White House will release its first crypto policy report on July 30, highlighting key reforms and a significant step for the U.S. crypto industry.

On July 30, 2025, the White House crypto policy report will be released, marking a significant milestone for the U.S. crypto business.

After the 180-day assessment is over, this will be the first thorough and in-depth cryptocurrency policy report ever.

Notably, experts think this report will establish a precedent for the rest of the world and alter the legislative environment surrounding digital assets.

White House Crypto Policy Report: What Is It?

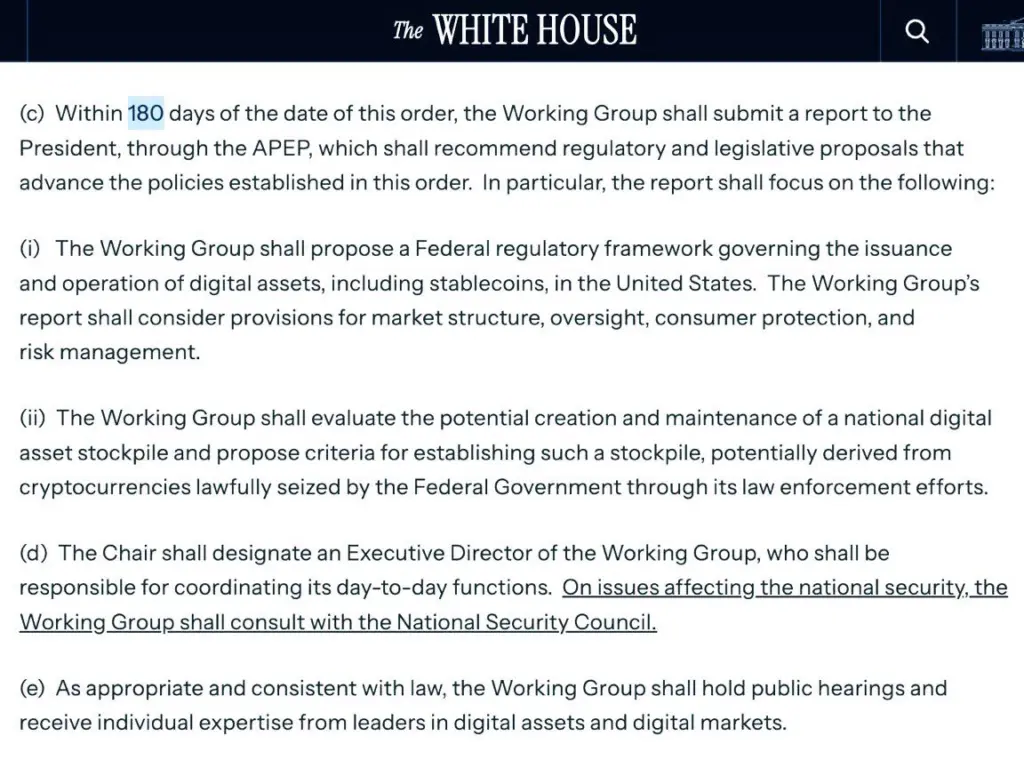

The 180-day study of Executive Order 14178, “Strengthening American Leadership in Digital Financial Technology,” culminates with the White House crypto policy report.

The presidential order, which focuses on US digital asset policy, national security, and strategic readiness, actually replaces the crypto instructions from the Biden administration.

Notably, the cryptocurrency report seeks to establish a technology-neutral framework for cryptocurrencies and would change the regulatory environment.

Additionally, it would stop the uncertainty and ambiguity of regulations.

What Will Be Covered In White House Report On Crypto Policy?

Clarifying regulations, safeguarding consumers, and many other issues would be the main topics of the White House study.

The recently established President’s Working Group on Digital Asset Markets is in charge of the structure of this study on cryptocurrencies.

Notably, the team is led by Congressman Bo Hines and Czar David O. Sacks, specializing in AI and crypto.

The report will address the following topics:

- Regulatory Clarity

As previously stated, the cryptocurrency study would clarify regulations, particularly about the involvement of federal authorities.

The Fed, FDIC, and OCC will now oversee stablecoins rather than the SEC and CFTC.

The GENIUS Act, which was recently signed into law by Donald Trump, made the same proposal.

📢 Breaking Today: The White House’s long-awaited Digital Asset Policy Report drops July 30, revealing critical plans for:

• A strategic Bitcoin reserve (legal & secure)

• Oversight standards for stablecoins

• A path to a potential CBDC

• Market structure reform to fight… pic.twitter.com/OKbMEJS5Dg— Mariachi (@0xMariachi) July 28, 2025

- Stablecoin Reform and CBDC Ban

This White House report on crypto policy will continue to focus on stablecoin.

The three leading suggestions are reserve backing for USD-pegged tokens, granting issuers access to Fed payment rails, and establishing licensing rules.

This could lead to the stablecoins’ legitimacy as financial infrastructure. International adoption would reach a peak and beyond if this were to occur.

Furthermore, the Anti-CBDC Act also discusses the possibility of a CBDC prohibition.

Interestingly, the leading market firms are already getting ready for these adjustments.

Ripple submitted applications for a Fed Master account and a banking license.

Circle is getting ready for the same thing, as are others.

- Consumer and Market Protections

Another crucial indicator in this case is the protection of consumers and the market.

Investors might anticipate that cryptocurrency exchanges and other services will be subject to appropriate rules and regulations.

The essential priorities are AML/KYC compliance, auditing, reserve transparency, and protecting investors from fraud, hacking, and other threats.

This could also address national security issues.

This includes stopping cryptocurrency from being used to finance terrorism and launder money.

- Updates on Strategic Bitcoin Reserve

The most eye-catching suggestion is to use the confiscated Bitcoin holdings (almost 200k BTC) for the U.S. Strategic Bitcoin Reserve.

A bull run-like situation would result in Bitcoin becoming a strategic national asset, impacting central bank policy.

Additionally, there are suggestions that XRP and other vital altcoins will be included in a National Digital Asset Stockpile.

Why Are Investors Affected?

One of the more optimistic announcements of July is the White House’s crypto policy report.

Investors are excited about the news because the unambiguous regulations will allow them to stop worrying about potential legal issues.

Crypto exchanges and other organizations can observe the unambiguous legislation, which helps them in their operations.

The crypto companies also have access to Federal Reserve payment channels, which will improve their standing in the larger financial industry.

In addition, the U.S. Strategic Bitcoin Reserve would promote acceptance and boost the cryptocurrency sector.

Finally, it might cause a ripple effect, with other countries following suit.