The current price surge of SOL indicates a 5% rally today; however, intricate on-chain analytics cast skepticism regarding Solana’s capacity to surpass the critical threshold of $190

On May 27, the value of SOL, the native token of Solana, increased by 5%, from $161 on May 26 to $171.

This increase in value bolstered investors’ optimism regarding further expansion, mainly because SOL had peaked at $188.90 on May 21, some days prior.

A proposition to increase validator yields instead of token burning has significantly contributed to SOL’s ascent even though network activity has remained unchanged.

Solana will cease consuming fifty percent of the priority transaction fees.

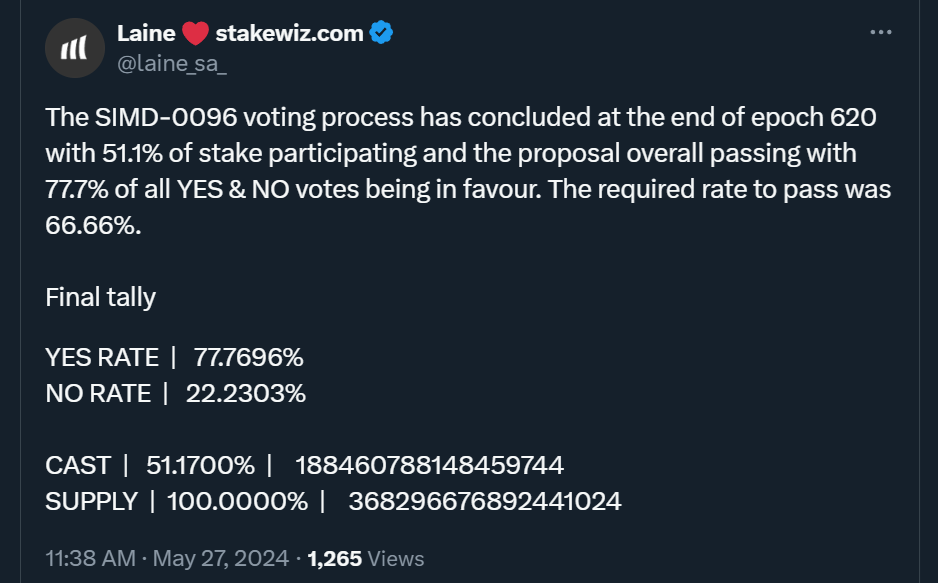

The SIMD-0096 proposal, which eliminates the 50% burn rate on priority transactions and sets it to 0%, was approved by Solana’s validators on May 27.

As a result, starting from epoch 621, every transaction fee will be distributed to the block producers.

This transition aims to incentivize validators to place network security and efficiency as their highest priorities rather than participating in arbitrage tactics that entail reordering or excluding transactions.

Maximal extractable value (MEV) pertains to the financial gains block producers achieve through the strategic sequencing of transaction processing on the blockchain.

Due to the limited number of pending transactions per block, validators can select which transactions to include. This can be detrimental to regular consumers of decentralized finance (DeFi) applications, as they may incur higher execution costs.

However, the SIMD-0096 proposal could have an adverse effect on the Solana Network by increasing the inflationary pressure on SOL, as noted by Laine, a validator of Solana staking.

Laine notes that priority fees were non-existent in May 2023, notwithstanding the annual issuance growth of 4.6%. This observation implies that the effective inflation rate would revert to around 9.9% per annum.

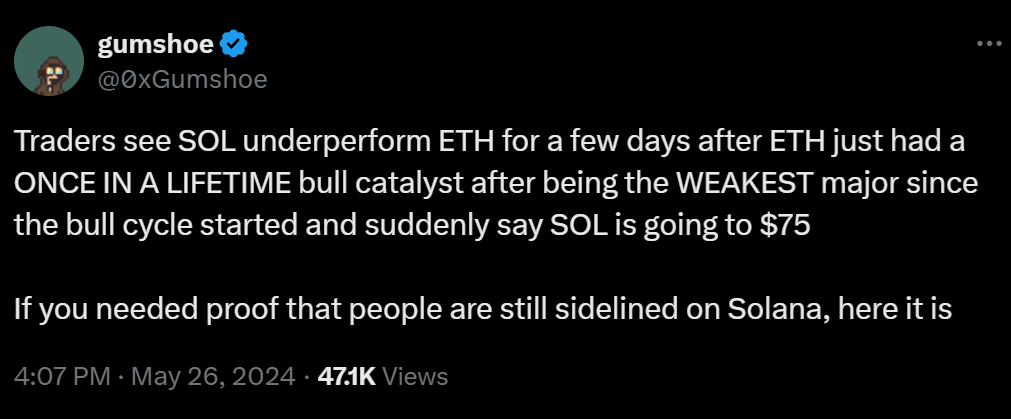

Certain analysts posit that the recent price adjustment of SOL is a response to a decrease in the cryptocurrency’s value precipitated by the United States’ approval of an Ether exchange-traded fund (ETF).

