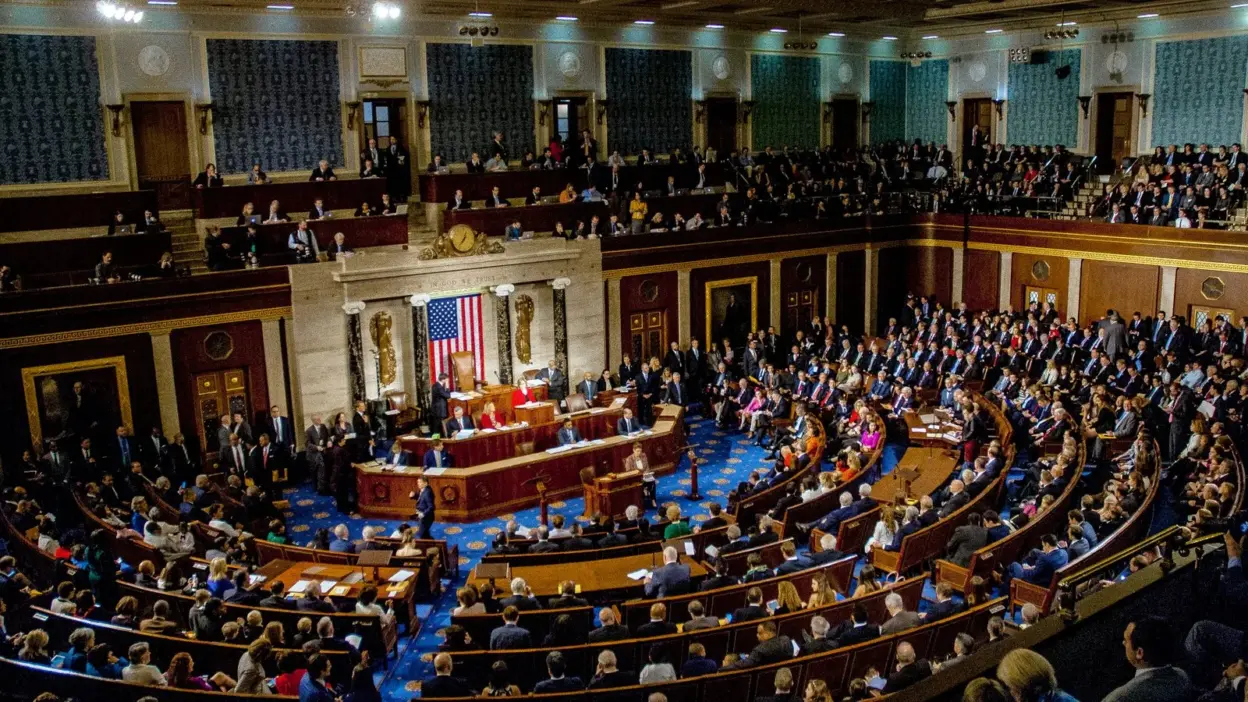

The U.S. Senate Crypto Bill—seeks to establish regulatory clarity around stablecoins, decentralized finance (DeFi), and digital asset exchanges

The urgency for such regulation stems from mounting global pressure, the fallout from 2022–2023 market failures, and political momentum following the 2024 U.S. elections. Lawmakers, now emboldened by bipartisan calls for financial oversight and consumer protection, aim to strike a balance between innovation and risk mitigation.

More than just legal fine print, this bill could be the first real test of America’s commitment to integrating blockchain technology into its financial fabric. The U.S. Senate Crypto Bill is poised to reshape how digital assets—especially stablecoins and DeFi protocols—are regulated in 2025 and beyond.

Bill Breakdown: Key Provisions at a Glance

The U.S. Senate Crypto Bill spans over 200 pages and outlines the most comprehensive federal framework for digital assets ever introduced.

Its provisions target three critical areas: consumer protection, stablecoin backing standards, and regulatory accountability for decentralized finance (DeFi) protocols.

