Elon Musk promised to reinstate Bitcoin payments if the network’s renewable energy usage increased, despite Tesla’s decision to remove them due to environmental concerns

Four years have passed since Tesla discontinued its acceptance of Bitcoin, citing environmental concerns. Tesla does not appear prepared to resume Bitcoin payments shortly, even though the mining industry has reportedly increased its share of renewable energy consumption.

Tesla disclosed a $1.5 billion investment in Bitcoin (BTC) on February 8, 2021, for $66,640.

In a document submitted to the Securities and Exchange Commission (SEC) of the United States.

Additionally, Tesla CEO Elon Musk elected to incorporate the cryptocurrency into the company’s treasury and initiated the acceptance of Bitcoin (BTC) as a form of payment for the company’s electric vehicles..

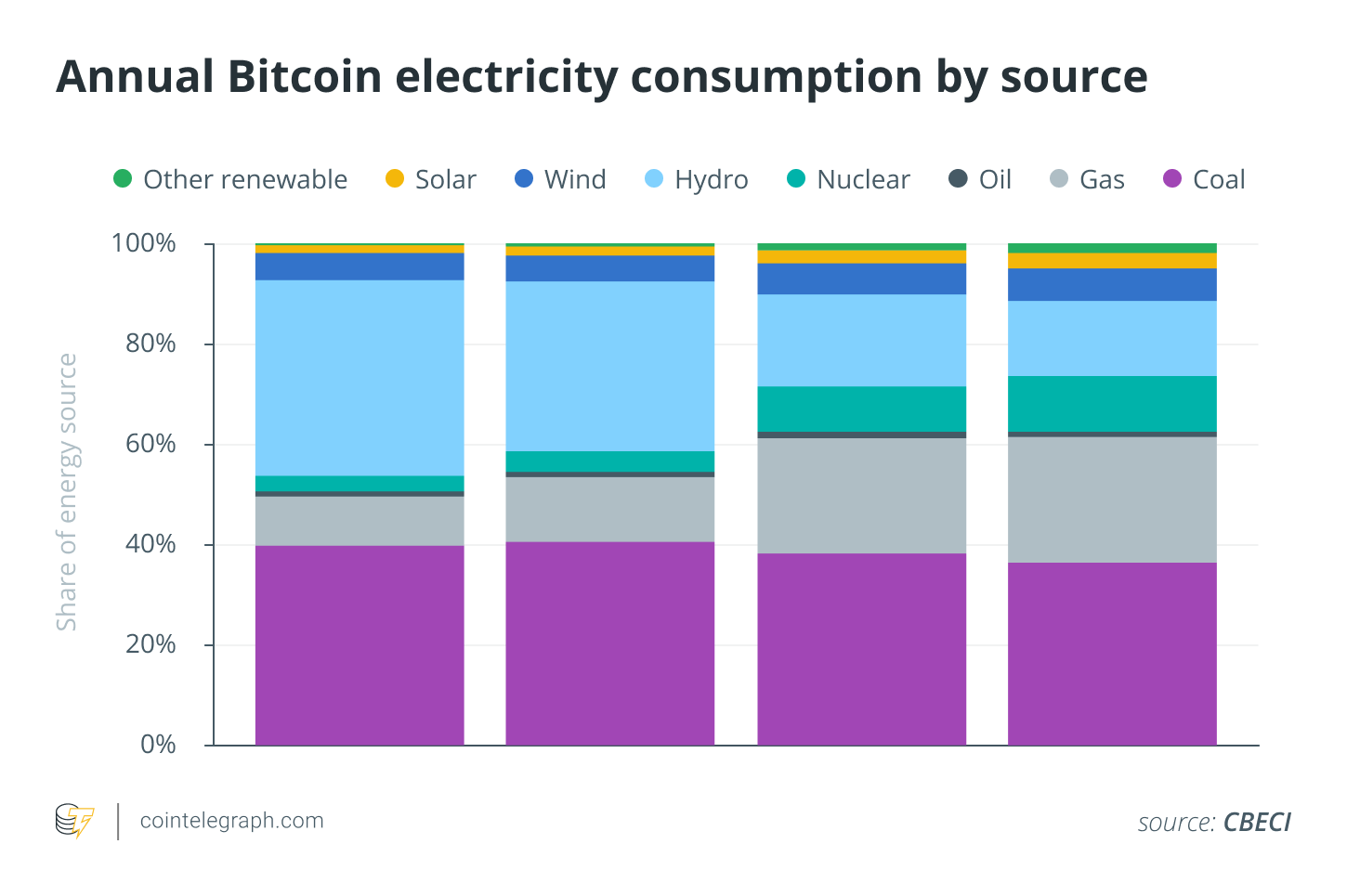

