XRP’s price still depends on what happens with the SEC and Ripple litigation, even with a possible breakout.

Many investors are placing bets on the XRP token’s price breakthrough. Is there potential for further upward momentum for it?

More traders are placing bets on the rise in the price of XRP.

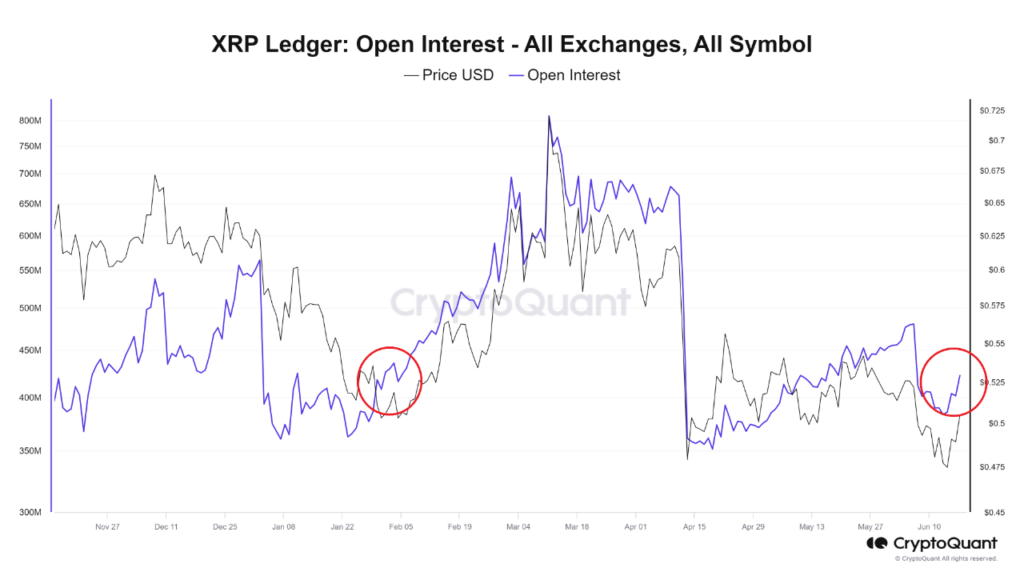

The spike in open interest (OI) indicates that more traders are placing bets on an increase in the price of XRP 0.49, according to market analysis by verified CryptoQuant contributor Woominkyu.

In a research paper dated June 18, he wrote:

“This trend suggests that as open interest rises alongside price, investors are opening more positions with the expectation of XRP’s price increase. This heightened interest indicates that more trading activity is occurring with it.”

However, the author issued a warning that this might also result in higher price volatility. He penned:

“As open interest increases along with the price, this could reflect investor expectations and actions, but it could also bring about sudden market fluctuations, so caution is necessary.”

According to Binance data, the price of XRP has been declining since the start of the year, down more than 19% year-to-date (YTD), and is currently trading at $0.49.

On June 11, XRP’s open interest began to increase, and developments may influence the likelihood of a breakout in Ripple’s legal dispute with the Securities and Exchange Commission (SEC).

Citing the SEC’s settlement with Terraform Labs, Ripple requested a penalty of “no more than $10 million” on June 13, far less than the regulator’s proposed $876.3 million civil penalty.

In a letter dated June 14 to Judge Torres, the SEC contended that “that low of a penalty would not satisfy the purposes of the civil penalty statutes.” After a day.

Investors would be relieved of a potential settlement because the two have been involved in legal proceedings since 2020 when the SEC said that Ripple offered securities that were not registered.

Is a breakout in the price of XRP imminent?

According to an essential technical chart formation, the price of the XRP coin may be poised for a breakout until the end of June.

A descending triangle has developed on the daily chart; as the triangle’s wedges become closer, this pattern may indicate a possible breakout in price. If it can stay above the $0.47 support level, this might lead to a surge in the price.

Fractals of XRP also suggest a possible breakout, provided the price chart replicates the patterns that appeared after the price broke out of an analogous ascending triangle pattern in February 2024.

Technical traders utilize fractal patterns to pinpoint critical support and resistance levels and possible trend reversals based on past data.

Simultaneously, traders need to consider any unfavorable news regarding the SEC v. Ripple litigation that can harm the market and drive the price below its present support level.