Core Provisions and Scope

At the heart of the U.S. Senate Crypto Bill are mandates designed to address longstanding concerns around transparency and financial stability. The legislation proposes:

- Stablecoin Reserve Requirements: All issuers must maintain 1:1 fiat or short-term Treasury backing for circulating stablecoins. These reserves must be audited quarterly by registered firms.

- Licensing and Registration: Issuers of stablecoins will be required to register with a new sub-agency under the Treasury Department, ensuring federal oversight over digital dollar equivalents.

- DeFi KYC/AML Enforcement: Front-end operators of DeFi platforms—those who develop or host user interfaces—must implement Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, or face civil liability.

- Smart Contract Disclosures: Developers of smart contracts used in financial applications must publish audit trails and vulnerability assessments, with regular updates for high-risk protocols.

This multifaceted approach underscores the U.S. Senate Crypto Bill’s ambition: to pull disparate parts of the crypto economy under a standardized regulatory roof, one that balances innovation with investor protection.

Regulatory Architecture: Who’s in Charge?

The bill assigns primary oversight to a mix of existing and proposed regulatory bodies:

- SEC (Securities and Exchange Commission) for crypto assets that meet the Howey Test.

- CFTC (Commodity Futures Trading Commission) for non-security tokens and derivatives.

- U.S. Treasury, overseeing stablecoin compliance and systemic risk monitoring.

- A newly proposed Digital Asset Oversight Council (DAOC) will coordinate inter-agency responsibilities and serve as an industry liaison group.

This council would feature members from the Federal Reserve, FDIC, OCC, and private-sector observers. The goal: to harmonize the fragmented enforcement approach seen in recent years.

Quick Stats

- Word Count: 213 pages

- Sponsors: 7 senators (4 Democrats, 3 Republicans), led by Sen. Cynthia Lummis (R-WY) and Sen. Kirsten Gillibrand (D-NY)

- Committee Oversight: Senate Banking, Housing, and Urban Affairs; Senate Finance Committee

In totality, the U.S. Senate Crypto Bill not only defines how digital asset markets must operate but also sets the stage for an international model of regulation.

As other jurisdictions look to the EU’s MiCA framework, the U.S. now signals its intent to lead with compliance-driven innovation.

Stablecoins in the Crosshairs: The New Compliance Era

Stablecoins—long the workhorses of crypto trading and cross-border transactions—face their most rigorous regulatory reckoning yet under the U.S. Senate Crypto Bill.

For the first time, federal law would provide a unified legal definition of what qualifies as a stablecoin, while imposing strict collateralization and transparency mandates.

Defining a “Stablecoin” in 2025

The U.S. Senate Crypto Bill formally defines a stablecoin as a “digitally-issued representation of value pegged to the U.S. dollar or another fiat currency, redeemable at par, and backed by audited reserves.”

This excludes algorithmic stablecoins unless they demonstrate consistent peg maintenance and have a fallback redemption mechanism.

Under the proposed law, all stablecoin issuers must:

- Maintain 100% reserves in cash or Treasury instruments.

- Submit monthly reserve disclosures and undergo quarterly independent audits.

- Segregate customer funds from corporate operating capital.

Federal Oversight vs. State Charters: The USDC–PYUSD Divide

One of the most hotly debated elements of the U.S. Senate Crypto Bill is its challenge to state-chartered stablecoin issuers like PayPal (issuer of PYUSD via Paxos).

While PYUSD currently operates under New York’s regulatory umbrella, the bill would shift oversight to the Federal Reserve for any issuer with more than $10 billion in circulating supply.

Meanwhile, Circle, the company behind USDC, has welcomed this federal alignment, calling it a necessary step toward building trust in dollar-backed digital assets.

This divergence creates a clear fork in the road: platforms operating under federal standards may see faster adoption in institutional finance, while state-based issuers could face added scrutiny or integration hurdles.

Algorithmic Stablecoins on Thin Ice

The bill is particularly critical of algorithmic stablecoins such as DAI and Frax, which do not rely on traditional fiat collateral. Instead, they use smart contract-driven mechanisms to maintain peg stability. The U.S. Senate Crypto Bill requires these protocols to:

- Prove “statistical resilience” to depegging events.

