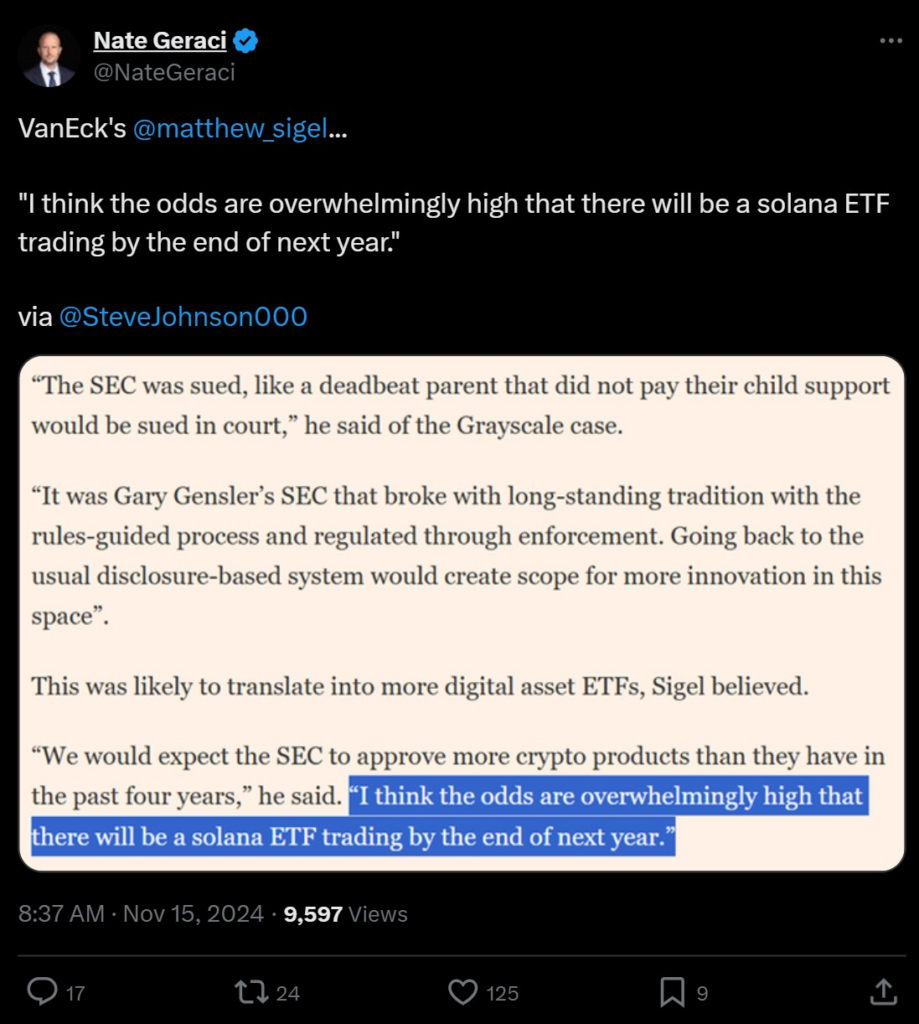

The U.S. focused on Bitcoin and Ether ETFs, could list a Solana ETF by 2025, says VanEck’s Matthew Sigel via the Financial Times.

Matthew Sigel, head of digital asset research at VanEck, stated on November 15 that there is an “overwhelmingly high” chance that a Solana ETF will list in the US by the end of 2025.

Following the victory of crypto-friendly Donald Trump in the Nov. 5 presidential election, Sigel anticipates that the US Securities and Exchange Commission will approve additional planned bitcoin products.

In an interview with the Financial Times, Sigel stated, “We would expect the SEC to approve more crypto products than they have in the past 4 years.”

“I think the odds are overwhelmingly high that there will be a Solana ETF trading by the end of next year.”

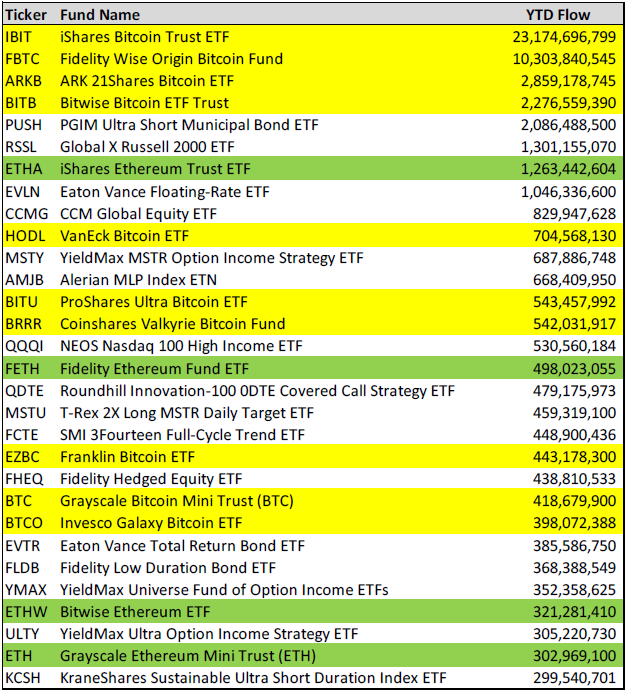

More than half a dozen proposed cryptocurrency exchange-traded funds (ETFs) are awaiting regulatory approval to list in the United States, thanks to Trump’s victory.

Asset managers filed numerous regulatory files in 2024 to launch exchange-traded funds (ETFs) that included altcoins, such as SOL and XRP.

Additionally, issuers are awaiting clearance for a number of anticipated crypto index exchange-traded funds (ETFs) that are intended to hold a variety of token bundles.

Eric Balchunas, an ETF analyst at Bloomberg Intelligence, stated on October 25 that these registrations were essentially “call options on a Trump victory” in the US presidential election.

The SEC has taken a tough regulatory approach to cryptocurrency under President Joe Biden, bringing up to 100 regulatory actions against businesses in the sector.

According to Balchunas, Trump “will put in a more libertarian [Securities and Exchange Commission] chair.”

Gary Gensler, the chair of the SEC, has not been replaced by Trump. Chris Giancarlo, the former chair of the CFTC, announced on November 14 that he would not be taking up the position.

According to reports, Trump is thinking of appointing Summer Mersinger as the CFTC’s chair.

Second only to the SEC in the United States’ regulated cryptocurrency markets, the CFTC is an important player.

Mersinger, a Republican commissioner at the CFTC, has called on the agency to be more lenient with regard to cryptocurrency.

The SEC began examining Grayscale’s application to establish the first exchange-traded fund (ETF) that holds a variety of cryptocurrencies, including a number of altcoins, on November 4.

A request to launch the first options linked to spot Ether ETFs on the NYSE American securities exchange was under review by US regulators as of November 8.

“[The] election was a huge victory for cryptocurrency.” Matt Hougan, Bitwise Asset Management’s chief investment officer, told the Financial Times, “It’s a total game-changer.”

“For the past four years, crypto has been operating with one arm, maybe two arms, tied behind its back. It’s faced a hostile SEC, major regulatory uncertainty [and] constrained access to basic banking services.”

Hougan remarked, “Just think of what will happen when the headwinds stop.”