Discover how CBDCs are transforming cross-border transactions and trade by providing faster payments, lower costs, and improved transparency to global businesses.

- 1 What is a cross-border transaction?

- 2 Why Cross-Border Payments Need Innovation

- 3 Understanding Central Bank Digital Currency (CBDCs)

- 4 What CBDCs Mean for Cross-Border Transactions and Trade

- 5 Real-World CBDC Applications in Global Trade: Case Studies

- 6 Benefits of CBDCs for Global Trade and SMEs

- 7 Challenges and Risks of CBDCs for Cross-Border Transactions and Trade

- 8 CBDCs’ Future in Cross-Border Transactions and Trade

- 9 Conclusion

What is a cross-border transaction?

A cross-border transaction is any financial or commercial activity between partners from different nations. This usually entails transferring money, goods, or services across national boundaries. These transactions are essential for global trade, international investments, and remittances.

Key Characteristics:

- Currency Exchange: The majority of cross-border transactions involve multiple national currencies, needing currency conversion and occasionally resulting in fluctuations in the exchange rate.

- Intermediaries: Traditional systems rely on banks, payment processors, or networks such as SWIFT to move funds.

- Regulatory Oversight: Cross-border transactions are subject to several nations’ regulations, including anti-money laundering (AML) and tax compliance requirements.

- Delays and Costs: Because of the complexity of intermediaries and currency exchanges, these transactions are frequently slower and more expensive than domestic transactions.

Examples:

- Examples of cross-border payments include import and export.

- Individuals send remittances to family members in distant countries.

- International investments or loans are facilitated between entities in different countries.

The evolution of digital currencies, such as CBDCs, is viewed as a solution to inefficiencies in traditional cross-border transactions by lowering costs, delays, and reliance on intermediaries.

Why Cross-Border Payments Need Innovation

Cross-border transactions and trade face constant challenges due to outdated infrastructure, inefficiencies, and excessive costs. These challenges significantly impede international trade, particularly for small enterprises and emerging markets.

- High fees and delays

Traditional cross-border payment systems, such as SWIFT and correspondent banking networks, involve several intermediaries, resulting in expensive transaction fees and long processing times.

On average, cross-border payments might take days to settle, generating financial strain for enterprises depending on timely payments.

- Currency Exchange Complexities

The volatility of foreign exchange (FX) rates, combined with the reliance on intermediaries for conversion, adds another layer of expense and uncertainty to transactions.

This issue disproportionately impacts smaller enterprises that may not have access to favorable rates or hedging procedures.

- Limited Accessibility and Financial Inclusion

Emerging markets face particular challenges because of their limited banking infrastructure and correspondent relationships. This lack of access limits the flow of international remittances and trade finance in these locations.

- Reliance on outdated systems

Current systems lack transparency and standardization, which frequently results in errors or compliance difficulties. While innovations like SWIFT GPI have offered real-time tracking for some payments, broad adoption remains limited.

Impact on Global Trade

These inefficiencies impede international trade, particularly for small-to-medium enterprises (SMEs). They raise the cost of doing business globally and reduce the competitiveness of enterprises seeking to expand into international markets.

Addressing these pain points is crucial to creating a more inclusive and efficient global economy.

Understanding Central Bank Digital Currency (CBDCs)

What are CBDCs?

Central Bank Digital Currencies (CBDCs) are digital representations of a country’s fiat currency issued and regulated by its central bank.

CBDCs are centralized and designed to integrate smoothly into existing monetary systems, in contrast to decentralized cryptocurrencies like Bitcoin, which run on peer-to-peer networks.

They strive to combine the efficiency of digital transactions with the stability and trust traditionally associated with central banks.

Major Differences Between Cryptos and Stablecoins

- Control: CBDCs are controlled by central banks, which ensures monetary policy enforcement and financial stability. In contrast, cryptos are decentralized, relying on blockchain technology and distributed networks. Private entities issue stablecoins, which are tied to fiat currencies but not directly regulated by central banks.

- Stability: CBDCs have stable values related to national currencies, making them less volatile than cryptocurrencies like Bitcoin or Ethereum.

