The long vs. short ratio for XRP on Binance has reached its highest level since March, potentially paving the way for a rally toward $8.

The XRP price has experienced an additional 14% increase in the past 24 hours despite the majority of the crypto market entering a consolidation phase late Tuesday. Additionally, certain market analysts anticipate that XRP will exhibit a chart pattern comparable to the 2017 bull run, expecting it to increase in value to $8 and beyond.

The Ripple crypto is once again on the brink of reaching its critical resistance level of $0.75, as its market capitalization has surpassed $41 billion, and its daily trading volume has increased by 166% to $11.53 billion.

Is the price of XRP poised to reach an all-time high of $8?

The XRP open interest has increased by 14% to $1.120 billion, as the Coinglass data indicates. Over the past 24 hours, it has resulted in $24.5 million in liquidations. The significant increase in open interest suggests a robust bullish sentiment toward the altcoin, and a further rally is likely.

Armando Pantoja, a crypto analyst, has identified a substantial opportunity in XRP and has established an ambitious target range for XRP between $8 and $30. Pantoja stated that the technical indicators for the Ripple cryptocurrency exhibit comparable patterns to those observed during the most recent significant rally.

The cryptocurrency XRP experienced a significant increase from pennies to over $3 the last time it exhibited a setup similar to the current one, which includes a positive MACD (Moving Average Convergence Divergence), increasing volume, and a symmetrical triangle pattern, according to Pantoja. He also cautioned that this may be the final opportunity to accumulate XRP below $1.

Market analysts also anticipate that the Ripple crypto could soon reach $1.28, resulting in a $100 billion market cap for XRP.

Are there signs of a forthcoming mega rally due to the accumulation of FOMO?

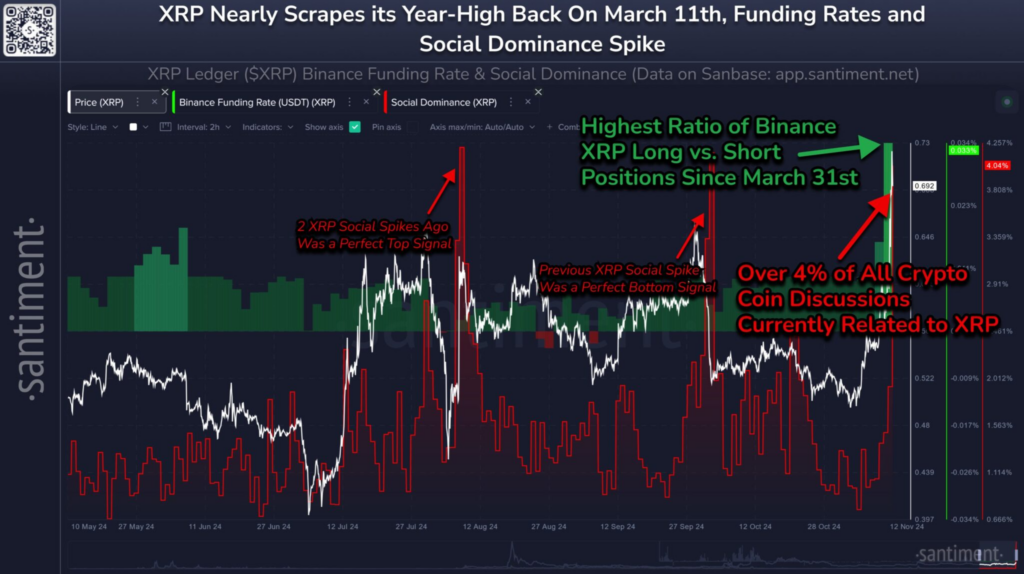

Since March of this year, the XRP price has had the highest long vs short positions on the crypto exchange Binance, according to the blockchain analytics platform Santiment. This demonstrates that bulls are again leading the charge in anticipation of a subsequent rally to $1 after the breakout from the $0.75 resistance. This scenario is feasible amid discussions regarding dismissing the protracted SEC vs Ripple lawsuit.

Additionally, the social sentiment is expanding rapidly, with the XRP discussions alone accounting for 4% of the overall crypto market chatter. The Ripple cryptocurrency has experienced a remarkable 45% increase in value over the past week following Donald Trump’s victory, contributing to this interest increase.

The subsequent critical test for XRP will involve surpassing its March high of $0.74, with market sentiment and Fear of Missing Out (FOMO) serving as significant variables. Analysts also observed that the potential for additional gains is contingent upon preserving balanced funding rates on major exchanges, such as Binance. This is to prevent the accumulation of leveraged long positions.

Conversely, the Ripple ecosystem is currently developing potential partnerships with other market participants to facilitate further expansion. Charles Hoskinson, the founder of Cardano, has alluded to the possibility of a collaboration with Ripple in the most recent development. However, he has not disclosed any additional information.