XRP, Ripple’s own cryptocurrency, became one of the top five cryptocurrencies by market price for the first time as the cryptocurrency market became more optimistic

During a crypto market rise on Friday, Nov. 29, Ripple XRP passed Binance’s BNB Coin and its $95 billion market cap. However, BNB Coin still faces significant challenges. The market for digital assets as a whole went up to $3.5 trillion, which was Ripple’s biggest level yet.

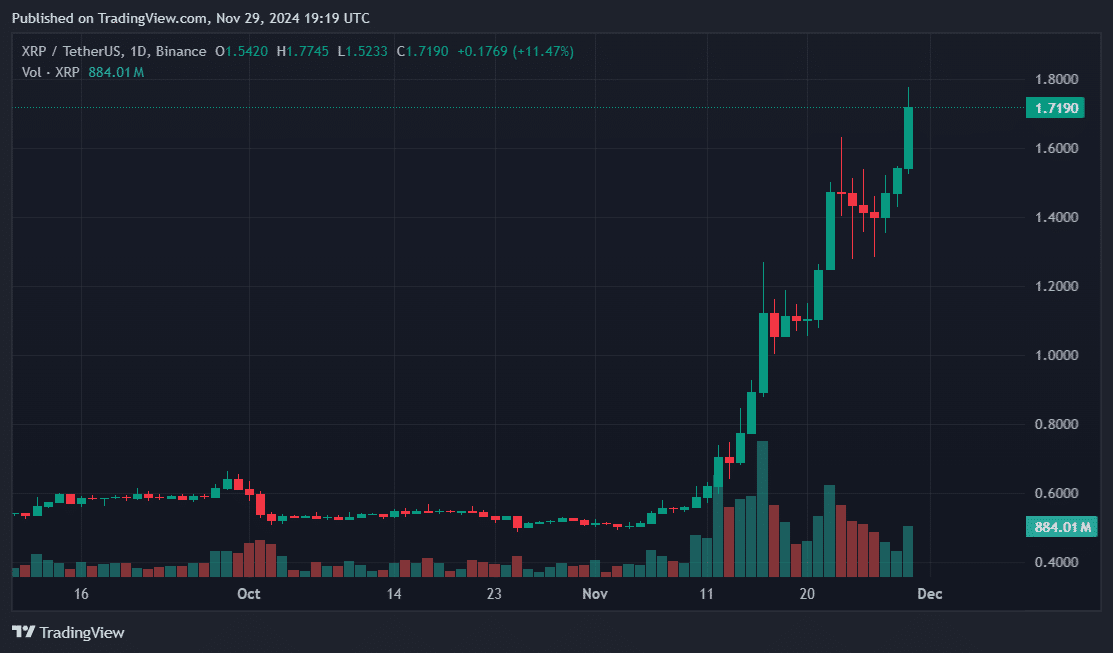

The price of XRP got closer to its all-time high because the market was generally optimistic, Ripple’s business grew, and regulations helped the price. XRP was trading at $1.70 as of this writing, up 15.8% in 24 hours and 226% in the last 30 days. The most it ever cost was $3.40 in January 2018.

Bitwise, Canary Funds, Grayscale, and WisdomTree were the first companies to push for a spot XRP exchange-traded fund. The Securities and Exchange Commission’s staff changes prompted this action.

One of the top candidates to replace retiring crypto-skeptic chair Gary Gensler was Paul Atkins, who used to be an SEC commissioner and was a supporter of crypto regulation. Gensler said he was stepping down on January 20, after Donald Trump won the race for president.

Ripple was also one of a new group of stablecoins that came out. The digital payment company put out its RLUSD on its XRP Ledger and Ethereum (ETH), which has the most user deposits and is the biggest decentralized financial environment.

Court victories over the SEC and upcoming crypto-friendly U.S. legislation have made Ripple even more of a giant in the world of digital assets. Even though the SEC said that selling XRP to regular people broke securities laws, the Southern District Court of New York didn’t agree with them. The judge also agreed to a $250 million fine for XRP sales by institutions.

However, the SEC might file an appeal, and Atkins, a new top SEC official, might alter the agency’s regulations.