With a history of price fall, a Solana validator unstaked a large amount of the asset again as the market saw a mild correction

Over the previous three days, 200,000 tokens were unstacked by a Solana whale, according to on-chain data. Subsequently, the validator transferred the assets, estimated to be worth $30 million, to Binance, the most significant cryptocurrency exchange in terms of trading volume.

1.2 million SOL, valued at $178 million, were unstacked and sold by the validator between June and July, as indicated by Solscan data. The Solana price plummeted from $170 to $125 in less than three weeks.

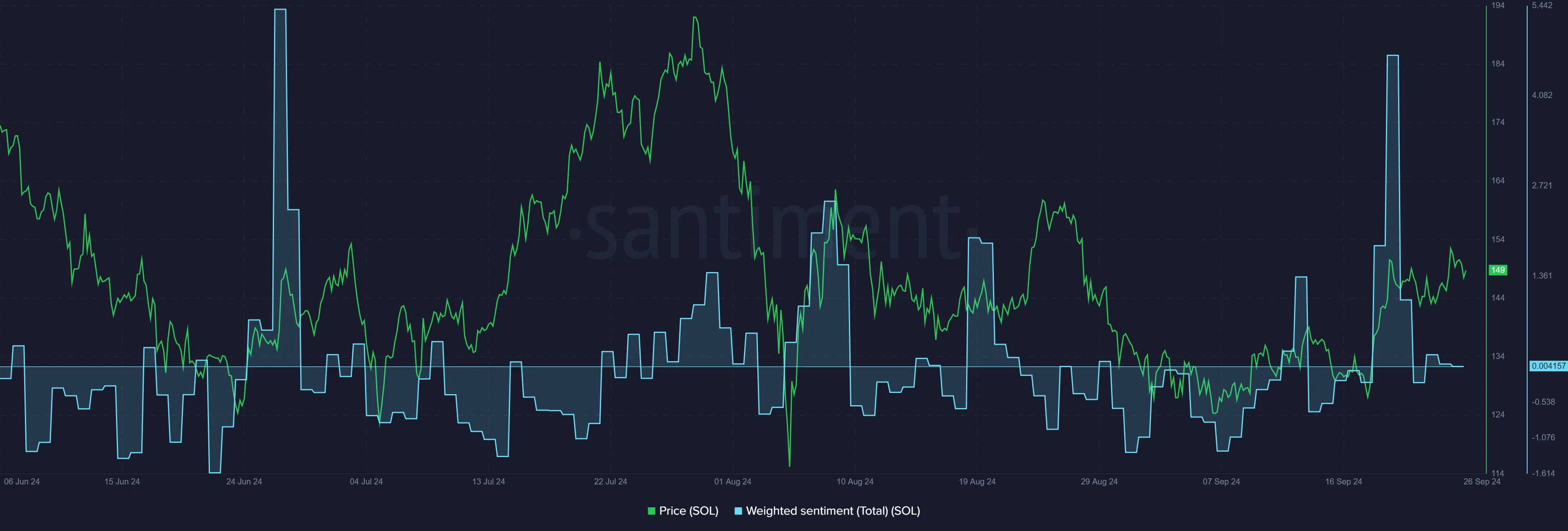

Solana observed a sentiment that was strikingly similar to the whale’s movements. The weighted sentiment surrounding Solana on social platforms on June 7, when the validator began unstaking, is as per the data provided by Santiment.

The asset has been experiencing a consistent decline in social sentiment over the past week and is presently undergoing a neutral momentum.

It is crucial to acknowledge that the current $30 million is nearly six times lower than the $178 million selloff four months ago.

Despite the market-wide correction, Solana has been consolidating around the $150 mark in the past 24 hours and has experienced a 9% price increase over the past week.

The asset’s daily trading volume has decreased by 33% and is presently at $1.9 billion, with no indications of a significant SOL selloff.

The SOL Relative Strength Index is currently at 48, according to data from crypto.news indicates. At this price position, the indicator shows that Solana is neutral, meaning it is neither overbought nor oversold.

SOL’s price decline is unlikely if the broader crypto market maintains its upward trajectory; however, it is prudent to exercise caution.