Yuval Noah Harari, a philosopher and historian, says unregulated AI in finance could cause a disaster.

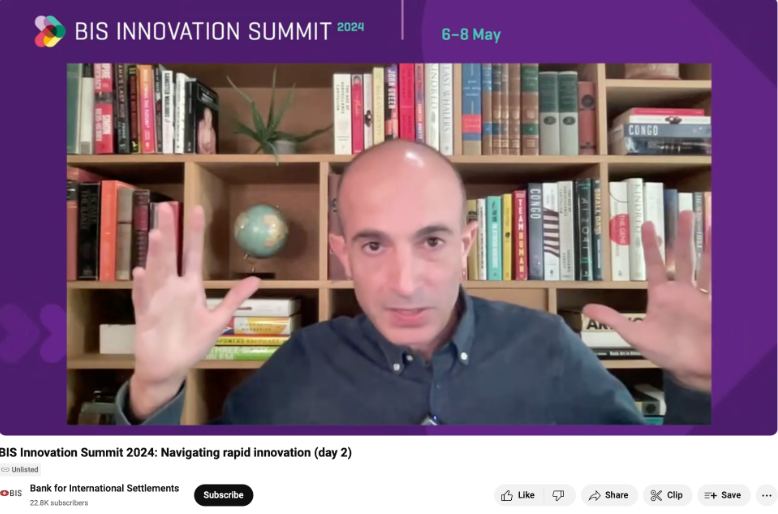

At the Bank for International Settlements (BIS) Innovation Summit, author, philosopher, and history professor Yuval Noah Harari warned an audience that unrestrained application of artificial intelligence (AI) in the financial system could have disastrous consequences. He stated that robust institutions are required to keep AI in control.

Harari argued that confidence is made in the financial system. Financial instruments such as money, bonds, and others enable millions of strangers to collaborate in pursuit of shared objectives. However, he stated that no effort has been made to simplify financial regulation for “humans.”

“Maybe 1% of the population understands how the financial system works. What happens when that number goes down to zero?”

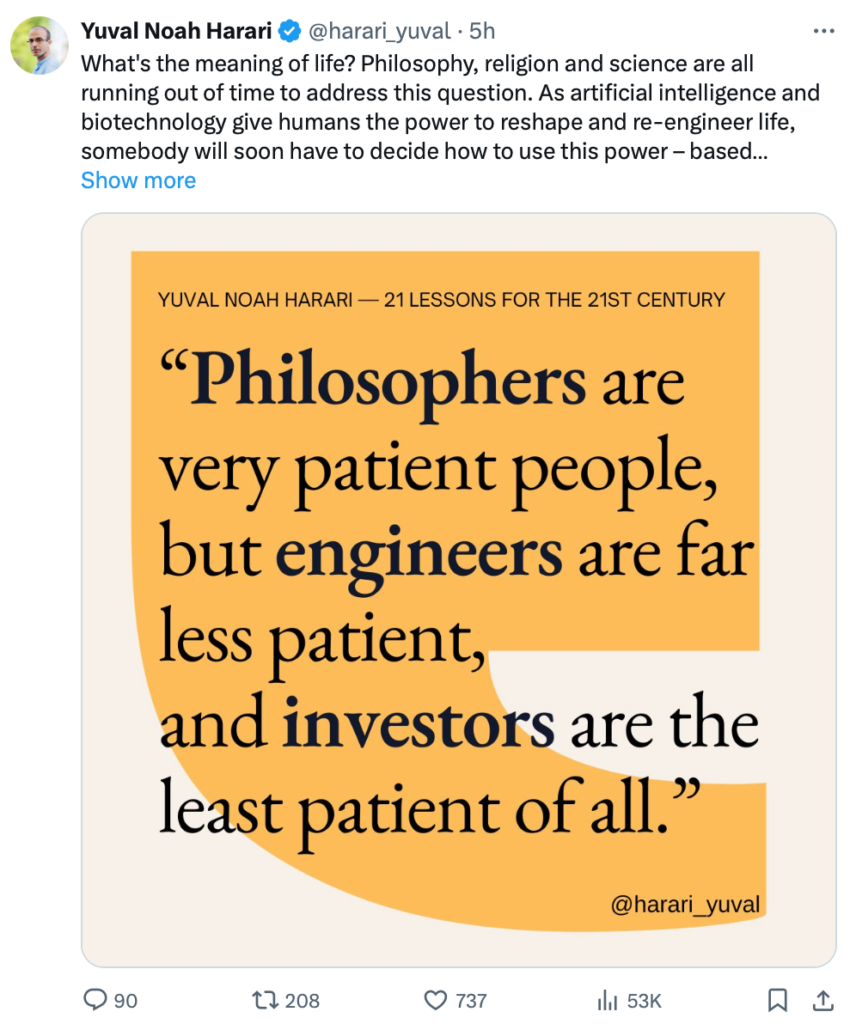

Harari attributed the financial crisis between 2007 and 2008 to inexplicable financial innovation. To govern novel financial products effectively, the regulatory bodies needed to be more knowledgeable about them.

AI is an extraterrestrial intelligence in its nascent stages of development. It lacks the capacity for human-like reasoning and could effortlessly generate financial mechanisms that defy comprehension, thereby transferring authority from legislators and regulators to algorithmic systems. Instead of establishing trust between individuals, it would be between AI systems; legislators and regulators would be compelled to place their faith in AI during a financial crisis.

This erosion of trust in interpersonal connections may result in social unrest. Harari observed that confidence in institutions and politicians is already eroding, adding:

“We need to prevent AI from becoming completely unfathomable. […] We need the ability to understand it and regulate it.”

Harari stated that regulation should not be entrusted to “charismatic leaders” or visionaries. Maintaining human awareness is an institution-exclusive capability.

Dangerous circumstances persist even under such conditions. Frequently, revolutionary advancements achieve success only after a sequence of unsuccessful endeavors to implement them. Imperialism, communism, and Nazism, according to Harari, were failed endeavors to establish industrialized societies that claimed the lives of tens of millions of people. In the interim, AI is capable of generating its utilization strategies.

According to Harari, regulators must prioritize fostering greater trust among individuals to ensure a stable and humane financial system in the future.