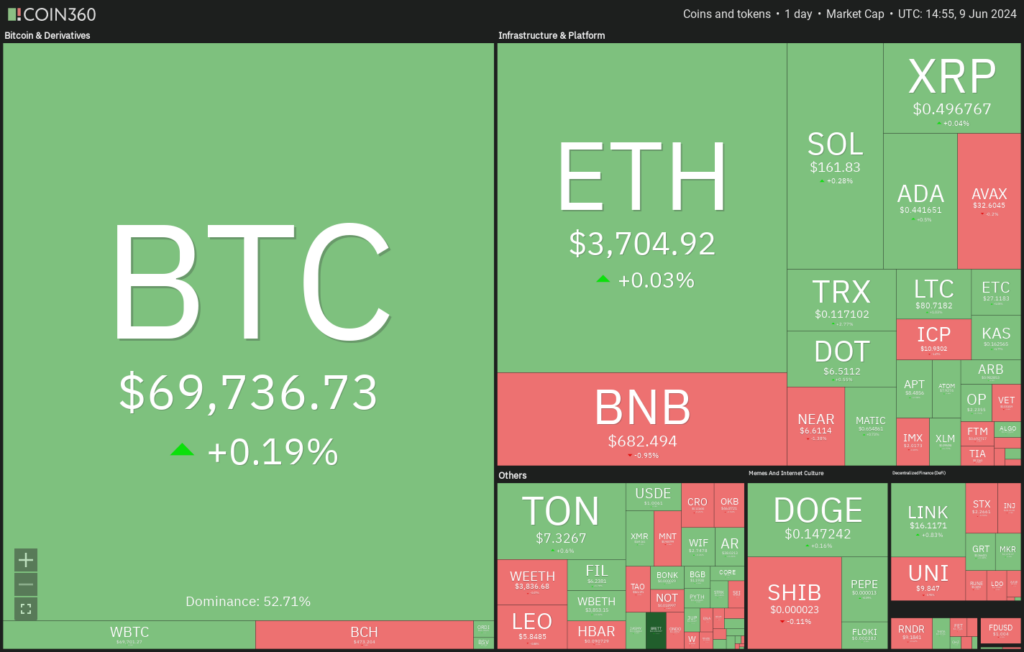

Bitcoin may rise if $69,000 holds as support, potentially boosting BNB, TON, FIL, and INJ. Inflows into Bitcoin ETFs indicate strong market confidence.

If Bitcoin succeeds in turning the $69,000 mark into support, BNB, TON, FIL, and INJ might all rise.

Although the price of Bitcoin BTC$69,678 is below its intraweek high of about $72,000, the bulls are still attempting to keep it above $69,000. With slight increases of over 2%, Bitcoin is expected to close the week on track. Customers have stuck with Bitcoin even if it hasn’t been able to break through the overhead resistance.

According to statistics from Farside Investors, spot Bitcoin exchange-traded funds had inflows of almost $1.7 billion this week. As of June 6, the total investments in spot Bitcoin ETFs amounted to $15.5 billion. The robust purchasing indicates that traders believe the upward trend will continue.

However, on June 7, Bitcoin dropped, which caused a decline in the number of altcoins. According to Trader Daan Crypto Trades, there was a $1.3 billion decline in Bitcoin’s open interest and a $800 million decline in Ether’s throughout the downturn. The fall hasn’t alarmed investors. Given that risk assets may profit from future moves the Federal Reserve takes, QCP Capital thinks that Bitcoin and Ether will probably reach local lows.

Could Bitcoin continue to trade above $69,000 and begin to rise again? Will cryptocurrencies jump in value next? Our next task is to examine the top 5 cryptocurrencies that appear robust on the charts.

Analysis of the price of bitcoin

On June 7, Bitcoin experienced a substantial decline from the minor resistance of $72,000, indicating that bears are still active at higher prices.

The 20-day exponential moving average ($68,603) supports the pullback, indicating that bulls still see dips as opportunities to purchase. The bulls will attempt to push the BTC/USDT pair to the overhead resistance of $73,777 once more if the price bounces off the 20-day EMA with power. Should this barrier be broken and closed above, a rally to $80,000 and even $88,000 could be possible.

On the other hand, a price breach below the 20-day moving average will indicate that the bulls have given up. The price might then drop to the 50-day simple moving average ($65,807).

