VanEck files for JitoSOL ETF, tracking Solana’s staking token, after SEC clarifies liquid staking isn’t a security, aiming for investor yield access.

A JitoSOL ETF has been submitted to the U.S. Securities and Exchange Commission (SEC) by asset manager VanEck. This represents a significant change in the industry, as this fund may become the first to concentrate its investments in a liquid staking token (LST).

Files S-1 for JitoSOL ETF with the SEC by VanEck

The asset manager has submitted its registration statement to the Commission to offer a JitoSOL, as evidenced by an SEC filing. The liquid staking token will be this fund’s primary asset, offering institutional investors spot exposure to the token.

This action is consistent with the Securities and Exchange Commission’s guidance on liquid staking activities, which clarified that the activities are not classified as securities. This paves the way for the prospective approval of the JitoSOL ETF, as LST does not qualify as a security.

Additionally, VanEck disclosed in the filing that the fund anticipates receiving specific staking rewards due to its ownership of JitoSOL. Users receive the LST, the native token of the liquid staking protocol Jito, when they stake their Solana tokens.

This implies that VanEck will be required to acquire Solana for its JitoSOL ETF. Subsequently, it will stake the ETF using the Jito protocol and receive these LSTs as compensation. The asset manager will also receive staking rewards during the process, and they are free to utilize their tokens for other DeFi purposes. Notably, the asset manager was among those who advocated for the SEC to authorize LSTs in Solana ETFs.

A stock exchange is anticipated to submit the 19b-4 form to list and trade shares of the JitoSOL ETF following the S-1 filing. The 19b-4 filing will initiate the review procedure, and the SEC will ultimately be required to approve or deny the proposed rule change.

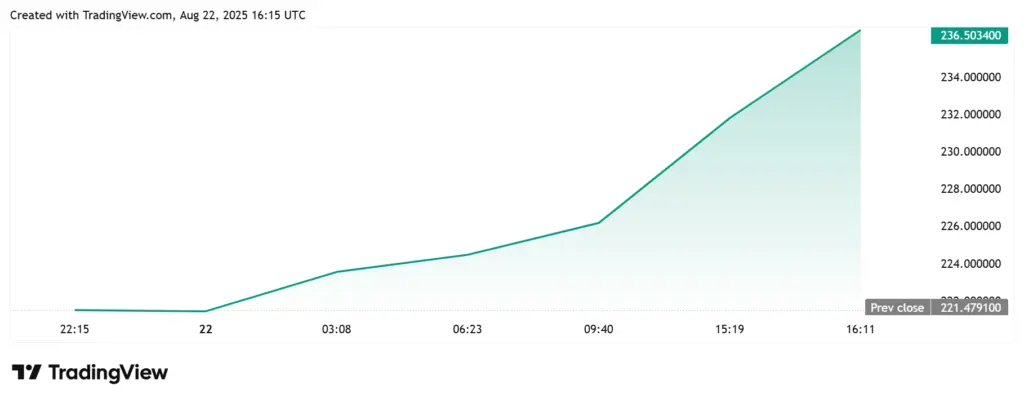

TradingView data indicates that the JitoSOL price has increased over the course of this filing. In the past 24 hours, the LST has risen by over 6%, trading at approximately $236.

Importance of ETF Filing

Brian Smith, the leader of the Jito Foundation, emphasized the importance of VanEck’s ETF filing in an X post. He observed that the unbonding periods, which confound the daily requirements of ETFs, are the most significant issue with staked Solana ETFs.

The result is that natively staked ETFs must maintain 25% of their assets under management in spot Solana. If they cannot honor investor redemptions, they are at risk of a bank run.

Smith clarified that this is where funds such as the JitoSOL ETF come in, as they resolve the challenge of achieving a high yield while maintaining liquidity. Fund issuers can completely stake the underlying asset with 100% LST-backed ETFs, and the mechanics for creation and redemption are simplified with the LST.