- Implement “emergency redemption modules” backed by real-world assets.

- Disclose smart contract code and risk assessments.

These provisions could spell regulatory exile for purely algorithmic designs unless they evolve or hybridize their models with fiat backing.

Industry Response: From Relief to Resistance

Reactions from major stablecoin players have ranged from cautiously optimistic to deeply skeptical.

- Circle has praised the bill’s clarity, stating it “levels the playing field and bolsters consumer confidence.”

- Tether, whose USDT remains the market’s largest stablecoin, has pushed back against full reserve transparency, citing “operational and jurisdictional concerns.”

- PayPal, though not publicly opposing the bill, is reportedly lobbying for carve-outs that protect state-chartered issuers from immediate federal transition.

For stablecoin projects navigating compliance, the U.S. Senate Crypto Bill could usher in a new era of legitimacy—and liability.

What was once a loosely governed corner of the crypto universe is now front and center in Washington’s regulatory agenda.

DeFi Dilemma: Regulation Meets Decentralization

As decentralized finance continues to challenge traditional banking systems, the U.S. Senate Crypto Bill seeks to define how—and if—DeFi can be regulated without compromising its foundational ethos.

With billions locked in permissionless protocols, lawmakers are drawing a bold new line between code and compliance.

Are DeFi Front-Ends Becoming Financial Institutions?

Under the U.S. Senate Crypto Bill, DeFi platforms that provide user interfaces—such as web apps or dashboards—are now considered “critical financial access points.”

These front-end developers would be required to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, similar to centralized exchanges.

This effectively shifts liability from protocol code to the teams building the gateways to that code. The logic: if a dApp facilitates financial transactions and profits from user volume, it must assume financial responsibilities.

KYC for DEX Users: Practical or Pipe Dream?

The mandate has stirred fierce debate within the DeFi community. Critics argue that requiring KYC for users of decentralized exchanges (DEXs) like Uniswap or Curve undermines user privacy and technical feasibility.

However, proponents claim it’s a necessary step toward mainstream adoption and regulatory compliance.

Case Study: Uniswap’s 2024 Compliance Update

In late 2024, Uniswap Labs voluntarily added geo-blocking and wallet screening tools to its front-end, barring addresses linked to sanctioned entities.

This move, widely viewed as a preemptive nod to expected regulation, set a precedent for DeFi’s gradual institutionalization.

Who Watches the Oracles?

Another under-the-radar focus of the U.S. Senate Crypto Bill is oracle and validator accountability. Protocols relying on off-chain data—such as Chainlink—must now demonstrate:

- Data integrity protocols

- Validator rotation transparency

- Fallback mechanisms in case of oracle failure

These measures aim to protect users from manipulated price feeds, a common exploit vector in flash loan attacks and synthetic derivatives.

DAOs in Legal Limbo

Perhaps the most legally ambiguous category under the bill is DAO governance tokens. The legislation stipulates that if token holders vote on treasury allocations or protocol upgrades—and if those votes are enforceable—then such DAOs may be recognized as unregistered investment clubs.

This definition could bring tokens like AAVE, COMP, and MKR under securities scrutiny unless they register or dramatically decentralize voting rights.

Case Study: Aave’s Institutional Pivot

In 2025, Aave launched a permissioned liquidity pool specifically for institutional clients, complete with whitelisted addresses and regulatory disclosures.

This dual-structure model—one permissionless, one compliant—may become the norm if the U.S. Senate Crypto Bill passes.

How Decentralized Is “Decentralized Enough”?

The bill also includes a “decentralization test,” requiring protocols to prove:

- No single entity controls over 20% of governance tokens

- No identifiable entity maintains more than 25% of backend infrastructure

- Decision-making processes are transparent, immutable, and community-driven

Protocols failing this test may be subject to the same licensing obligations as centralized finance (CeFi) platforms.