Tesla ceased accepting Bitcoin as a form of payment on May 13, 2021, as a result of concerns regarding the rapid expansion of the use of fossil fuels, particularly coal, for Bitcoin mining and transactions.

Tesla announced that it would resume accepting Bitcoin once the cryptocurrency became more sustainable, even though it had previously ceased accepting BTC.

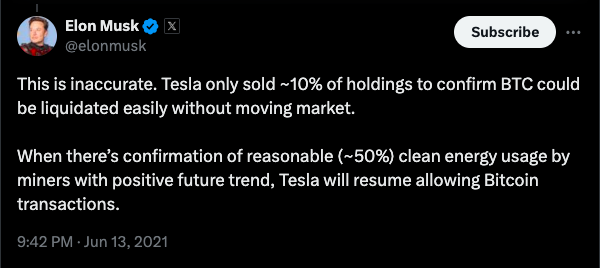

Musk announced on June 13, 2021, that Tesla would permit BTC transactions once it was certain that a minimum of 50% of the energy consumed by miners was renewable and had a positive future trajectory.

The dynamics of Bitcoin have undergone numerous changes since 2021. Spot Bitcoin exchange-traded funds (ETFs), acceptance as legal tender, technological advancements in its protocol, and enhancements in renewable energy utilization rates for crypto mining have all contributed to indirect institutional adoption.

