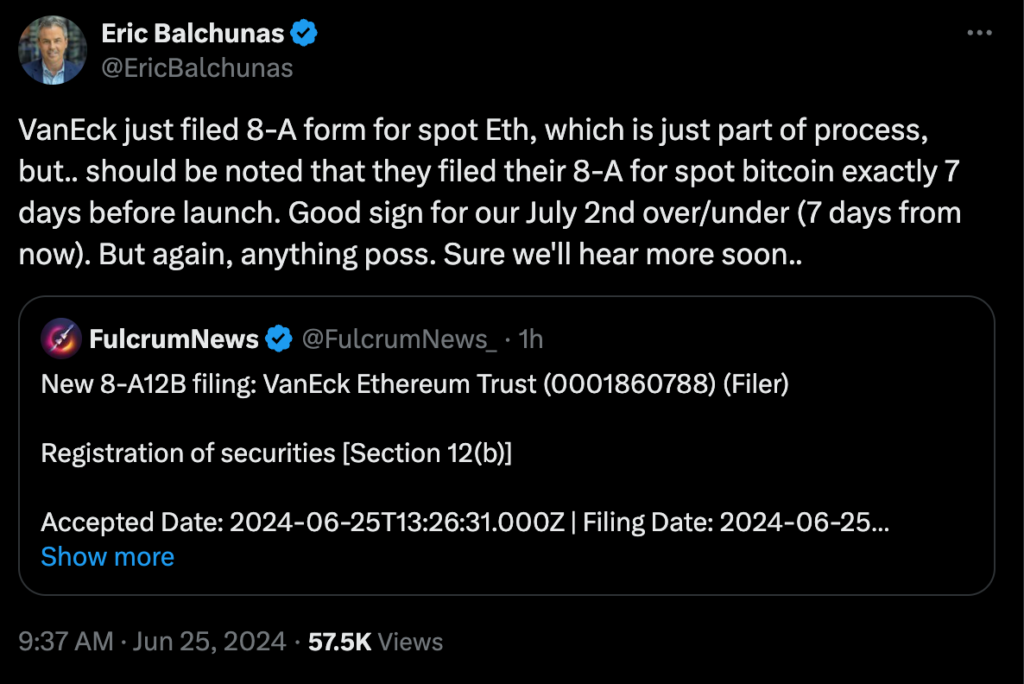

VanEck’s 8-A filing for its Bitcoin ETF was cited by senior Bloomberg ETF analyst Balchunas as a potential indicator of the launch window for an Ethereum ETF.

The spot Ethereum exchange-traded fund, managed by VanEck, was one step closer to live trading when it filed form 8-A with the United States Securities and Exchange Commission (s) on June 25.

Senior Bloomberg ETF analyst Eric Balchunas speculated that spot Ethereum ETFs could be available for trading as early as July 2, 2024, in response to the updated filing. Balchunas’ prediction was reinforced by VanEck’s 8-A registration for its Bitcoin ETF, submitted seven days before the investment fund’s market debut.

The world awaits

Earlier in June, the senior Bloomberg analyst anticipated an early July ETF launch window due to the absence of substantial commentary from SEC staff regarding the S-1 filings of the ETF applicants.

The lack of commentary implies that the regulator has not identified significant issues with the ETF offerings, which could expedite the listing process.

Balchunas also observed that the approval of the Ethereum ETFs was unexpected and likely influenced by political factors from the current administration.

Nevertheless, SEC Chair Gary Gensler conveyed the opposite sentiment and stated that listing Ethereum ETFs on stock exchanges could take months and may only occur in September 2024. Gensler attributed the responsibility for the Ethereum ETF listings to the applicants and asserted that the process is wholly contingent upon their response times.

Political tailwinds

The approval of a spot Ethereum ETF in the United States surprised many and represents a radical departure from the current administration’s policies, as Balchunas suggested.

The 2024 election year has brought cryptocurrencies into sharper focus as presidential candidates across the board attempt to appeal to pro-crypto voters.

Pro-crypto voters constitute a tangible voting cohort in American elections, as approximately 52 million Americans possess cryptocurrency, as the Stand with Crypto political action committee reported.

The PAC also disclosed that it had achieved a substantial milestone by collecting one million advocate signatures from the public.

The blockchain industry has capitalized on the opportunities presented by an election year by mobilizing various initiatives to inspire the voting public.

These initiatives include the recent announcement that the Gemini exchange will facilitate donations to pro-crypto candidates and the establishment of the Bitcoin Voter Project. This non-profit organization focuses on Bitcoin education and awareness.