ZKSync strives to promote personal freedom and drive widespread crypto adoption with its developer-focused blockchain infrastructure.

ZKsync has set ambitious objectives to accomplish over 10,000 transactions per second (TPS) and reduce transaction fees to as low as $0.0001 by 2025.

ZKsync is a layer-2 (L2) scaling solution that enhances the scalability, security, and privacy of the Ethereum mainnet by utilizing zero-knowledge proofs (ZK-proofs).

ZKsync’s 2025 roadmap, disclosed in a blog post on December 12, indicates that the company intends to enhance usability by increasing its performance to more than 10,000 TPS and decreasing its transaction fees to $0.0001.

In 2025, Most Popular Options For Blockchain Developers Will Be Elastic Network, ZK Stack

The roadmap delineates the company’s intentions to enhance ZKsync’s Elastic Network and ZK Stack, thereby establishing them as the preferable tools for blockchain developers.

If ZKsync’s technology were to surpass 10,000 TPS with $0.0001 median transaction fees for Ethereum-native ERC-20 tokens by the end of the year, it would be more enticing to builders.

In a Dec. 12 X post, ZKsync stated that the protocol is fundamentally about advancing the personal freedom of investors and accelerating mass crypto adoption.

“Today, Web2 builders are forced to make tradeoffs between Web3’s values and usability, often opting for centralized developer platforms. ZKsync’s answer is to create an elastic, cloud-like development environment without builders to choose between UX, performance, and security.”

Widespread Adoption Of Cryptocurrency May Be Facilitated By Privacy-Preserving Technologies

A general paucity of private states in Web3 has discouraged the majority of mainstream institutions from participating in the decentralized finance (DeFi) sector.

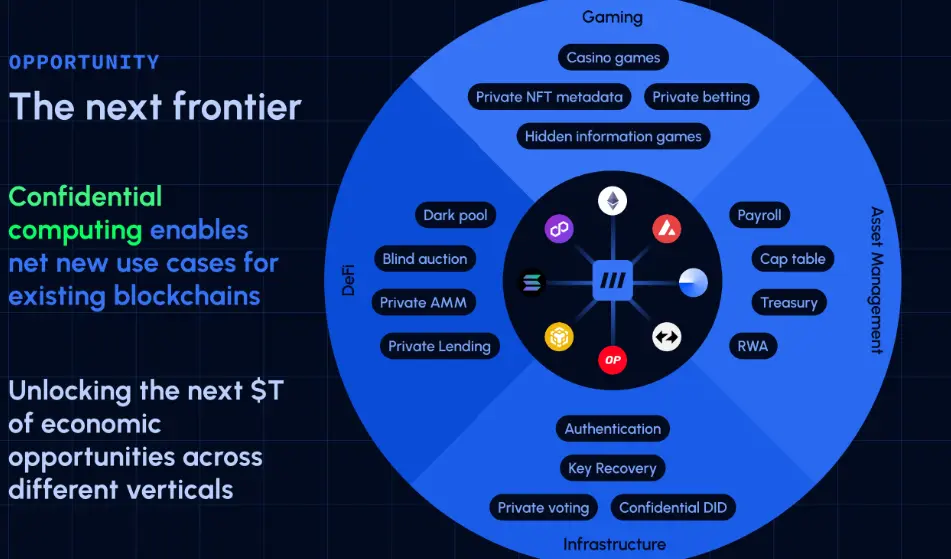

Remi Gai, the founder of Inco, believes that institutional participation and liquidity in crypto could be enhanced by confidential computing-based technologies.

Gai stated to Cointelegraph during the 2024 FHE Summit that institutions prioritize privacy:

“Institutions are still having a hard time entering the space because everything is transparent. If you enable an experience similar to what they’re comfortable with in Web2, suddenly, this could bring more liquidity, use cases, bigger participants and money to enter the space.”

Financial institutions are presented with substantial opportunities by confidential computing technologies. For instance, computations can be executed on encrypted data without the need to decrypt it using fully homomorphic encryption (FHE) solutions.

Gai suggests that the crypto space could access the next $1 trillion in capital through the implementation of confidential computing, provided that technological advancements persist.

In 2024, there has been a surge in interest in privacy-preserving technologies, such as ZK-proofs, in part due to the most recent regulatory decisions regarding privacy-oriented protocols, such as the crypto mixing protocol Tornado Cash.

Alexey Pertsev, the developer of Tornado Cash, was subjected to an extension of his pre-trial detention on November 23 as he awaited legal proceedings.

Nevertheless, on November 26, a three-judge panel of the Fifth Circuit Appeals Court ruled that the Office of Foreign Assets Control exceeded its authority in sanctioning Tornado Cash’s immutable smart contracts.

This decision reversed a lower court’s decision and granted the platform’s users a partial summary judgment.