XRP ETF approval odds hit 86% on Polymarket after ProShares’ Ultra XRP ETF launch, driving $3.51 price and institutional interest.

The ProShares Ultra XRP ETF’s successful debut has increased the probability of full XRP ETF approval to 86%, according to Polymarket data.

The likelihood of the XRP ETF being approved has increased to 86%

The probability of the XRP ETF being approved has now exceeded 86%, as indicated by Polymarket data. This coincides with the effective launch of the ProShares Ultra XRP ETF, resulting in a 15% increase within 24 hours.

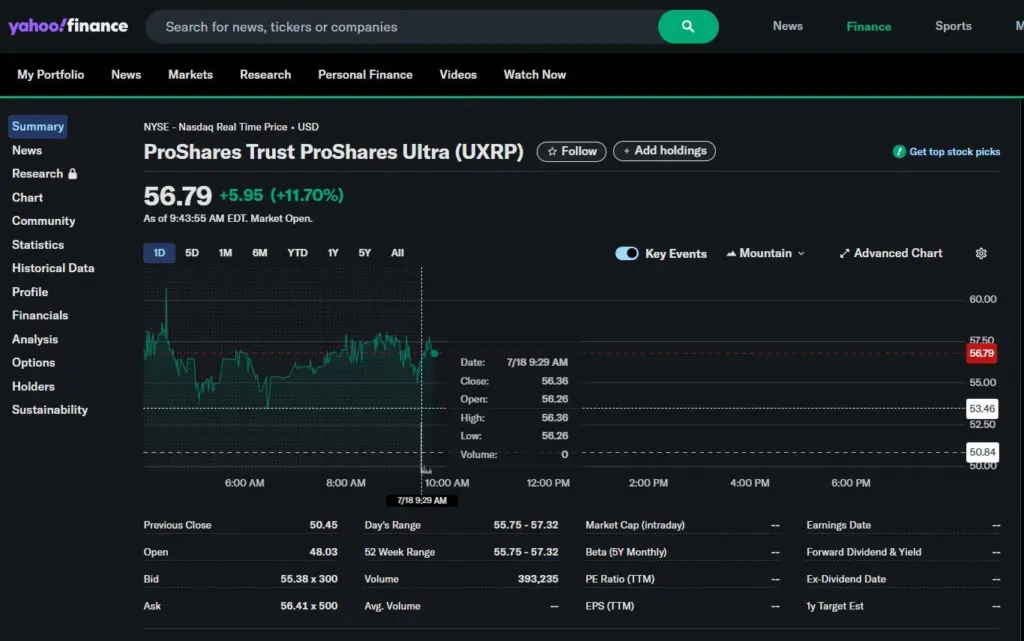

On July 18, ProShares officially launched its Ultra XRP ETF (UXRP) on NYSE Arca, indicating a positive outlook regarding imminent ETF approvals. The leveraged fund began trading at $50.84 and rapidly rose to an intraday high of $57.86 before closing at $53.94, a 6.10% increase on its first day of trading.

In contrast to standard products, this product provides investors with a 2x leveraged exposure, which is associated with Ripple’s ongoing growth, the integration of the ISO 20022 payment standard, and the increasing rate of institutional adoption.

The scale of the market for XRP ETFs has once again been demonstrated by this successful launch, according to analysts. The early trading volume and price action suggest XRP-based investment vehicles are gaining popularity before regulators authorize a real spot ETF.

Even though the ProShares UXRP ETF is currently a leveraged, futures-based product, there is already speculation regarding its potential evolution. Chad Steingraber, a crypto enthusiast with a significant following, confirmed on X that ProShares intends to petition for a conversion of UXRP, which is not yet a spot ETF.

This tactic is comparable to the recent strategies employed with Bitcoin and Ethereum products, in which issuers initially introduced futures-based ETFs before requesting spot approval when market conditions and regulations permitted.

The Factors Increasing the Proximity of XRP to ETF Approval

The likelihood of the ETF being approved has been further bolstered by several external factors. The recent passage of significant crypto laws in the United States, such as the GENIUS Act, is important. After a protracted debate, this resolution was ultimately approved by the House. It is designed to enhance the digital asset framework and elucidate the stablecoin regulations. This fosters a more favorable environment for the approval of exchange-traded funds (ETFs).

Earlier this week, SEC Commissioner Hester Peirce publicly alleviated concerns regarding spot ETF rejections, enhancing public sentiment. This occurred after the SEC’s postponement of numerous crypto ETF decisions. The market was reassured by her comments that the agency is amenable to novel products, as long as issuers comply with compliance standards.

The conversation has shifted from “if” to “when” an XRP ETF might obtain full spot approval, as evidenced by the proven demand, fresh legislative backing, and more explicit rules that were evident on the first trading day.