The U.S. Senate Crypto Bill introduces a pivotal question: Can DeFi retain its decentralization—and its soul—while complying with Washington’s new rules? For many builders, the answer may lie in architectural innovation or legal restructuring, not just idealism.

Market Reactions and On-Chain Impact (Q2–Q3 2025)

Since the unveiling of the U.S. Senate Crypto Bill, the market’s reaction has been a complex mix of short-term volatility and strategic repositioning.

While the legislation is still in committee review, its mere introduction has already influenced price behavior, developer migration, and protocol governance at a foundational level.

Following the bill’s announcement in early Q2 2025, stablecoin markets experienced immediate pressure. USDT briefly dipped to $0.987 on some exchanges, triggered by concerns over Tether’s reserve opacity in light of the bill’s strict audit requirements.

USDC and PYUSD, by contrast, saw increased inflows, as investors viewed their alignment with U.S. compliance standards as a hedge against regulatory fallout.

The total value locked (TVL) across major DeFi protocols dropped by 7.3% within two weeks, reflecting user caution around KYC mandates and potential disruptions to liquidity mining models.

Venture capital activity also showed a temporary slowdown in May. Several U.S.-based crypto funds paused late-stage funding rounds, waiting for further regulatory clarity.

However, by mid-Q3 2025, the tone began to shift. Prominent players like a16z Crypto and Electric Capital publicly supported the bill’s emphasis on stablecoin transparency, reinvesting in projects building “compliance-native infrastructure.”

Rather than stifling innovation, the U.S. Senate Crypto Bill appears to be creating a bifurcation: projects that adapt are rewarded with renewed capital interest, while those resisting change face declining runway.

This adaptation is already visible across top protocols. Chainlink, long a critical middleware layer for DeFi, fast-tracked its “Proof-of-Reserve 2.0” feature, offering real-time attestations for stablecoin issuers and vault-backed assets.

Compound Labs deployed a compliance plugin enabling front-ends to screen addresses and tag wallet risk scores—an early nod to the bill’s AML clauses.

Perhaps the most striking shift is not on-chain, but across borders. Developer migration from the U.S. has quietly accelerated, with new Web3 team registrations rising sharply in Dubai, Lisbon, and Singapore.

According to GitHub metadata tracked by Alchemy Labs, the U.S. now accounts for just 38% of new DeFi repository commits, down from 52% at the start of 2024.

The U.S. Senate Crypto Bill, while offering regulatory certainty, is also prompting devs to seek jurisdictions with friendlier startup conditions and sandbox frameworks.

Still, not all see this as brain drain. Some argue that the bill is separating serious builders from opportunistic actors.

By formalizing crypto’s compliance obligations, the U.S. Senate Crypto Bill may be catalyzing a market reset that rewards resilience, transparency, and long-term alignment with global financial standards.

Industry Voices: Applause or Alarm Bells?

As the U.S. Senate Crypto Bill continues its legislative journey, reactions from key stakeholders across the crypto ecosystem have revealed a landscape of mixed praise, cautious optimism, and deep concern.

While some see a historic step toward legitimacy, others warn of the unintended consequences of regulatory overreach.

Coinbase’s Take: Compliance with Caveats

Brian Armstrong, CEO of Coinbase, welcomed the bill’s clarity but voiced reservations about implementation.

“We support sensible regulation, and the U.S. Senate Crypto Bill brings needed structure to stablecoins and DeFi. That said, innovation must not be sacrificed in the name of bureaucracy.”

Armstrong emphasized that KYC mandates on decentralized apps must account for technical realities—especially when front-ends are open-source and globally hosted.

Blockchain Association: Progress, But Not Perfection

Kristin Smith, executive director of the Blockchain Association, issued a more measured response.

“The bill marks progress, especially in recognizing stablecoins and DAOs, but we urge lawmakers to avoid one-size-fits-all frameworks that stifle innovation outside the U.S.”

She noted that requiring developers of DeFi front-ends to register could push open-source innovation offshore, contradicting the bill’s stated goal of economic inclusion.

Senator Lummis: “A Framework for the Future”

One of the bill’s lead co-sponsors, Senator Cynthia Lummis (R-WY), described it as a foundational step for American financial leadership.

