Tokenized RWAs on XRPL soar 2,260%, fueled by rising institutional demand and Ripple’s growing ecosystem.

With tokenized RWAs on the network soaring by 2,260% in recent weeks, the XRP Ledger (XRPL) is seeing an incredible uptick in activity.

The expanding ecosystem of Ripple may be the cause of this.

Tokenized RWAs Reach New XRPL Ecosystem Milestone

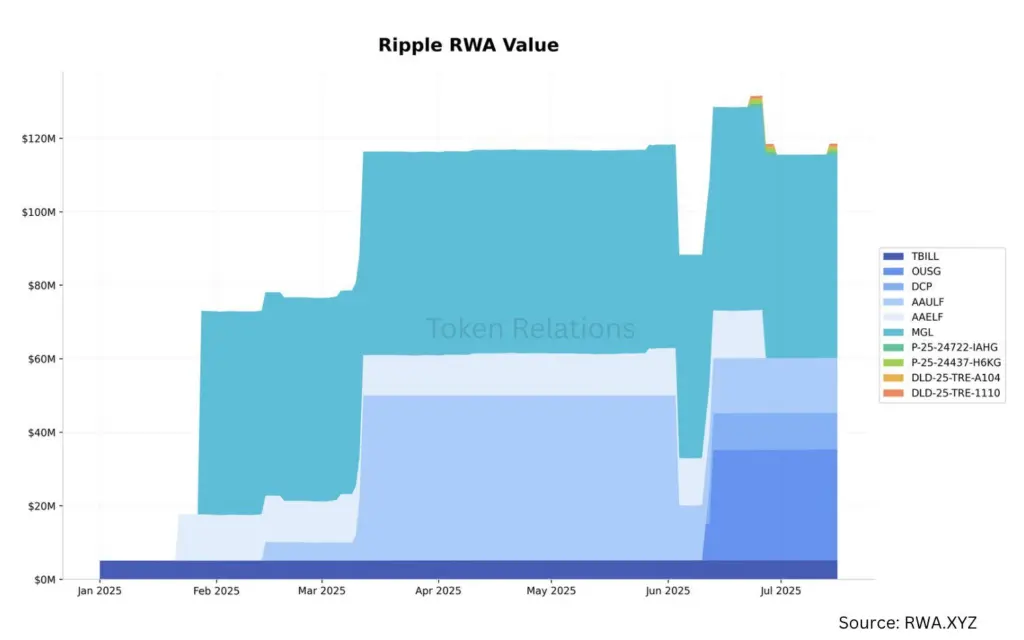

According to recent research by Token Relations and Ripple, the value of tokenized RWAs on XRPL increased by 2,260% in just six months, from $5 million in January to over $118 million today.

Tokenizing assets like US Treasuries and real estate on the XRPL is attracting the attention of more significant entities.

The XRPL network is expanding its decentralized finance (DeFi) options beyond tokenized RWAs.

At $86.66 million, the total wealth locked in DeFi has grown by 57%.

The average number of daily transactions has increased to 1.77 million due to the increased use of stablecoins and decentralized exchanges (DEX) trading.

With extremely low median costs of about $0.000037, XRPL is a fantastic option for regular payments.

Notably, the XRPL stablecoin ecosystem has grown quickly this year with the introduction of new offerings. RLUSD now has a market capitalization of over $65 million, alongside Circle’s USDC. These changes show that XRPL is expanding beyond just payments to support tokenized financial assets and institutional DeFi.

With more than 900 nodes globally and more than 170 active validator nodes that support consensus, XRPL boasts a robust network.

Only around 1% of these validators are managed by Ripple, yet the network remains decentralized and can handle the demanding requirements of business transactions.

It can process over 1,000 transactions per second and charges less than one penny.

Ripple’s Global Push Strengthens Institutional Adoption

The rapid global expansion of Ripple facilitates additional institutions’ use of XRPL.

Obtaining a license from the DFSA in the United Arab Emirates grants entry to a $400 billion trading market.

Cross-border payments are made simpler via partnerships with Mamo Pay and Zand Bank.

According to CoinGape, Ripple is collaborating with Ctrl Alt to tokenize property title deeds in Dubai’s real estate sector.

In Europe, Ripple Custody services are enhanced by collaborations with organizations including DZ Bank, BBVA Switzerland, and DekaBank.

Additionally, adding Societe Generale’s stablecoin expands XRPL’s user base.

Furthermore, Ripple’s partnerships with BDACS in Korea and Straits in Singapore demonstrate its ambition to serve as the cornerstone of institutional digital asset infrastructure.

XRPL is driving the adoption of tokenized assets across the region, as seen by the launch of the BBRL stablecoin and Mercado Bitcoin’s $200 million tokenization plans in South America.

Since its inception, the XRP Ledger (XRPL) has handled more than 3.3 billion transactions.

It is now much more than a simple payment method.

It is growing in popularity for digital assets and decentralized finance due to its affordable fees, strong partnerships, and high scalability.