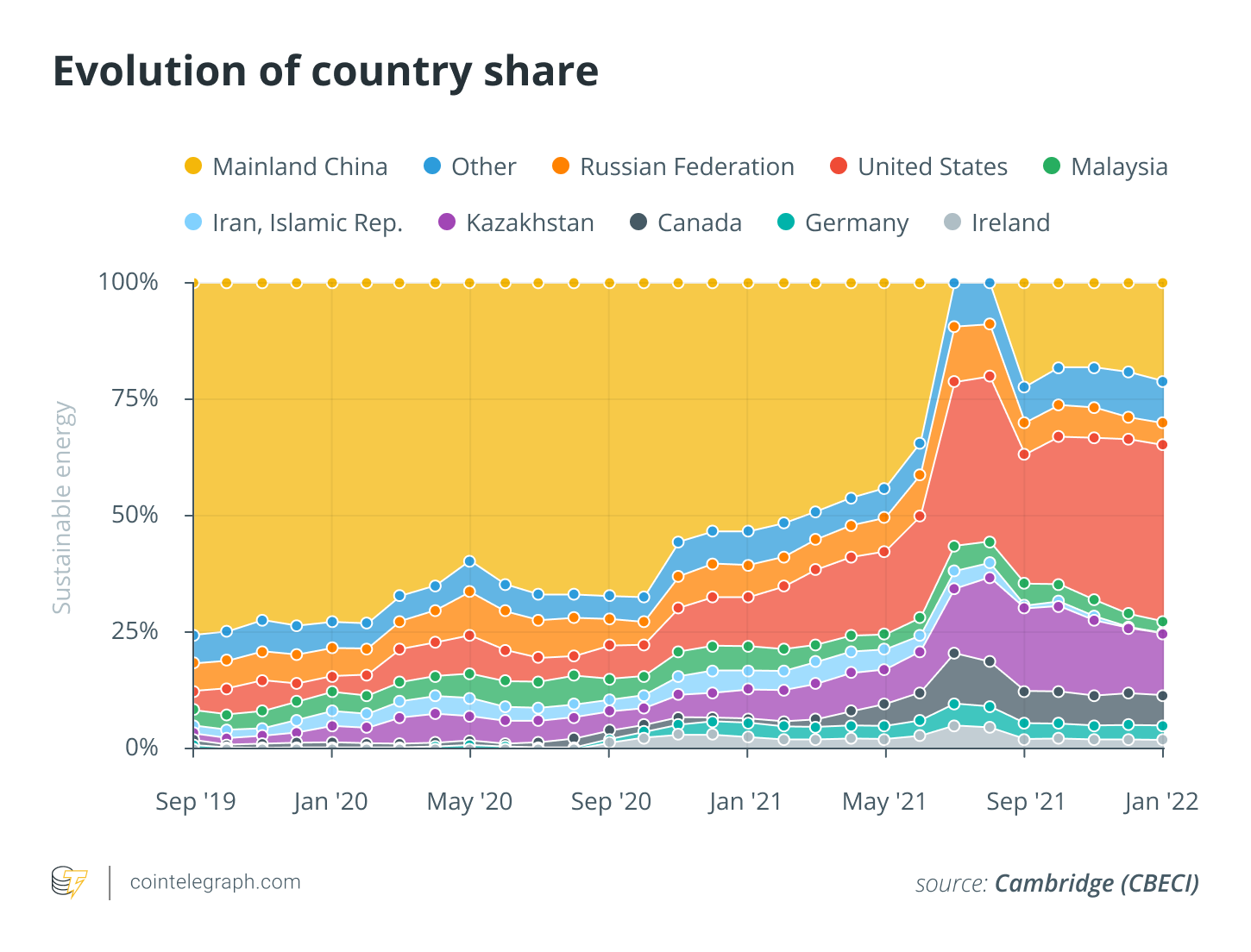

Bitcoin mining is presently at an all-time high of over 55% in terms of sustainable energy usage, as indicated by the graph below, created by climate tech venture capitalist Daniel Batten and data analyst Willy Woo. The increase is a component of a consistent upward trajectory that has persisted since mid-2021.

Musk appears to have fulfilled both of his prerequisites; therefore, will Tesla and Musk fulfill their obligation to reinstate Bitcoin payments?

Bitcoin producers’ extravagant assertions regarding renewable energy sources

Verifiable and reliable data is necessary for significant decisions, such as accepting a cryptocurrency for payment in a multibillion-dollar business. However, is the data regarding Bitcoin’s energy consumption sufficiently reliable?

In an interview with Cointelegraph, Alex de Vries, a data analyst and researcher at De Nederlandsche Bank and Vrije Universiteit Amsterdam, stated that the energy disclosures of Bitcoin miners are not transparent or verifiable.

“The Bitcoin mining industry loves to talk about transparency until you ask for specific data.”

According to him, the European Markets in Crypto-Assets Regulation (MiCA) mandates the disclosure of information that is “rigorous, systematic, objective, capable of validation, and applied continuously.” He believes that the requirements of MiCA will demonstrate these companies’ lack of transparency.

De Vries emphasized that the United States Energy Information Administration (EIA) had some firsthand experience with this when it attempted to acquire data from crypto miners.

Earlier in 2024, a group of crypto miners, including Riot Platforms and the Texas Blockchain Council, filed a lawsuit against the EIA for what they deemed to be an “invasive” request to collect energy consumption data on crypto miners. The EIA ultimately lost in court and consented to destroying all the data it had received.

