Worldcoin price surges 28% as World ID extends to over 40 countries, driving WLD interest and a 76% increase in trading volume.

The World ID initiative, which Sam Altman co-founded, has expanded its identity verification services to over 40 countries, resulting in a 28% increase in the price of Worldcoin.

With an emphasis on developing a secure, decentralized ID system that employs biometric verification, this rapid international expansion encompasses recent launches in Austria, Poland, and Costa Rica. Worldcoin’s global presence has steadily expanded despite regulatory obstacles, notably those related to iris-scanning Orbs, which has bolstered interest in its native cryptocurrency, WLD.

- 1 The price of Worldcoin has increased by 28% due to the expansion of global ID verification

- 2 Sam Altman Commends the Project’s Growth in the Face of a User Surge

- 3 Analysis of the WLD Price: Will it Rise to $3?

- 4 Institutional interest and substantial transactions are indicative of market confidence

The price of Worldcoin has increased by 28% due to the expansion of global ID verification

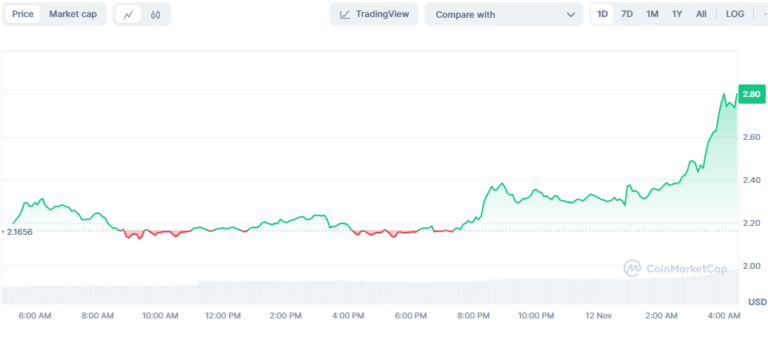

In the past 24 hours, the price of Worldcoin (WLD) has been on a bullish rally, fluctuating between an intra-day high and low of $2.83 and $2.12, respectively. At the time of publication, the price of WLD was $2.80, representing a 38% increase from the support level and a 66% increase in the past week. The World Initiative has made substantial progress in Latin America, establishing new operations in Colombia, Ecuador, and Guatemala.

The initiative addresses digital fraud concerns and secures identity verification by introducing Orbs in these regions. This approach has also been well-received in some areas of Europe, where Worldcoin’s reach has been expanded despite regulatory challenges, as evidenced by recent launches in Poland and Austria.

Nevertheless, regulatory scrutiny continues to be a matter of concern. Regulators in South Korea and authorities in Spain and Germany have expressed concerns regarding the privacy implications of biometric data collection. Local officials in Kenya suspended Worldcoin’s operations due to concerns regarding data privacy. These obstacles illustrate the intricate terrain that Worldcoin must negotiate to establish itself in new markets.

Sam Altman Commends the Project’s Growth in the Face of a User Surge

Sam Altman, the co-founder of the World initiative, recently commemorated the team’s advancements, stating that World ID has verified more than 16 million users. Altman commended Alex Blania, the CEO of World, for his successful leadership in facilitating the project’s expansion in a regulatory environment that was difficult to navigate.

Altman expressed his optimism regarding the future potential of cryptocurrency on social media, writing, “Amazing progress at World over the past year.”

The global presence of Worldcoin has resulted in a surge in interest in WLD, as millions of users have been verified. The recent price momentum of WLD has been influenced by the increasing adoption and visibility of the World project, as the token gains traction as more users join the network.

Analysis of the WLD Price: Will it Rise to $3?

The price of Worldcoin (WLD) has experienced an increase in trading activity as the cryptocurrency’s user base expands. The recent 28% price increase is consistent with a 76.56% increase in trading volume, which has now reached $2.38 billion.

Additionally, open interest has increased by 38.51%, currently totaling $346.38 million. As new funds enter the market, this volume and open interest increase frequently indicate a favorable outlook, as it has the potential to support additional upward movement.

Technical indicators also indicate positive tendencies for WLD. The Chaikin Money Flow (CMF) indicator indicates moderate buying pressure, while the Money Flow Index (MFI) is currently at 70.51, near overbought territory. Analysts predict that WLD may approach the $3.00 resistance level if it maintains its current momentum. However, there is a possibility of a pullback if buying pressure decreases.

Institutional interest and substantial transactions are indicative of market confidence

The surge in Worldcoin’s price has accompanied significant activity from major holders and institutions. The transaction volumes for trades exceeding $100,000 have reached $236.93 million in the past week, suggesting substantial institutional interest.

This implies that more prominent investors are actively modifying their positions in WLD and are becoming more optimistic about Worldcoin’s long-term potential.

The cryptocurrency has demonstrated resilience in the face of volatility, with 45% of holders presently “in the money” and profitable at the current Worldcoin price. The sustained increase in large-scale transactions indicates a strong foundation of market confidence, even though some analysts warn that the WLD price may encounter short-term resistance, particularly near the psychological $3.00 level.