The sanction by the SEC on May 23 pushed ETH to $3,975 on May 27, which was just below its 2024 peak of $4,090.

A ‘gumshoe’ investor and analyst claims that traders became adverse to SOL after the approval of the Ether spot ETF, which was characterized as a “once-in-a-lifetime bull catalyst.”

Contrary to the market’s preponderance in focusing on the Ether ETF decision, he contends that SOL’s year-to-date gains of 69% are nearly identical to Ether’s 72% over the same period.

In the past week, Solana’s network activity has been stagnant.

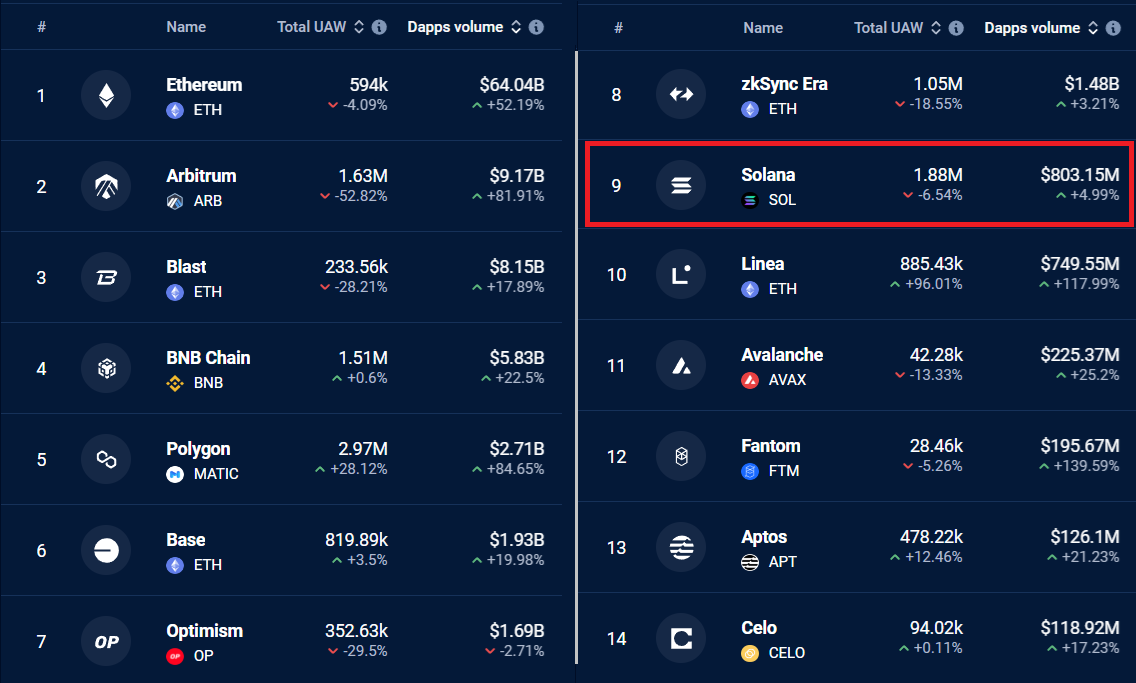

Notwithstanding divergent analyses regarding the ramifications of removing the fire mechanism, the expansion of Solana’s network utilization continues to be stagnant, particularly in comparison to Ethereum and its layer-2 solutions.

Solana’s decentralized application (DApp) volumes increased by a mere 5% over the past week, according to recent data from DappRadar, which is a significant underperformance in comparison to Ethereum’s 52% increase.

During the same time period, the BNB Chain increased by 22%, illustrating Solana’s relative underperformance.

Solana’s 6% weekly decline in unique active addresses is comparable to Ethereum’s 4% weekly decline in active users. Conversely, rivals such as BNB Chain and Polygon MATIC have observed active user growth of at least 25%.

This week, consumers of Raydium, the second-largest decentralized exchange on Solana, decreased by 16%. Similarly, Magic Eden, the NFT marketplace operated by Solana, witnessed a decline of 22%.

It is also unclear how much of SOL’s recent decline to $161 was attributable to speculative activity surrounding the approval of Ether ETFs and when these instruments will become available for trading in the United States.

As the burn mechanism has been eliminated, resulting in inflationary adjustments that have been heavily criticized and on-chain activity has been stagnant, it seems improbable that SOL will recover to its previous peak of $188.90 in the near future.