De Vries stated that producers have made some “wild claims” regarding using renewable energy. He remembered a time when the digital asset firm CoinShares asserted that 78% of miners were using renewable energy in 2019, a claim that he had to “wallow years later.”

He believes that Musk was “well aware of this” data manipulation, which could have been the reason Musk prevented Tesla from accepting Bitcoin.

Energy data that is precise for Bitcoin processing

Obtaining precise data for Bitcoin mining is intricate, as is the case for numerous other industries. As seen in the mid-20th century, when tobacco companies funded research that produced misleading conclusions about the link between smoking and cancer, biased researchers may find it advantageous to align data metrics for their agenda.

Alexander Neumüller, the research head at the Cambridge Centre for Alternative Finance (CCAF), which researches the energy consumption of crypto, informed Cointelegraph that data retrieval is in a state of perpetual improvement.

However, he recognized that “the current methodologies for determining the electricity mix continue to be predicated on numerous assumptions or are susceptible to specific biases.”

To prevent this, researchers must implement a rigorous data collection methodology.

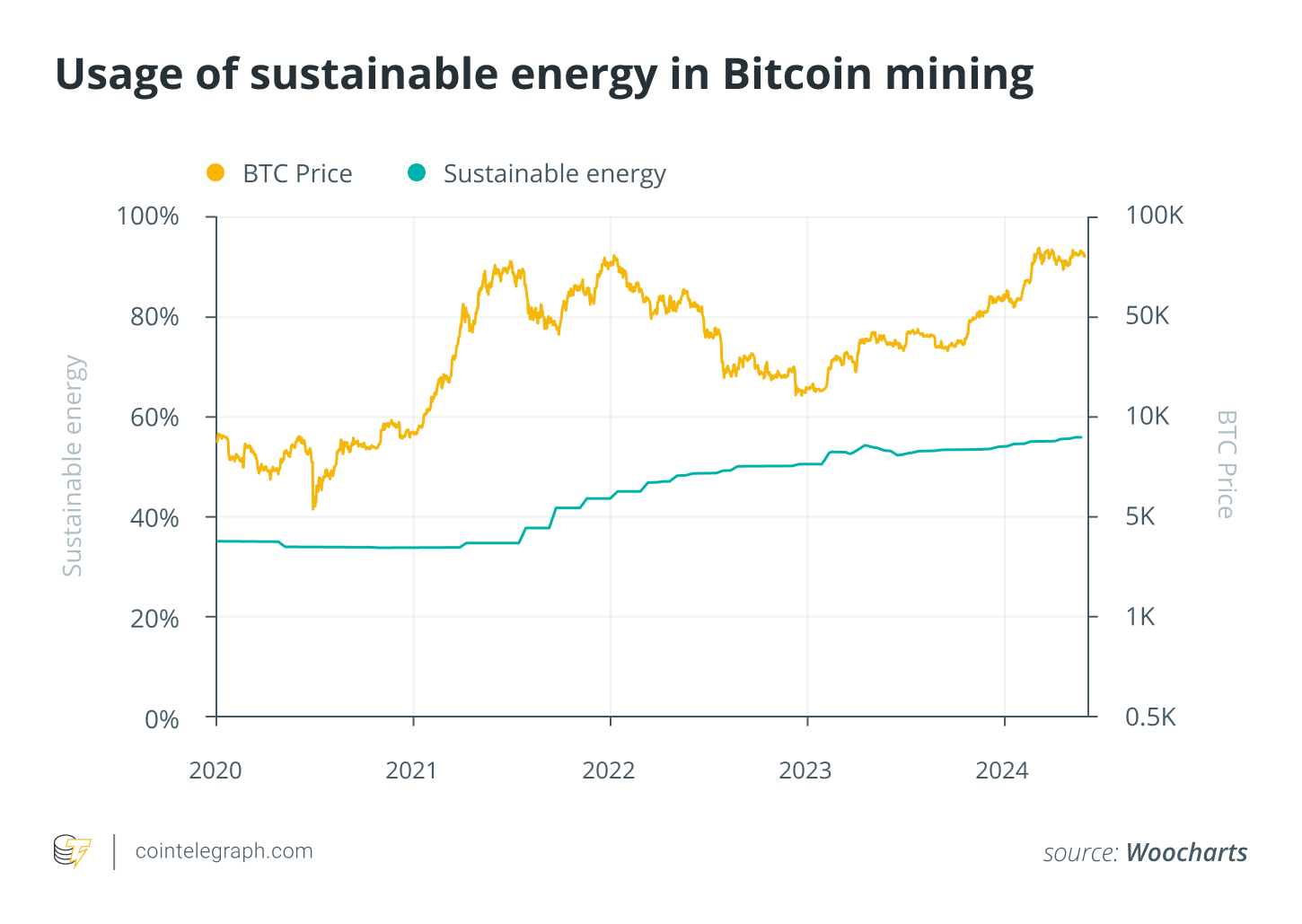

They combined the highest and lowest bounds to generate an estimate from multiple data points to determine Bitcoin electricity consumption, resulting in the Cambridge Bitcoin Electricity Consumption Index (CBECI).

