Despite the potential sell pressure from Mt. Gox creditors, which could result in 99% of investors selling, bitcoin whales continue to accumulate.

Even though more than one-third of the Bitcoin owed to defunct creditors of the Mt. Gox exchange has already been distributed, large Bitcoin holders continue their buying frenzy unabated.

According to a July 17 X post by CryptoQuant, over 36% of the Bitcoin owed to the creditors of Mt. Gox has already been distributed. They composed the following:

“The trustee holds 141,686 BTC, which will be distributed over time. With yesterday’s transaction, 36% of the Bitcoin has been moved to their former users.”

The potential sell pressure that could be introduced by the Mt. Gox repayment and its potential downward pressure on the Bitcoin price has been a source of concern for crypto investors.

The approximately 127,000 creditors of Mt. Gox who have been waiting for over a decade to recover their funds are owed over $9.4 billion in Bitcoin.

Bitcoin whales continue accumulating

Large Bitcoin holders, also called “whales,” persist in accumulating despite the potential sell pressure from Mt. Gox creditors.

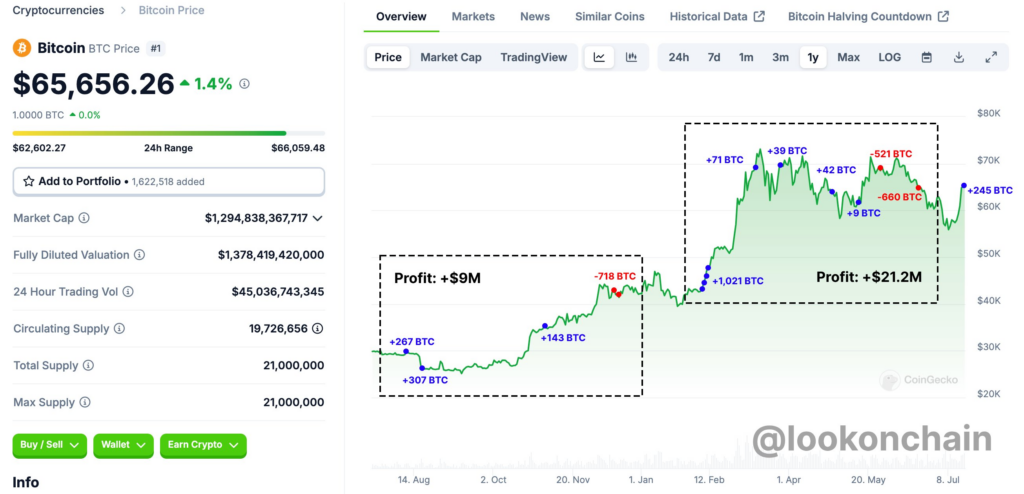

On July 17, a prudent whale acquired 245 BTC, equivalent to nearly $16 million. According to a July 17 X post by Lookonchain, the address has only transacted Bitcoin twice in the past year, resulting in a profit of over $30 million.

“From Aug 9 to Dec 18, 2023, he bought 718 $BTC at $29,385 and sold at $41,953, making $9M. From Feb 7 to Jun 20, 2024, he bought 1,181 $BTC at $48,822 and sold at $66,792, making $21.2M.

Investors frequently examine wholesale purchasing patterns to evaluate the market’s health and potential long-term investment opportunities.

Will 99% of Mt. Gox creditors sell their Bitcoin, or only the ‘paper hands’?

According to finance analyst Jacob King, up to 99% of the creditors may consider selling their BTC from the defunct exchange.

This is partially because the value of Bitcoin has increased by more than 8,500% in the decade following the collapse of Mt. Gox.

Nevertheless, ZachXBT, a prominent on-chain analyst, predicts that this will only result in short-term Bitcoin selling pressure, as only the weakest Bitcoin holders will be inclined to sell their tokens.

In a post on July 16, the analyst stated:

“I expect CT (read as the softest of the men, soyest of soy) to react to the first few 5k BTC+ transfers to CEX. Transfers on-chain (shuffle of coins within wallets) do fuck all.”

The price of Bitcoin, which has recently recovered from a downtrend that lasted over one month, can be significantly influenced by the volume of sale pressure currently flooding the market.