Venezuelans have been subjected to an economic nightmare as a result of spiraling inflation, sanctions from the United States, and government malfeasance.

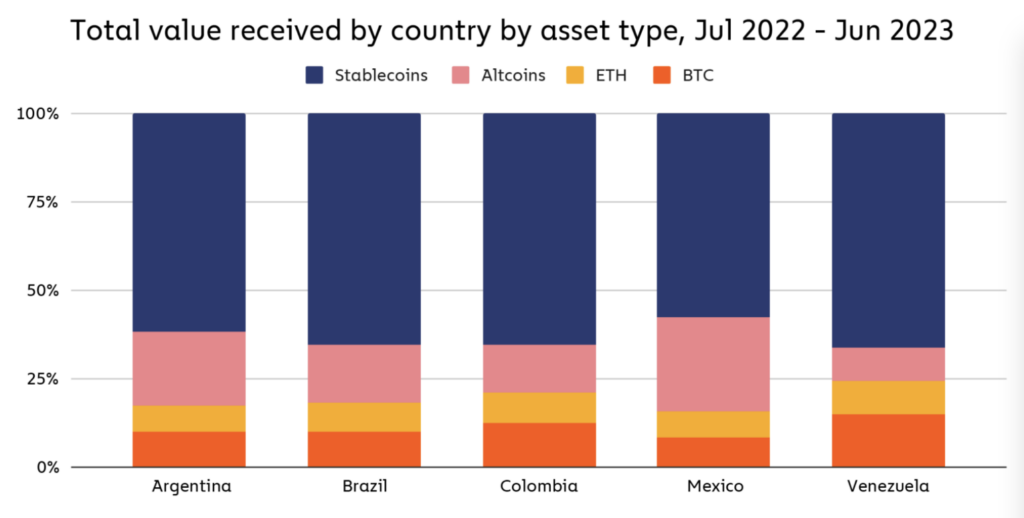

Crypto remittances from family members living abroad have increased to assist Venezuelan residents experiencing persistent inflation and supply issues as the economic situation in the country continues to deteriorate.

Cryptocurrencies comprised 9% of the $5.4 billion in remittances sent to Venezuela in 2023, valued at $461 million. Chainalysis has reported that remittances to Venezuela have increased annually since 2018, except in 2020.

Western Union is a common service used to send remittances. Nevertheless, despite their robustness, these services can often be unfeasible for individuals in the developing world due to comparatively high fees, waiting periods, and currency supply issues.

Venezuela’s economic catastrophe

Venezuela’s economy remains beset by persistent inflation, supply issues, government corruption, and crushing sanctions despite possessing the world’s largest proven hydrocarbon reserves.

In 2018, the Venezuelan government established a state-backed cryptocurrency called the “Petro” to circumvent United States sanctions on the energy-rich nation. Regrettably, the cryptocurrency was unable to achieve widespread adoption due to its perceived corruption and lack of legal tender status within the country.

Even Venezuela’s central bank declined to acknowledge the Petro, discontinued in 2024 after six years of tenuous existence. Nevertheless, the Venezuelan government continued to employ digital assets to circumvent U.S. sanctions.

Reports emerged earlier this year that the Venezuelan government attempted to utilize cryptocurrencies to facilitate international oil trade. Tether, a stablecoin issuer, responded by announcing that it would suspend USDT assets held by Venezuela by U.S. sanctions.

Interestingly, the nation is also grappling with extensive energy shortages. Venezuelan officials declared in May 2024 that crypto mining was prohibited due to the excessive strain on the country’s power grid, which has been in a state of crisis for the past decade.

Maduro government hostile to mining?

The prohibition of crypto mining in May 2024 was not the first instance in which Venezuelan officials have targeted mining operations and implemented anti-crypto policies.

In 2023, the country closed mining facilities in response to an ongoing corruption investigation into Venezuela’s oil industry and the activities of the director of its crypto ministry, Joselit Ramirez Camacho.