Ethereum price dips under macro pressure, but 140K ETH outflow, ETF inflows, and whale moves suggest a potential bullish reversal.

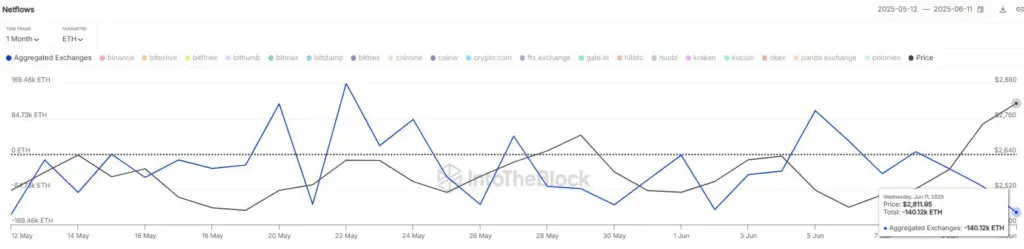

Ethereum has experienced significant outflows in the past few days, with 140,000 tokens departing the exchanges in a single day.

On June 11, the ETH token experienced its most significant single-day inflow in nearly a month, as millions of tokens were withdrawn from exchanges.

Nevertheless, these are not linked to the price rally but are indicative of a correction.

Let us deliberate on the specifics.

Ethereum Price Has Plummeted, But Withdrawal Of 140K ETH Suggests Otherwise

The Ethereum price is currently experiencing volatility in the crypto market, which the publication of the US CPI data and the Claims and PPI data have exacerbated.

ETH is currently trading at $2,719.39, with a market capitalization of $328.31B, as macroeconomic events influence the trading activities of investors in the charts.

The investors’ confidence in the top altcoin is still increasing despite the decline, as 140k ETH tokens, equivalent to $393M, have been removed from exchanges.

The quantity of ETH outflows is higher during the 48 hours. Additionally, the Future Open Interest of the company increased to $40.72B at the time of publication, further bolstering investor interest.

This withdrawal indicates investors’ strong confidence in the digital asset, as they transferred their tokens from crypto platforms to self-wallets, suggesting that they are holding sentiments.

Undeniably, the token’s price differs from investor interest, as evidenced by inflow data and other factors.

Whale Buying, Ethereum ETF Inflows’ New High, More

The on-chain reports indicate that the altcoin’s whale activity is considerably elevated.

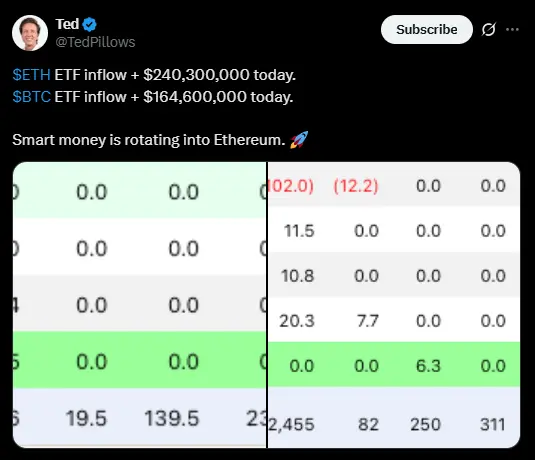

Even the Bitrue infiltrator has spent $8.3M to acquire 2,999 ETH tokens. Furthermore, the ETFs are experiencing substantial inflows, with $240.7M on Wednesday alone, the highest since February.

It is intriguing that the net volumes have been positive for 18 consecutive days and exceeded BTC’s.

This increasing momentum is a clear indication of the increasing confidence of investors in this asset, which could support a recovery in the price of Ethereum once the momentum is established.

Nevertheless, the likelihood of a subsequent sell-off is greater in the short term.

The MVRV indicator is currently emitting sell signals, according to crypto analyst Muthoni.

This is because short-term holders are resting on unrealized gains, which raises the possibility of profit-taking.

The token’s price may be subject to downward pressure due to the merchants’ potential sale of their holdings.

If the price of ETH cannot maintain the $2,410 support level, it may experience a further decline to $2,000 unless significant catalysts reverse the trend.