WazirX plans to compensate users after a $235M cyberattack, using a Singapore court-approved restructuring. Its liquid assets of $566.38M USDT exceed user claims of $546.47M.

The Indian cryptocurrency exchange WazirX was hacked in July 2024 and lost $235 million. The company has now revealed a plan to restructure in order to pay back users who were affected.

The exchange, which is said to be a target of North Korea’s Lazarus Group, has laid out the plan while Singapore’s legal system watches.

In August 2024, Zettai, the parent company that runs WazirX, asked the Singapore High Court for a halt and put forward a plan to restructure the company under a Singapore Scheme of Arrangement.

A Singapore Scheme of Arrangement is a legal way for companies to restructure their debts and liabilities that has been allowed by the courts. It lets the business make a legally binding deal with its creditors, which keeps the business from going bankrupt.

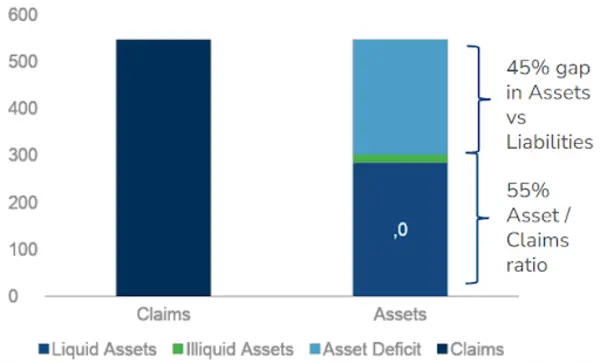

WazirX had $566.38 million USDT in liquid assets as of December 2024, which was more than the $546.47 million USDT in claims made by users in July 2024.

The business has also created recovery tokens to settle unpaid debts. This way, creditors can get money from future platform activities and recovered assets.

Nischal Shetty, the founder of WazirX, said that the change was a step toward restoring trust among users.

“Our swift filing for the moratorium and application to the court for a Scheme process was a decisive step taken for the benefit of users so they can receive distributions as soon as possible,” Shetty told Cointelegraph. “Token distributions will be made shortly after the Scheme is approved by creditors and sanctioned by the court […] my number one goal is to add more value than what was stolen.”

The business said it would return users’ money through token distributions, which could give back 75% to 80% of the value of their account amounts at the time of the hack.

Ten business days after the plan is accepted and goes into effect, the first distributions will be made.

Recovery tokens will stand for the remaining creditor claims. These tokens will be bought back regularly with profits from running the platform and a proposed decentralized exchange (DEX).

WazirX also wants to start a DEX to make more money and settle claims that are still open.

CoinSwitch, an Indian cryptocurrency exchange that competes with WazirX, has announced a recovery fund to help people who were hurt by the WazirX hack.

On January 7, CoinSwitch shared on X that the WazirX hack recovery fund, which is worth 69.9 million Indian rupees, was now open for business. The fund is called “CoinSwitch Cares” and is run by the company.

Notably, CoinSwitch is also going to court against WazirX to get back 2% of its funds that are stuck with WazirX. This is worth a total of 12.4 crore rupees ($1.44 million).