WazirX has implemented a reorganization strategy supported by Singapore to bounce back from its $235 million cyberattack in July 2024.

Following a $235 million cyberattack in July 2024, the Indian cryptocurrency exchange WazirX revealed a reorganization plan to compensate impacted users.

The exchange laid out the scheme, allegedly targeted by North Korea’s Lazarus Group while supervised by Singapore’s judicial system.

In August 2024, its parent company, Zettai, submitted a request for a moratorium to the Singapore High Court and a restructuring plan under a Singapore scheme of arrangement.

Companies can restructure their debts and liabilities through a court-approved legal process called a Singapore Scheme of Arrangement. It enables the business to offer creditors a legally enforceable agreement, guaranteeing settlement and preventing liquidation.

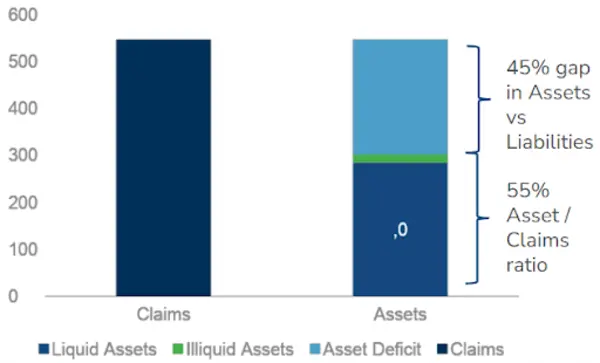

WazirX reported liquid assets of $566.38 million USDt USDT$0.9998 as of December 2024, more than the $546.47 million USDT in total claims submitted by users in July 2024.

The business has also launched recovery tokens to resolve unresolved claims, which let creditors profit from recovered assets and future platform activities.

Concentrate on getting better.

The restructuring is a start toward rebuilding user trust, according to Nischal Shetty, creator of WazirX.

“We took a decisive step for the benefit of users so they can receive distributions as soon as possible by filing for the moratorium and applying to the court for a scheme process so quickly,” Shetty said. “My main objective is to add more value than what was stolen, and token distributions will take place soon after the scheme is approved by creditors and sanctioned by the court.”

According to the firm, 75% to 80% of the value of users’ account balances at the time of the cyberattack might be recovered through token distributions.

The first distributions will be made in ten business days following the scheme’s approval and implementation.

Recovery tokens, which would be used to represent the remaining creditor claims, will be repurchased regularly utilizing platform operating earnings and a planned decentralized exchange (DEX).

To make more money and resolve unresolved claims, WazirX also intends to introduce a DEX.

CoinSwitch profits from the hack in response to the WazirX breach.

CoinSwitch, an Indian cryptocurrency exchange that competes with WazirX, has created a recovery fund to aid those affected by the cyberattack.

On January 7, CoinSwitch officially announced the opening of its recovery fund, “CoinSwitch Cares,” which has a total value of 600 crore Indian rupees ($69.9 million) and was created in response to the WazirX breach.

Interestingly, CoinSwitch is also suing WazirX to recoup 2% of its money stuck with WazirX, totalling 12.4 crore rupees ($1.44 million).