The Aave community has raised concerns about the proposal, questioning its effectiveness in addressing key risks.

A new proposal on Aave proposes hard-coding the price of Ethena’s USDe to match Tether’s USDt in Aave’s pricing feeds.

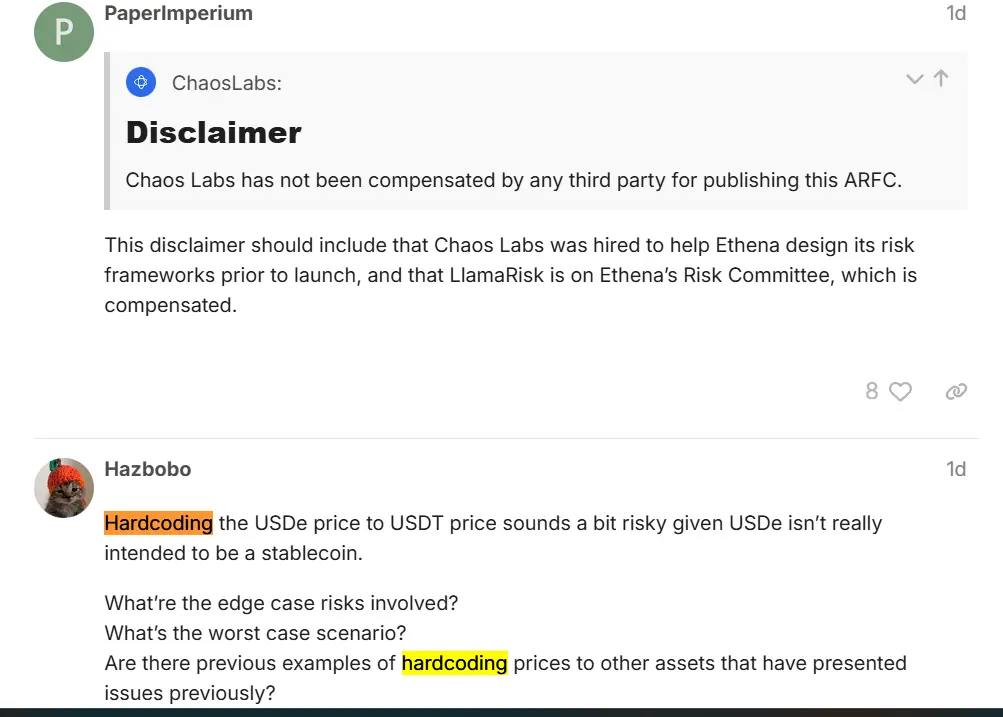

On January 3, Chaos Labs and LlamaRisk submitted a proposal to safeguard Aave users from secondary market fluctuations.

Notably, LlamaRisk is a member of Ethena’s risk committee.

The proposal is as follows:

“By linking USDe’s value directly to USDt, we align the sUSDe oracle with USDt pricing, ensuring seamless integration and avoiding disruptions caused by transient price fluctuations in USDe.”

Aave is the most extensive decentralized finance (DeFi) lending protocol, with a total value of $37 billion that has been secured.

This protocol enables users to borrow and lend cryptocurrencies without the need for intermediaries.

Users have the option to deposit assets into Aave’s liquidity pools and either borrow using crypto as collateral or earn interest.

USDe is a synthetic dollar stablecoin that is supported by onchain assets and derivatives, in contrast to USDT, which is reliant on fiat reserves.

It was developed by Ethena. According to CoinGecko, USDE is currently the third-largest stablecoin, with a market capitalization of $5.85 billion, following USDt.

What Is Behind Peg USDE To USDT?

Aave currently employs Chainlink’s USDe/US dollar price input to value staked USDe (sUSDe), a staked version of USDE.

The proposition suggests that a 5% decrease in the price of USDE could result in the liquidation of over $300 million in USDE-backed loans on Aave. This could result in the sale of collateral to satisfy outstanding debt.

“To reduce the risk associated with a USDe depeg event, we recommend that USDe’s price be hardcoded to USDT,” the authors stated.

Community Outrage

Aave users have expressed skepticism regarding the proposal, as they query whether it adequately mitigates fundamental risks.

According to user Hazbobo, the process of hardcoding the USDe price to the USDT price appears to be somewhat hazardous, as USDe is not specifically designed to function as a stablecoin.

“What are the potential risks associated with the edge cases?” What is the most detrimental scenario?

The proposal was criticized by ElliotNess, another community member, for neglecting to address the underlying risk factors.

“This ARFC is disappointingly low-quality, as it fails to investigate any potential conflicts between two service providers.” In all honesty, this can be said of every non-hardcoded asset specified on the Aave protocol,” they observed.

ElliotNess questioned the rationale behind pegging USDE to USDT, arguing that if Aave intends to hardcode USDe’s price, it could as well peg it directly to $1.00 to prevent secondary market price deviations entirely.

The proposition is currently in the preliminary stages of discussion, and there is no scheduled formal vote at this time.

AAVE was trading at $340 at the time of publication, representing a 7% increase in the past 24 hours and a 230% increase over the past year.

Aave’s expansion into new markets, such as BNB Chain, Scroll, ZKsync Era, and Ether.fi, has been the primary factor driving its growth in 2024.

In 2025, the protocol is also considering additional integrations, including Sonic, Mantle, Ethereum layer 2 Linea, Bitcoin layer 2 BOB, Spider Chain, and Aptos, subject to community approval.

Ethena’s Roadmap for 2025

Ethena experienced a 17% increase in value subsequent to the publication of its 2025 roadmap, which delineated its intentions to integrate with Telegram and introduce a new dollar savings product.

iUSDe, a wrapped version of sUSDe, was introduced in the Jan. 3 roadmap and presently provides a 10% yield.

Ethena has disclosed its intention to incorporate sUSDe into Telegram, capitalizing on the platform’s 900 million users.

The integration will introduce a payment and savings app that is based on sUSDe, with the objective of providing a “neobank experience” within the messaging platform.