Examples of CBDC projects

Several countries are advancing CBDC initiatives to modernize payment systems and improve cross-border transactions:

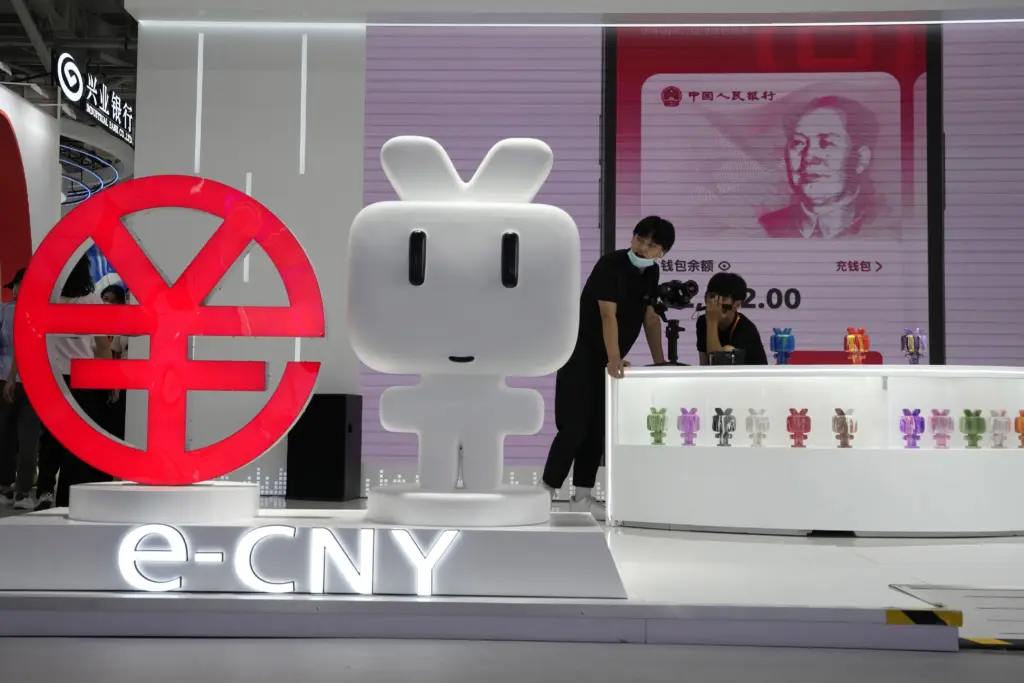

- China: China’s e-CNY (Digital Yuan) is one of the most advanced CBDCs, aimed at increasing retail and wholesale payments both locally and globally.

- European Union: The European Central Bank is creating a Digital Euro to improve payment security and efficiency across the EU.

Relevance to Cross-Border Transactions

CBDCs have the potential to improve efficiency in global trade and cross-border payments. They can shorten transaction times, reduce costs, and eliminate the need for intermediaries such as correspondent banks by using centralized digital frameworks.

Wholesale CBDCs, in particular, are designed for financial institutions to provide secure and conditional payments, hence improving global trade operations.

What CBDCs Mean for Cross-Border Transactions and Trade

Central Bank Digital Currencies (CBDCs) aim to transform cross-border transactions and trade by solving inefficiencies in traditional financial systems. Here’s how they’re reshaping the landscape:

- Streamlined Cross-border Payments

- Lower transaction costs

- Managing Currency Risks

- Enhanced Transparency and Security

- Promoting Financial Inclusion

- Interoperability Challenges

Streamlined Cross-border Payments

CBDCs make cross-border transactions and trade faster and more efficient by avoiding traditional intermediaries such as correspondent banks and networks like SWIFT. This direct transaction mechanism shortens processing times from several days to nearly instantaneous settlements.

This development promotes global trade by speeding supply chains and minimizing operational bottlenecks.

Lower transaction costs

CBDCs reduce the need for multiple intermediaries in the payment process, resulting in significant savings in transaction fees. This cost-effectiveness benefits small and medium-sized businesses (SMEs) and developing countries, making cross-border transactions and trade more accessible and equitable.

Managing Currency Risks

CBDCs serve as a stable and transparent platform for currency exchange in cross-border transactions and trade. By relying on a standardized digital infrastructure, they lessen the risk of volatility and discrepancies in exchange rates, which are crucial for global trade.

Enhanced Transparency and Security

CBDCs enhance transparency and lower fraud risks by recording transactions on a secure digital ledger. This enhanced security boosts trust between trading partners and financial institutions, which is crucial for large-scale international trade operations.

