Today, XRP is predominantly driven by institutional inflows, as with the rest of the crypto market, the bullish outlook is further bolstered by the increasing whale holdings

XRP XRP

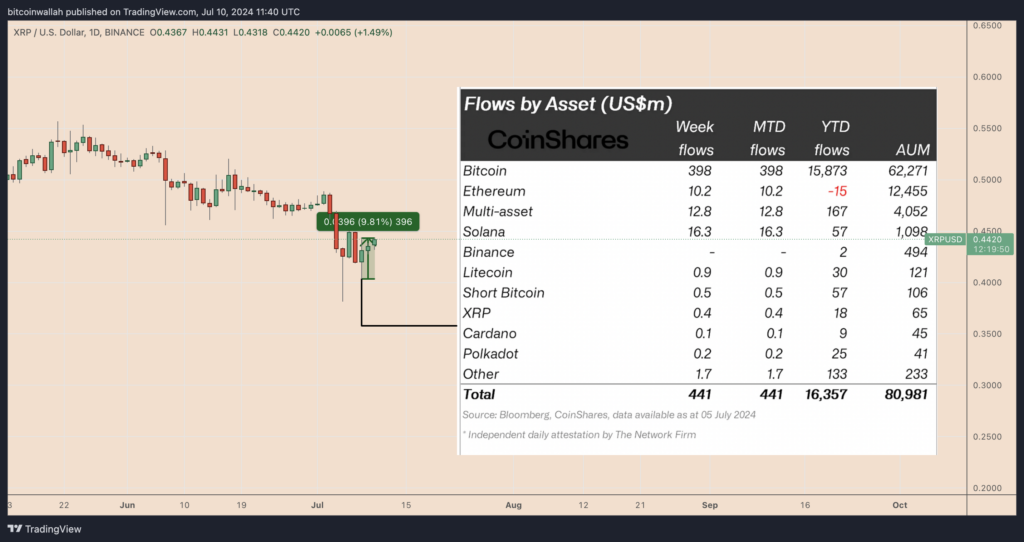

During the Price Collapse, XRP Funds Experience Inflows

The gains that XRP has experienced today are part of a broader recovery that commenced on July 8, when asset management platform CoinShares reported that crypto funds collectively experienced $441 million in inflows during the same week that the crypto market experienced an 11.28% fall.

In the week ending July 5, investment funds focused on XRP generated $400,000 in revenue. The XRP/USD pair has increased by roughly 10% since the report was published on July 8.

James Butterfill, a researcher at CoinShares, observed:

“Digital asset investment products saw inflows totalling US$441m, with recent price weakness prompted by Mt Gox and the German Government selling pressure likely being seen as a buying opportunity.”

Wall Street’s increasing bets on a rate cut in September correlate with the inflows into XRP and the broader crypto market funds, which were prompted by weaker-than-expected employment data released on July 5. Intriguingly, XRP’s spot market returns from the July 5 trough are approximately 16%.

In his testimony to Congress on July 10, the Chairman of the Federal Reserve in the United States, Jerome Powell, reiterated a similar dovish outlook.

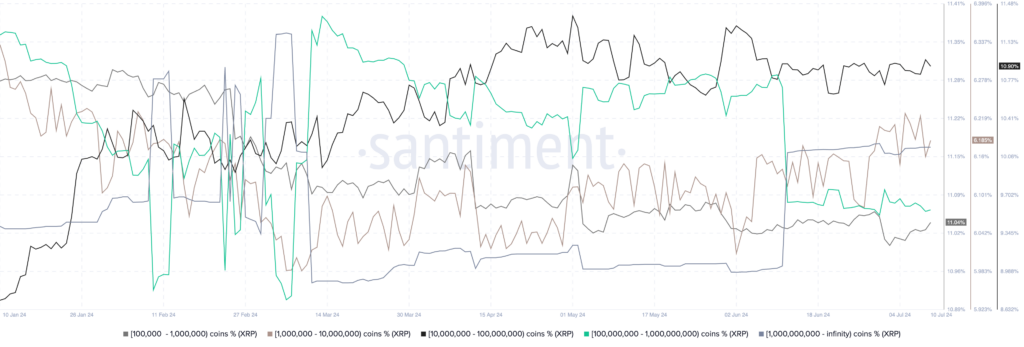

A slight increase in the number of XRP whales held

XRP’s gains today are further correlated with a modest increase in the supply held by one of its wealthiest investor cohorts.

It is important to note that the XRP supply held by entities with a balance of 100 million—1 billion tokens (teal) has increased in the past 24 hours, while the supply held by the 10 million—100 million cohort (black) has decreased.

In the interim, the supply held by addresses with more than 1 billion tokens (blue) remained constant. This implies that entities in the lower cohort are accumulating XRP to transition to the upper cohort, indicating a rise in confidence and investment among the larger market participants.

Following an “oversold” condition, the price of XRP experienced a rebound.

XRP’s gains today are a component of an oversold bounce, a common market reaction that occurs when an asset’s relative strength index (RSI) declines below 30. This is the case from a technical perspective.

Furthermore, the price of XRP has rebounded after attempting the lower trendline of its current falling wedge pattern as support, a trend similar to that of April. The wedge’s upper trendline, near $0.45, appears to be the next upside target for July if the fractal repeats. This represents a 5% increase from the current price level.