For a while, bitcoin prices have fluctuated between $66,500 and $72,000. A pullback is underway due to the price’s inability to break above the overhead resistance, with support being sought at around $69,000. To increase the likelihood of a rise to $72,000, buyers must push the price above the 20-EMA and hold it there.

A closure below $68,420 on the downside will shift the short-term advantage in the bears’ favor. The pair might then crash to $66,500, a solid support level.

Analysis of BNB prices

On June 6, BNB$ 677 began a decline from $722, suggesting short-term traders were booking profits. Regarding support, the 20-day EMA ($639) is critical to watch.

It will indicate that traders are buying on dips and that sentiment is still bullish if the price vigorously bounces back off the 20-day EMA. That will make it more likely that the upward trend will resume. After that, the pattern target of the BNB/USDT pair might rise to $775.

This optimistic assessment will be rendered useless if the price breaks below the $635 breakthrough barrier shortly. That could snare the belligerent bulls and pull the pair toward the upward trend line.

The bears could drag the price below the 20-EMA, but only once it reached the 50-SMA. This implies that at lower levels, sales stop. The bulls will push the price back above the 20-EMA. Should they take such action, the pair may rise to $695 and then $722.

On the other hand, a price decline from the 20-EMA will indicate that bears are attempting to turn the level into resistance. After that, the pair might fall to the 50-SMA. The next stop might be $635 if this support breaks. Therefore, it’s crucial to keep an eye out for it.

Analysis of Toncoin prices

Short-term traders may have been tempted to book profits due to the bulls’ persistent inability to keep Toncoin (TON) above the overhead resistance level of $7.67.

The fact that the decline is finding support at the 20-day moving average ($6.80) is encouraging. The bulls will make another effort to break through the barrier at $7.67 if the price moves higher from its current position. If they succeed, the TON/USDT pair will move faster toward the psychological $10 milestone.

On the other hand, it will indicate that the bulls are pulling out quickly if the price declines from the current level or the overhead resistance breaks below the 20-day EMA. The pair might drop to $6 as a result.

The lower levels encouraged buying despite the TON/USDT dropping below the 50-SMA. The $7.67 overhead resistance level is where the bulls will attempt to drive the price. The next leg of the trend might begin with a break and close above this level.

On the downside, the uptrend line is a crucial mark to watch. This support’s failure will indicate the beginning of a more significant correction. The $6 to $6.26 range will likely support the pair.

Analysis of Filecoin Prices

For several days, Filecoin FIL$6.24 has bounced between $5 and $6.77, suggesting that the bulls are attempting to build a base.

On June 7, the bulls attempted to drive the price above the overhead resistance, but as the candlestick’s extended wick indicates, the bears are tenaciously holding the level. The fact that the purchasers stopped the decline at the moving average is encouraging. The price may indicate the beginning of a new upmove if it rises from its current level and breaks above $6.77. The pair FIL/USDT may increase to $8.54 and, after that, to $9.35.

In contrast to this presumption, a steep decline from the above resistance will indicate that the pair might stay inside the range for a while longer.

The 4-hour chart indicates that the 50-SMA supports the decline from the overhead resistance of $6.77. The upsloping 20-EMA and the positive zone of the RSI indicate buyer advantage. If this level is reached, the pair may test the minor resistance at $6.77. Alternatively, there is a minor barrier at $6.50.

More than likely, the bears have different ideas. The price will attempt to be pulled below the 50-SMA. Should they take such action, the two may drop to $5.60 and then $5.48.

Subjective price analysis

Injective (INJ) has established an ascending triangle pattern, and it will end on a break and close above $29.93.

The RSI has entered the positive zone, and the 20-day EMA ($26.15) has steadily increased, indicating a modest advantage for the bulls. The INJ/USDT pair is expected to gain momentum and rise to $36.50, finally reaching the pattern target of $41.74 if buyers break through the resistance at $29.93.

If the price declines and breaks below the support line, this bullish opinion will be disproved shortly. Then, the pair might drop to $18.

The bulls pushed the price above the overhead resistance of $29.93 but could not maintain the breakout, as the 4-hour chart demonstrates. This indicates that the bears are selling above $29.93 with vigor. The price fell and passed below the 20-EMA, but it rose above the 50-SMA quite rapidly.

The bulls will attempt to break through the resistance zone between $29.93 and $31. The pair is likely to begin a new rise if they are able to do it. The bears will have the upper hand if there is a break below the 50-SMA.