Promoting Financial Inclusion

CBDCs can integrate underbanked areas into the global financial system by offering a secure, low-cost digital payment option. This inclusion enables enterprises in developing nations to participate in international trade, boosting economic progress.

Interoperability Challenges

While CBDCs hold enormous promise, problems persist, including ensuring seamless interoperability across CBDC systems in different countries. Standardized protocols and worldwide collaboration are required to realize their full potential.

Broader implications

CBDCs not only revolutionize cross-border transactions, but they also shape global trade dynamics. They facilitate smoother, more cost-effective transactions, reduce risks, and democratize access to global markets.

CBDCs are poised to play a critical role in shaping the future of trade and economic globalization, with projects such as China’s e-CNY and the European Digital Euro already underway.

Real-World CBDC Applications in Global Trade: Case Studies

- China’s e-CNY in Cross-Border Trade

China has led the way in the adoption of Central Bank Digital Currencies (CBDCs) with its digital yuan (e-CNY), which is currently being tested for cross-border transactions.

China is collaborating with regions such as Hong Kong and Southeast Asian countries to lessen reliance on traditional payment systems such as SWIFT.

The e-CNY is already being utilized in pilot projects to promote real-time settlements, streamline currency exchanges, and reduce transaction costs for international trade.

- European Digital Euro for Intra-EU Trade

The European Central Bank (ECB) is advancing its digital euro initiative to boost intra-European trade. This program aims to improve payment efficiency between member states while tackling the issues posed by the EU’s existing fragmented payment systems.

The ECB’s unified digital currency aims to facilitate cost-effective cross-border transactions while maintaining strong regulatory oversight.

- Project mBridge: A Multi-CBDC Platform

Project mBridge is a collaboration between the Bank for International Settlements (BIS) Innovation Hub and central banks from Hong Kong, Thailand, the UAE, and China.

This platform enables cross-border transactions by utilizing numerous CBDCs over a blockchain-based network.

During a six-week experiment in 2022, mBridge processed over $22 million in real-value transactions, demonstrating its potential to significantly reduce settlement times, improve transaction transparency, and minimize costs for global trade participants.

The Impact of These Case Studies

These case studies demonstrate CBDCs’ transformative potential in solving inefficiencies in cross-border trade.

CBDCs lay the foundation for more inclusive and efficient global trading systems by removing the need for intermediaries, providing faster and cheaper transactions, and increasing transparency.

However, challenges such as interoperability across CBDCs from different countries and regulatory harmonization remain significant barriers to overcome.

Benefits of CBDCs for Global Trade and SMEs

Central Bank Digital Currencies (CBDCs) have transformative potential for global trade and small businesses by addressing inefficiencies in traditional payment systems. Here’s how:

Faster and Cost-Effective Transactions

CBDCs eliminate the need for intermediaries such as correspondent banks, resulting in significantly lower transaction costs and delays.

This is especially useful for SMEs, as it allows for real-time payments across borders, which improves cash flow and minimizes financial restraints on small businesses.

Enhanced Global Market Access

CBDCs facilitate cross-border transactions and trade, allowing enterprises in developing nations to engage in global trade. This promotes greater inclusivity, enabling SMEs to broaden their reach and compete with bigger businesses on a global scale.

Mitigating Currency Risks

CBDCs can reduce the risks of currency fluctuations by providing a more stable and predictable exchange system. This is especially important for enterprises trading across various jurisdictions, as it helps them manage financial uncertainty effectively.

Reduced Financial Exclusion

CBDCs can help to bridge the gap in underbanked or unbanked areas by providing businesses and individuals with reliable and secure digital payment methods. This inclusion promotes economic growth and increases engagement in global marketplaces.

Transparency and Security

CBDCs boost transaction transparency, lower fraud risks, and enhance trust in financial systems. This creates a more secure environment for trade by encouraging cross-border investments and collaborations.

While CBDCs show great promise, issues such as establishing interoperability between different national systems and addressing privacy concerns must be resolved before their full potential can be achieved.

However, their potential to streamline and democratize global trade positions them as a game changer for SMEs and international commerce.

Challenges and Risks of CBDCs for Cross-Border Transactions and Trade

Central Bank Digital Currencies (CBDCs) offer the possibility of transforming cross-border transactions and trade, but they also face major challenges and risks that must be addressed. Here are the main challenges:

Regulatory Challenges and Jurisdictional Conflicts

CBDCs are being introduced in different countries; however, regulatory disparities exist. Countries have different laws and frameworks for data protection, financial stability, and monetary policy.

