In the last 24 hours, the price of Ethereum options has risen by up to 18%, going beyond the $3,650 level.

Over the past twenty-four hours, the price of Ethereum (ETH) has increased by an astounding 18%, surpassing $3,650, while daily trading volume has increased by an even more astonishing 250%.

This occurred as Bloomberg analyst Eric Balchunas increased the probability of spot Ethereum ETF approval from 25% to 75%. In addition, the analyst noted that the US SEC has requested 19b-4 filings from exchanges such as the Nasdaq and NYSE. Balchunas observed that the US SEC is probably responding to political pressure, given the lack of interaction between the regulator and issuers the day prior.

Nevertheless, according to Nate Geraci, president of the ETF Store, the ultimate determination concerning the registration mandate for individual funds (S-1s) remains outstanding, notwithstanding the issuers’ submission of the 19b-4 filings.

The potential separation of SEC approval for the exchange rule changes (19b-4s) and the fund’s registration (S-1) could cause a delay in the latter, which could extend beyond the May 23 deadline for VanEck’s Ethereum spot ETF request. This method allows the regulator to evaluate and approve the required documents.

The Expiration of Ethereum Options

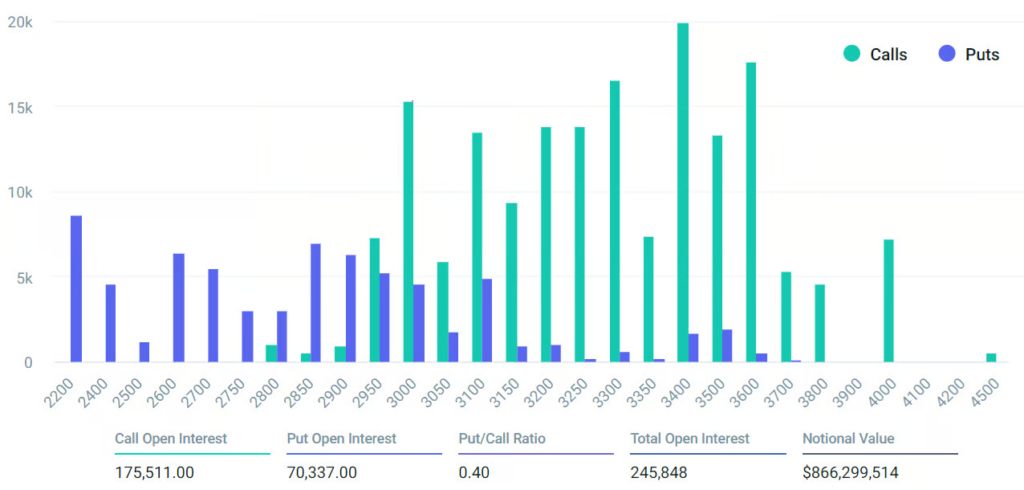

The increase in ETH shares’ price following the rising demand for spot Ethereum ETFs has stimulated interest in ETH options’ weekly and monthly expirations. According to data from the cryptocurrency exchange Deribit, the open interest for the May 24 expiration is $867 million, whereas for the May 31 expiration, it is an astounding $3.2 billion.

Similarly, the monthly open interest for ETH options on CME is a mere $259 million, whereas it is $229 million for OKX. Deribit’s call-to-put ratio exhibits a notable inclination towards call (buy) options, suggesting that speculators purchase a greater volume of call options than put options.

If options are settled at 8:00 am UTC on May 24, they will be valued at only $440,000 if the price of Ether remains above $3,600. If ETH trades above these levels, the opportunity to sell it at $3,400 or $3,500 becomes irrelevant in this scenario.

Those possessing call options with a maximum value of $3,600 will exercise their prerogative and profit from the price differential. Should ETH continue to trade above $3,600 until the weekly expiration, a significant $397 million in open interest would be generated in favor of call options.