“We’re not here to kill crypto—we’re here to ensure it grows up. The U.S. Senate Crypto Bill puts in guardrails without taking the wheel away from innovators.”

Lummis stressed that bipartisan consensus was essential, and hinted at potential amendments to support smaller developers and international interoperability.

Legal Experts Weigh In

Crypto law scholars, including Jake Chervinsky, chief legal officer at Variant, offered nuanced perspectives.

“The bill gets a lot right—especially on stablecoin reserves—but fails to account for the technical nuance of decentralization. Regulation by interface is a blunt instrument.”

Chervinsky warned that classifying DAO governance tokens as securities based on voting mechanisms could set a precedent with chilling effects for open governance models.

Civil Liberties Groups: Privacy at Risk

Not everyone is focused on financial stability alone. The Electronic Frontier Foundation (EFF) and the ACLU both flagged serious concerns about surveillance and user rights.

In a joint statement, they wrote:

“By compelling KYC on non-custodial wallets and open-source front-ends, the U.S. Senate Crypto Bill risks infringing on free association and digital privacy—core American values.”

These organizations are now lobbying for clearer carve-outs for non-custodial tools and stronger protections for pseudonymous developers.

A Fractured but Forming Consensus

Despite diverging opinions, one theme runs through nearly every response: the U.S. Senate Crypto Bill marks a turning point.

It has succeeded in uniting voices across the spectrum in calling for smart, adaptive governance—but not all agree on what that looks like.

As final amendments are debated in committee, the crypto industry finds itself in a rare moment of political engagement.

What emerges may not be perfect, but it will likely form the blueprint for how the U.S. approaches digital asset regulation for years to come.

Conclusion

The U.S. Senate Crypto Bill has emerged not just as a piece of legislation, but as a defining moment for digital finance in 2025.

It promises stability and transparency for stablecoins, setting clear reserve requirements and bringing them under the watchful eye of the Federal Reserve.

For DeFi, however, the message is far more complex—scrutiny, accountability, and a reckoning with the meaning of “decentralization.”

As the U.S. Senate Crypto Bill advances, stablecoins may become safer—but DeFi could face an existential regulatory test.

What lies ahead is a new paradigm: one where compliance becomes a competitive advantage, not a constraint.

Projects that adapt may find themselves at the forefront of mainstream adoption, attracting institutional capital and regulatory goodwill.

Those that resist could be marginalized—or forced to operate from the periphery of legal and financial systems.

This isn’t just about laws. It’s about whether the crypto ecosystem is ready to evolve beyond its rebellious adolescence.

The bill offers a roadmap—but it also demands hard choices about architecture, transparency, and responsibility.

Will this bill break crypto—or finally let it grow up? The answer may not be binary, but one thing is certain: the revolution is being regulated, and the next era of digital assets will be defined by how well it can walk that line.

FAQs

What is the U.S. Senate Crypto Bill?

The U.S. Senate Crypto Bill is a landmark 2025 legislative proposal aimed at establishing a federal framework for regulating stablecoins, decentralized finance (DeFi), and other digital asset markets through licensing, compliance mandates, and inter-agency oversight.

How does the bill affect stablecoins?

It imposes strict requirements on U.S.-issued stablecoins, including 1:1 fiat reserves, independent audits, and federal licensing—creating a compliance benchmark that could edge out unregulated or algorithmic alternatives.

What does the bill mean for DeFi platforms?

DeFi platforms may be required to implement KYC/AML checks, publish smart contract audits, and ensure governance transparency, shifting legal liability to developers and front-end operators.

Will the bill impact crypto prices or liquidity?

Yes, the bill has already sparked short-term volatility, particularly in DeFi and algorithmic token markets, while long-term liquidity will depend on how quickly protocols adapt to the new rules.

Can the bill still be modified?

Absolutely. The bill is currently under committee review, and ongoing lobbying from crypto industry groups, civil liberty advocates, and legal experts could lead to significant amendments before final passage.