The hacker responsible for the $235 million crypto exchange WazirX theft has switched around $150m in crypto to ETH to avoid having their money blocked.

Blockchain security firms report that criminals often convert altcoins to Ether for laundering, as the native token lacks a freezing mechanism.

The hacker responsible for the $235 million cryptocurrency exchange WazirX theft has switched around $150 million in cryptocurrencies to Ether to avoid having their money blocked or banned.

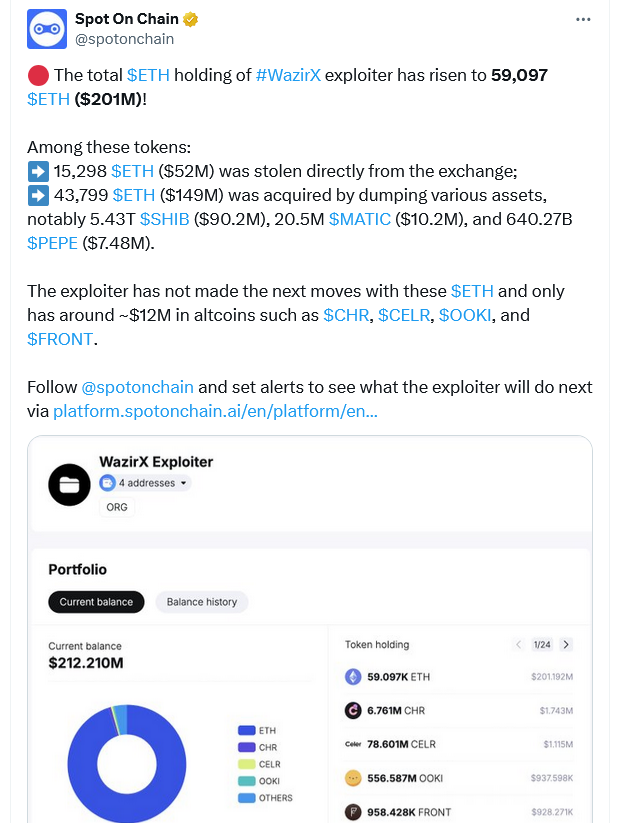

The hacker exchanged $90.2 million in Shiba Inu (SHIB$0.000017), $10.2 million in Polygon (MATIC$0.5192), and about $7.5 million in Pepe (PEPE) for Ether ETH$3,425 on July 18 and July 19, according to blockchain analytics company Spot On Chain.

The total amount of stolen money in Ether ETH, $3,425, has increased from $52 million to $201 million due to the transfers.

Numerous Justifications for Switching to Ether in the WazirX Hack

According to Spot On Chain, the hacker most likely moved the ERC-20 tokens to Ether because it is far more liquid and cannot be blocked.

“Some ERC20 tokens have a contract function to blacklist addresses, while ETH native token does not have such a feature.”

Blockchain security company PeckShield stated that, “Swapping to Ether quickly can help the hacker secure their funds before any preventative measures are taken by authorities or the issuers of centralized tokens.”

Stablecoin provider Tether is a prime example; it has added USDT$1.00 Spot On Chain to its blocklist of hundreds of wallets that have made questionable transactions.

The price of Ether is also considerably more steady and, therefore, more straightforward to launder through mixer protocols and cryptocurrency exchanges, according to blockchain security company Beosin.

The hack caused a selloff in SHIB, which has dropped by around 7% since the event, but Ether’s price has only declined by 0.1%.

According to Spot On Chain in the X article, the hacker still possesses tokens worth about $12 million from Chromia (CHR), Celer Network (CELR), Frontier (FRONT), and Ooki (OOKI).

Based on WarzirX’s June proof-of-reserves statement, the Indian cryptocurrency exchange stopped accepting withdrawals on July 18 after the security compromise destroyed over half of its reserves.

“Although this is an uncontrollable force majeure situation, we are trying to track down and retrieve the money.” WazirX tweeted to X, “We have already stopped a few deposits and contacted the affected wallets for recovery.

Elliptic, a blockchain forensics company, said that they thought North Korean hackers were responsible for the $235 million hack because of specific patterns and tactics in the WazirX attack.