Webus International files Form 6-K with SEC, confirming a $300M XRP reserve deal with Samara Alpha to enhance global payment infrastructure.

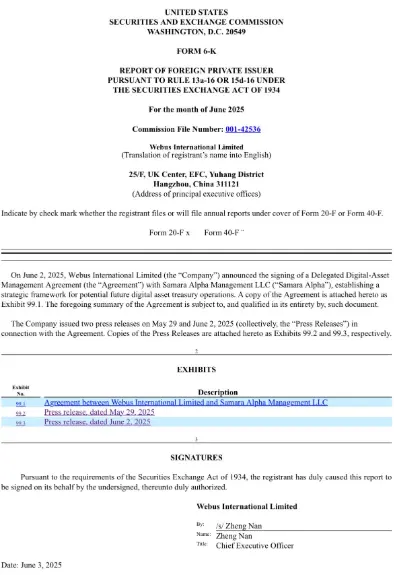

As part of its strategic partnership with Samara Alpha Management LLC to oversee up to $300 million in XRP, Webus International Limited, a Nasdaq-listed AI-driven mobility solutions provider based in China, submitted a Form 6-K to the US Securities and Exchange Commission.

Webus submits Form 6-K to the Securities and Exchange Commission (SEC) for its Treasury Operations

In his most recent X post, Bill Morgan, an XRP litigator, disclosed the Form 6-K filing regarding its Delegated Digital-Asset Management Agreement with the SEC-registered investment adviser. Morgan observed,

Webus has filed its form 6-K with the SEC after signing the previous day a Delegated Digital-Asset Management Agreement with a delegated manager to establish a strategic framework for potential future digital asset treasury operations, which it asserts are focused on XRP management and an authorised mandate cap of up to $300M.

They intend to establish an XRP reserve by raising $300 million through various non-equity financing sources. The platform is developing a blockchain infrastructure on the XRP network to mitigate delays and fees associated with international transactions.

Webus has formed a partnership with Samara Alpha Management

Webus and Samara Alpha Management, a prominent SEC-registered investment adviser, announced their partnership on June 2. The joint venture’s objective is to establish a strategic framework for the future of digital asset treasury operations. Samara Alpha will be the exclusive digital asset manager for Webus under the Agreement, with a mandate limit of up to $300 million.

Nan Zheng, the Chief Executive Officer of Webus, expressed her perspective on the platform’s vision, stating,

This Agreement defines a clear structure for trusted digital asset management in the future. As we continue to evaluate innovative approaches to treasury management, establishing this framework with a regulated, institutional-grade partner provides us with strategic optionality while maintaining prudent controls.

Webus is not the only organization investigating the potential of XRP for corporate applications. VivoPower, an additional Nasdaq-listed company, has implemented an XRP-centric treasury strategy by raising $121 million to establish an XRP reserve.

The XRP price has experienced a notable increase of 3.3% over the past day due to these significant developments. The token is currently trading at $2.25, and the trading volume has increased by 23%, indicating that traders’ sentiment has increased.