Curious about today’s crypto updates? Here’s the latest on daily trends and events shaping Bitcoin prices, blockchain, DeFi, NFTs, Web3, and crypto regulations.

Uniswap has achieved a new monthly volume record amid heightened demand for assets and stablecoins in decentralized finance (DeFi),

while Tether has ceased minting its Euro-pegged EURt stablecoin and will discontinue support in November 2025.

Additionally, cryptocurrency exchange XT.com has suspended withdrawals following a suspected $1.7 million hack.

After Suspected $1.7 million Breach, XT.com, Cryptocurrency Exchange, Has Suspended Withdrawals

After a suspected $1.7 million breach, XT.com, a cryptocurrency exchange with a reported daily trading volume of $3.4 billion, has suspended withdrawals.

On November 28, the exchange announced that withdrawals had been suspended due to “wallet upgrade and maintenance.”

The statement was released approximately one hour before the publication of a report by blockchain security firm PeckShield, which indicated that XT.com had been “hacked” for $1.7 million in cryptocurrency.

Subsequently, XT.com released a statement that recognized an “abnormal transfer of platform wallet assets.”

The suspected XT.com hacker had already exchanged funds stolen from the exchange for 461.58 Ether, as indicated by PeckShield data. PeckShield identified the Ethereum address where the transferred assets were located.

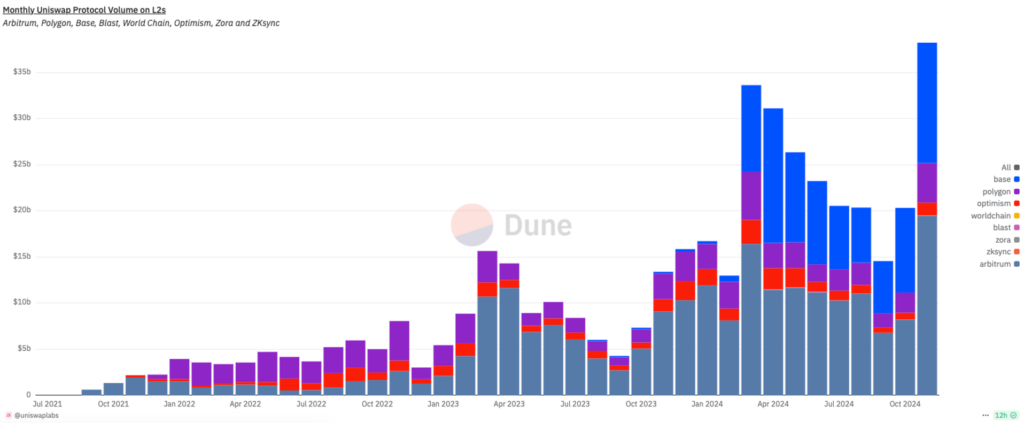

Uniswap Experiences Monthly Volume Of Record On L2 As DeFi Demand Returns

As DeFi enthusiasts returned to the ecosystem, Uniswap has obliterated its monthly volume record for Ethereum layer 2s.

Uniswap generated a record $38 billion in volume across prominent Ethereum layer-2 networks, including Base, Arbitrum, Polygon, Optimism, and several others, according to data from Dune Analytics.

The November record surpasses the previous greatest month, which was established in March, by $4 billion.

According to Henrik Andersson, the chief investment officer at Apollo Crypto, the increased demand for assets and stablecoins in the broader DeFi ecosystem could be attributed to the increased volumes for Uniswap on Ethereum layer-2s, as reported by Cointelegraph.

“This is consistent with the recent increase in ETH/BTC and the DeFi renaissance.” Andersson also noted that onchain yields are increasing.

Andersson further stated that this recent increase may serve as the commencement of a period of anticipated outperformance for the Ethereum ecosystem.

“Ethereum and DeFi coins have begun to move whenever Bitcoin approaches 100,000.”

In response to “evolving” regulations, Tether discontinues the EURt stablecoin.

Tether, a cryptocurrency company, has declared that it will discontinue the support for its EURt stablecoin, which is anchored to the euro.

The company has ceased the production of new EURt, with the final order being processed in 2022. Balances will be settled by November 2025.

According to Paolo Ardoino, the CEO of Tether:

“Tether’s decision to delist EURt has not been taken lightly, but until a more risk-averse regulatory framework in Europe is in place—one that fosters innovation, offers the stability and protection our users deserve and avoids potential banking systemic risks—we have chosen to prioritize other initiatives.”

The company had previously restricted the availability of its USDt and EURt stablecoins to maintain both.

However, this most recent action suggests that the company is prioritizing the dollar-pegged offering in the future.