Yield App suspends operations despite prior guarantees of no appreciable impact, alleging losses from FTX exposure.

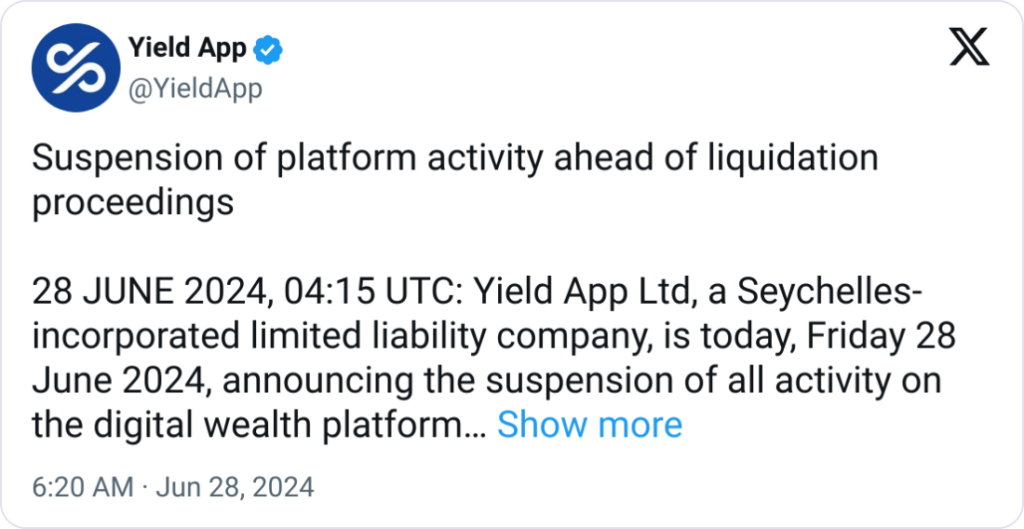

The cryptocurrency investment platform Yield App, incorporated in the Seychelles, declared on June 28 that it would suspend all activities on its site effective immediately.

The choice ” had been made to ensure fair and equal treatment for all Yield App’s users and stakeholders,” according to an official statement.

“This follows the realization of portfolio losses incurred through third-party hedge fund managers that held Yield App assets in custody on the collapsed cryptocurrency exchange FTX, and who are subject to ongoing litigation.”

What investors should understand

The official statement states that Yield App had portfolio losses due to “ongoing litigation” involving third-party hedge fund managers in charge of holding Yield App assets on FTX.

Community channels on the Yield App have been suspended, although a support channel is still accessible to the general public through the official website.

Variations in exposure to FTX

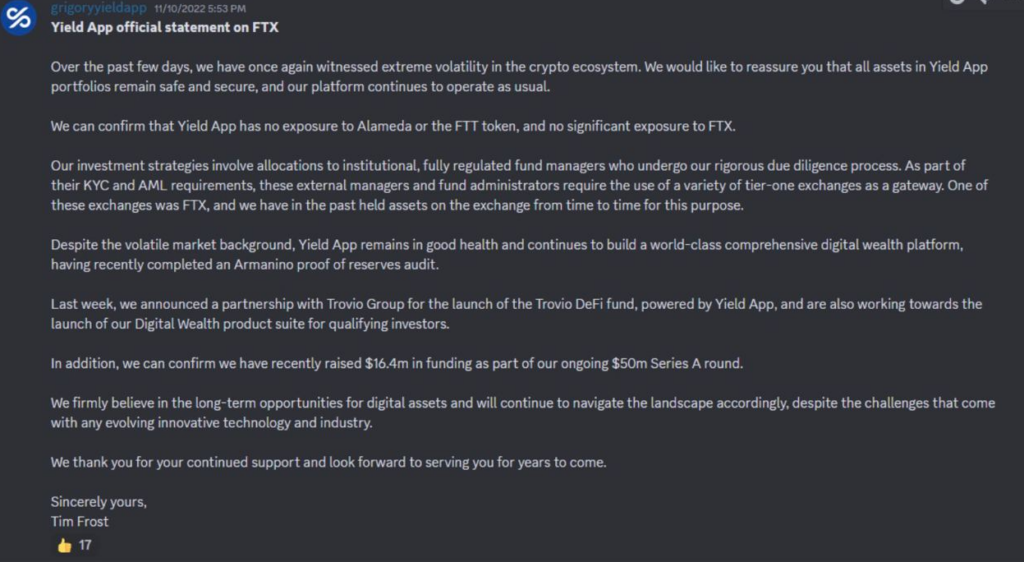

Even with the revelation, Yield App’sApp’s prior remarks have raised questions about how transparent the business is and how much it was exposed to the FTX crash.

Yield App Tim Frost informed customers that the cryptocurrency investing firm has “no significant exposure to FTX” in a message posted on Discord on November 10, 2022.

An unnamed source voiced bewilderment about the circumstances, stating that:

“This whole thing doesn’t make any sense. I think it’s super weird they got affected by FTX when it’s already two years ago, and they gave an official statement.”

Continued selloffs in FTX

The defunct cryptocurrency exchange FTX sold off several of its assets and claims in 2024, resolving numerous conflicts.

Just in February, FTX sold $33 million for the sale of its European branch, offloaded 8% of its investment in the artificial intelligence (AI) company Anthropic, and scheduled the sale of Digital Custody for $500,000.

The defunct cryptocurrency exchange’s ongoing asset sales activities are a component of its bankruptcy proceedings.