XRP price could surge 1,300%, says expert, as XRPL activity hits record highs and investor interest picks up.

As activity on the XRPL (XRP Ledger) continues to increase, a cryptocurrency specialist has forecast a 1,300% spike XRP price.

According to the expert, there are similarities to the 2017 explosive run, but on-chain statistics and practical use cases indicate that this cycle may be considerably larger.

XRP Ledger Gains Strength As Global SWIFT Volumes Decline

There appears to be a rising trend away from SWIFT and toward the XRPL.

The decades-old foundation of global banking, SWIFT, suffered a 15% decline in transaction volume.

On the other hand, because of its speed, cost-effectiveness, and removal of correspondent financial chains, XRPL activity is increasing.

Ripple CEO Brad Garlinghouse forecasted at the Apex XRPL Summit that the ledger could capture up to 14% of SWIFT’s global volume within five years. Given that SWIFT handles over $150 trillion annually, this projection suggests that more than $21 trillion could move over XRPL.

Notably, the XRPL is being used by more financial institutions because of its clear structure, three to five-second settlement times, and reduced requirement for pre-funded accounts.

International transactions worth billions of dollars are currently handled by RippleNet, which runs on the XRPL.

This allows banks and fintech businesses to improve their cash flow and cut expenses.

The new EVM-compatible sidechain for the XRP Ledger was formally released on June 30th, adding to the bullish environment.

More than 1,400 smart contracts went live in its first week, as CoinGape revealed.

More than 1,300 contracts have remained active since its launch.

In the meantime, the $685 billion remittance sector is the target of Ripple’s RLUSD stablecoin.

The volume of transactions on XRPL is anticipated to rise as more people utilize RLUSD for remittances, DeFi, and payments.

Due to increased on-chain liquidity, this increase in activity will increase demand for XRP and raise its price.

Expert Predicts 1,300% Increase In XRP Price

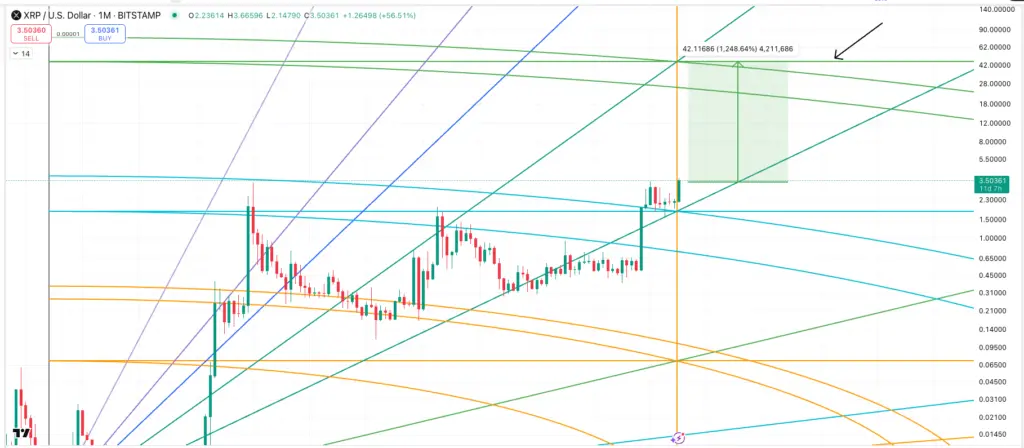

XRP price displays a re-expansion of monthly Bollinger Bands, a pattern last observed before its historic rally in 2017, according to a recent analysis by renowned specialist The Great Mattsby.

At the time of the breakout, XRP surged an extra 1,300%.

This possible rise aligns with Mattsby’s Gann-based chart analysis, which places XRP at about $45 per share.

XRP price has remained indisputable, notwithstanding its previous difficulties.

With a market valuation of over $207 billion and a current price of $3.5, XRP has increased by more than 63% in the last month.

This is also consistent with the increasing activity of the XRP Ledger.

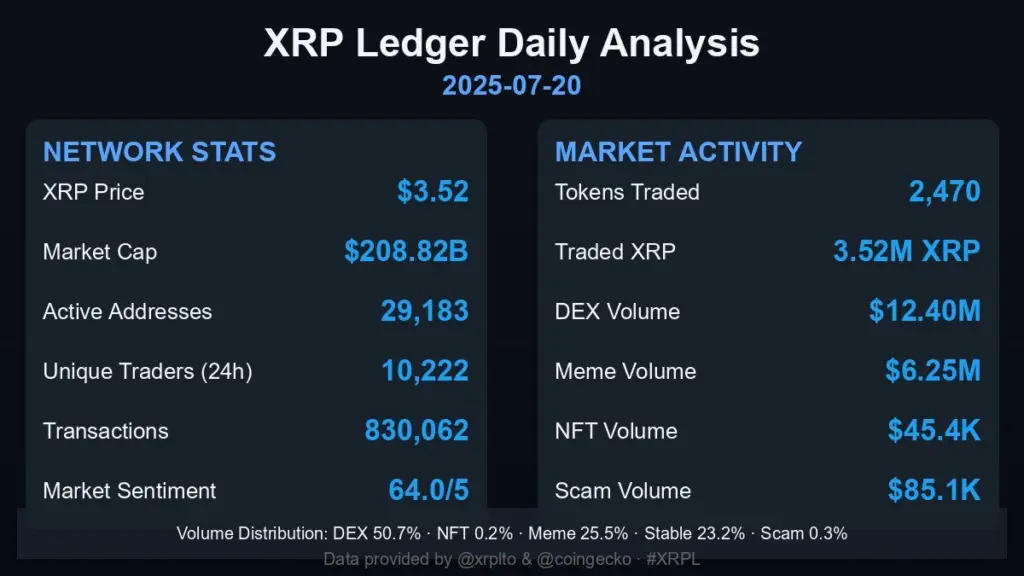

Activity on the XRPL is growing rapidly. Daily active addresses have increased 7x, and transaction volumes have reached record levels. The XRPL now has more than 29,000 active addresses and over 10,000 unique traders.

Additional data indicates that around 830,000 transactions were made every day.

Meme coin trading generated $6.25 million in revenue as well.

While the total volume on decentralized exchanges (DEX) on XRPL reached over $12 million, indicating high liquidity, stablecoin activity remained consistent at about $5.6 million.

In conclusion, analysts think XRP price may experience a significant spike as the cryptocurrency moves from payments into smart contracts and stablecoin remittances.