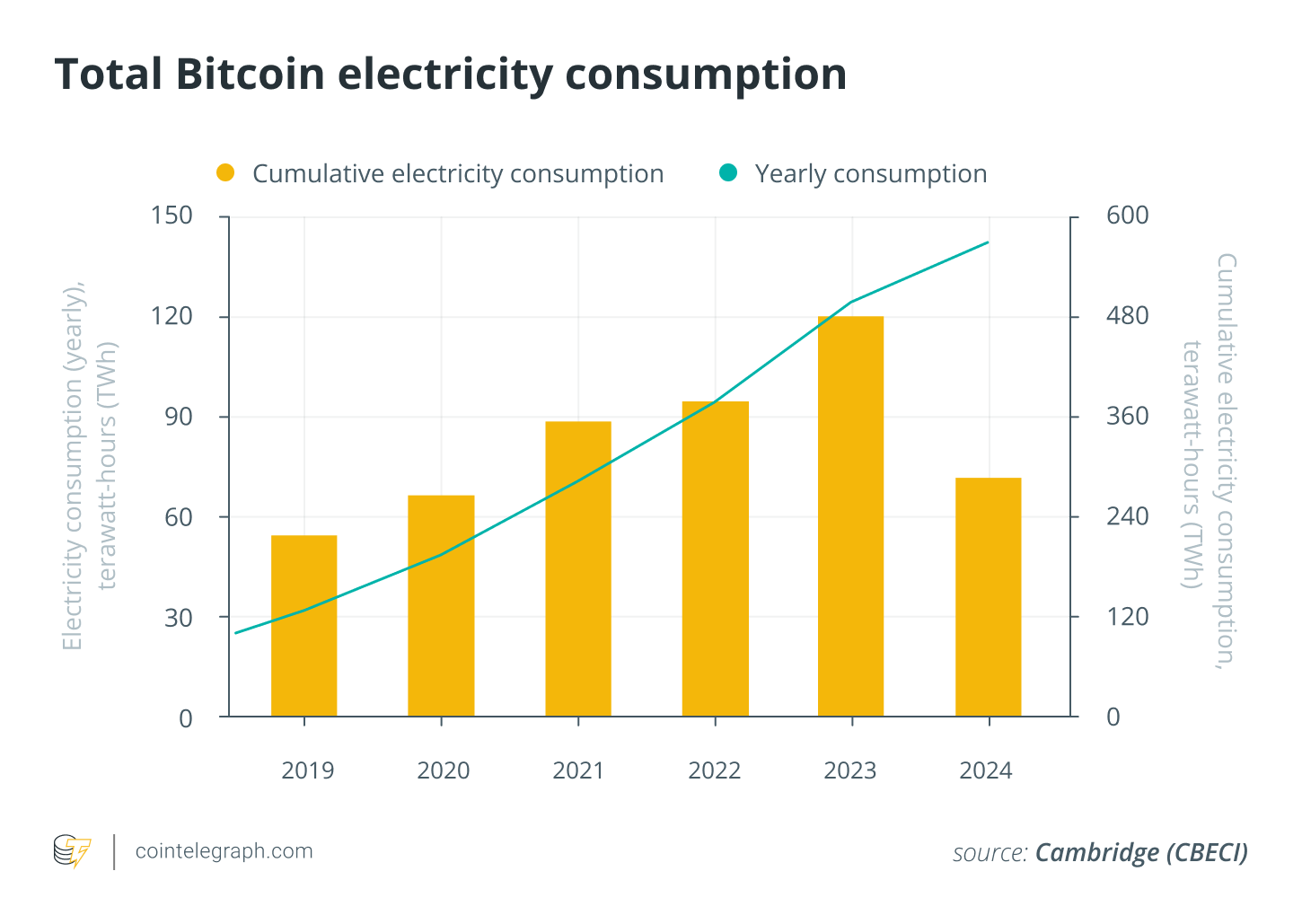

Nevertheless, it is crucial to ascertain the energy sources that the producers employ. The CBECI indicates that coal usage has remained relatively consistent, with a minor decrease from 40% to 36%.

Bitcoin mining’s renewable energy usage rate would be 63% if gas and nuclear were included as sustainable energies, with gas assuming the lead. Nevertheless, the rate would decrease to 28% if both variables were eliminated.

Neumüller cited additional research conducted by the Bitcoin Mining Council (BMC), which employs surveys rather than estimations. The global mining industry’s sustainable electricity consumption has increased to 59.9%, as indicated by the most recent report from BMC, published in mid-2023. This information is obtained from surveys conducted among miners in North America.

The BMC is an industry body established by miners, whereas an independent entity conducts the CCAF’s research. As he elaborated in his introduction to his research model, the Bitcoin Energy and Emissions Sustainability Tracker, this enhances the reliability of the CCAF for Batten.

Despite the empirical approach of the CCAF, Batten observed the absence of data on off-grid mining, which is associated with sustainable energy sources that are not part of the conventional electricity grid. These consist of flare gas, hydroelectric, solar, and wind power.

Batten stated that the CCAF’s estimation is based on data from January 2022, which is considered old-fashioned. Neumüller acknowledged this issue and observed that the CCAF mentions this discrepancy in their data, stating that it “likely leads to an overestimation in our emission estimate by approximately 25%.”.

Neumüller stated that the CCAF is presently investigating the addition of a new collection of data “directly from miners” and is actively seeking ways to improve the current IP-based electricity mix estimate by incorporating more granularity in terms of the energy sources and location used by miners.

The cryptocurrency sector is dynamic and constantly changing. Neumüller concluded that, based on the evidence he has observed thus far, he would “anticipate a substantial decrease in emission intensity.” This decrease would be “driven by a greater proportion of sustainable sources and a shift in the composition of the fossil fuel mix, with coal being largely replaced by gas.”

Batten is certain that the rate is above 50%, even though Bitcoin mining data is volatile.

“There is still a statistically a possibility that mining is still under 50%, but I would rank this likelihood at less than one in a million now.”

Bitcoin producers’ utilization of renewable sources exceeds 50%, which satisfies Musk’s prerequisite. Nevertheless, can BTC miners ensure the long-term expansion of renewable energy adoption?

A stable regulatory framework is essential for the development of renewable energy.

The pseudo-ban on crypto mining in China was one of the most significant developments in the dynamics of the Bitcoin mining industry. China did not explicitly prohibit crypto mining; it prohibited coal-based Bitcoin mining and certain larger operations that were transferring funds outside the country.