These distinctions can impede the seamless adoption of CBDCs in cross-border transactions and trade, as highlighted by diverse policies in the United States, Europe, and China.

China stresses government control over data, the EU prioritizes privacy and investor protection, and the US is hesitant to issue a digital dollar.

Data Privacy and Surveillance Concerns

CBDCs can provide central banks with unprecedented visibility into financial transactions. This raises questions about the scope of data surveillance and misuse.

For example, China’s e-CNY combines financial data into its broader social credit system, raising concerns about privacy invasion. Similarly, some policymakers worry that CBDCs could enable authoritarian governments to monitor or regulate financial activities.

Interoperability Challenges

To be effective in cross-border trading, CBDCs must seamlessly integrate across national systems. However, attaining interoperability is hindered by geopolitical tensions and different technical standards.

Efforts like Project mBridge, a collaboration between Asian central banks, try to develop multi-CBDC frameworks, but these projects frequently work only within aligned geopolitical zones, leaving others excluded.

Economic Dependency Risks

Dominant CBDCs from major economies, such as China’s e-CNY or a potential digital dollar, could create economic dependence on smaller countries. This reliance might reduce monetary sovereignty, especially in regions without the means to create their own CBDCs.

Technical and Cybersecurity Risks

CBDCs require a strong technology infrastructure to enable reliable and secure operations. Concerns about cyberattacks, hacking, and technical failures are crucial, as interruptions could undermine trust and hinder adoption.

These challenges highlight the importance of coordinated global efforts to standardize CBDC frameworks, promote interoperability, and balance innovation with privacy and security measures.

CBDCs can only reach their full potential for transforming cross-border transactions and trade if they work together globally.

CBDCs’ Future in Cross-Border Transactions and Trade

CBDCs and Global Financial Landscape

Central Bank Digital Currencies (CBDCs) have enormous potential to transform international trade and the global financial system.

Their digital nature addresses inefficiencies in traditional systems such as SWIFT, resulting in faster, cheaper, and more transparent cross-border transactions and trade.

While SWIFT relies on existing infrastructures, CBDCs offer decentralized models that eliminate intermediaries, enabling real-time payments and reducing costs for international businesses and individuals.

Disrupting Cross-Border Payments

CBDCs aim to transform cross-border transactions and trade by enhancing interoperability across many national systems.

Initiatives such as mBridge, supported by BRICS countries, highlight how CBDCs can lessen reliance on legacy financial systems controlled by Western economies. This presents an opportunity for developing nations to increase their economic sovereignty and financial inclusion.

A Complement or a Replacement for SWIFT?

Although some anticipate that CBDCs could replace SWIFT, experts believe the two systems can coexist. SWIFT is working to integrate CBDCs into its infrastructure, with an emphasis on interoperability with traditional banks.

CBDCs, on the other hand, pave the way for more decentralized and efficient payment systems. Cross-border transactions and trade may evolve into a hybrid model with complementary systems.

Adoption Trends and Projections

CBDC adoption is projected to accelerate, with more than 100 countries actively exploring their implementation. CBDC transaction volumes are expected to expand significantly by 2030, particularly as governments and central banks enhance their strategies.

Developing countries may profit from these advancements by obtaining more access to global markets and trade opportunities.

Global Implications

CBDCs are more than just financial innovation; they also reflect the geopolitical dynamics of international trade. China’s e-CNY initiative demonstrates how CBDCs can boost South-South cooperation and influence economic power dynamics.

Also, CBDCs have the potential to revolutionize cross-border transactions and trade by providing faster, more affordable, and more secure alternatives to present methods.

However, their success is dependent on addressing regulatory issues, maintaining interoperability, and encouraging global collaboration. CBDCs are expected to play a significant role in the global trade framework over the next decade as the financial sector advances.

Conclusion

The emergence of central bank digital currencies (CBDCs) is a game changer for cross-border transactions and trade, offering solutions to traditional systems’ inefficiencies.

CBDCs provide faster settlements, reduced reliance on intermediaries such as SWIFT, and cheaper transaction costs.

These advantages can specifically benefit medium-sized businesses (SMEs) and developing economies by increasing financial inclusion and improving access to global trade networks.