Before the moratorium, China was located at approximately 50–60% of the global Bitcoin mining capacity. The moratorium resulted in an exodus that has since altered the industry landscape.

Neumüller elucidated that the United States has become a global mining hotspot, accounting for 37.84% of Bitcoin’s total hash rate due to the significant decrease in mining activity in China and Kazakhstan and the advent of other countries.

The researcher stated that the global distribution of mining activity has been altered by this geographic change, affecting their estimate of the electricity mix. Miners are compelled to seek out the most cost-effective energy source due to the dynamics of Bitcoin mining. Renewable energy is the most cost-effective energy source in the United States, as it is in numerous developed countries.

The United Nations’ Sustainable Development Goals, which necessitate, among other things, the ubiquitous use of renewable energy, are being met by developed countries by seeding this new industry with subsidies. The utilization of discarded energy due to the mismatch between renewable generation and demand by crypto miners can benefit renewable energy issuers.

Additionally, Bitcoin mining is not restricted by geographic location; miners may establish their operations in any location with a renewable energy facility. For instance, numerous mining facilities have relocated to countries like Ethiopia, Uruguay, and Paraguay, which possess hydropower surpluses.

The U.S. is currently engaged in a heated debate regarding regulating the Bitcoin mining industry, as evidenced by the Chinese case, which underscores the importance of regulation in energy consumption.

The crypto industry asserts that President Joe Biden’s position could result in the extinction of the U.S. Bitcoin mining industry. In contrast, former President Donald Trump advocates for Bitcoin to be “made in the USA.”

Miners can relocate to other countries if regulations prohibit them or render their enterprises unprofitable. Nevertheless, Tesla’s decision to accept Bitcoin or not may be hindered by regulatory uncertainty, as the rates of renewable energy could fluctuate significantly based on regulation.

Is it possible for Musk to reinstate Bitcoin in Tesla?

Musk may be controversial, but the billionaire has demonstrated a lack of concern for public criticism when he has a specific objective.

This was made clear when he shared his infamous remarks directed at Disney CEO Bob Iger in response to the advertisement boycott on X.

Nick Cowan, CEO of fintech company Valereum, stated to Cointelegraph, “I genuinely do not believe that he is afraid of anyone other than his mother!”

Tesla is a corporation that is dedicated to the enhancement of the environment by providing electric vehicles and technological solutions. The public’s perception that Bitcoin has a significant environmental impact was inconsistent with its principles. It is uncertain whether Musk would be willing to take that action even though numerous data metrics indicate that Bitcoin is not as environmentally harmful as previously believed. De Vries thinks that Tesla may suffer as a result:

“Relying on any claims about Bitcoin mining and renewables at this time would set Tesla up for another PR disaster.”

According to Oleg Fomenko, a co-founder of the Sweat Economy and an entrepreneur, Tesla is already making significant contributions to the environment as an electric vehicle manufacturer. Consequently, he believes the company does not need to succumb to environmentalist pressure.

According to de Vries, certain segments of society do not perceive Bitcoin as having any practical application. They would be “disappointed” if they were to allocate valuable renewable energy resources to Bitcoin computations that are ultimately rendered pointless. He thinks “no amount of renewable energy can resolve issues such as e-waste generation.”

Donald Trump recently expressed his desire for the United States to regulate the Bitcoin mining industry.

Fomenko concluded that Musk must determine the “cost of action versus the cost of inaction.” A few of us reading this might harbor disappointment over Elon not upholding his word in the event of inaction, while the results are uncertain, and there is more at stake if he takes action.

He thinks this would be contingent upon “Elon’s desire to take another potshot at Gary Gensler and the U.S. Securities and Exchange Commission.”

Musk is the ultimate decision-maker at Tesla. If he were to reinstate Bitcoin, he would need to be prepared with data and prepared for backlash, particularly from green policy advocates.