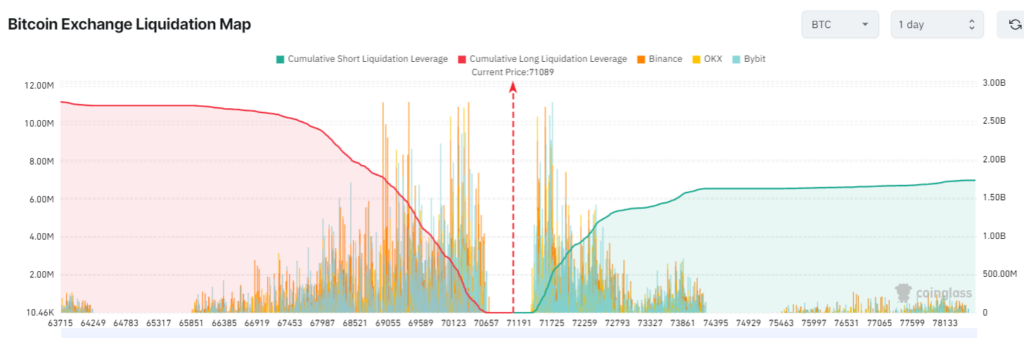

A Bitcoin price exceeding $72,000 would liquidate $800 million in leveraged shorts, rendering it an all-time high for BTC.

The psychological barrier of $75,000 would be breached if the price of Bitcoin reached $72,000, which would serve as a “fuse.”

According to analyst Willy Woo, the event of Bitcoin reaching $72,000 would result in a surge of mass liquidations, which would pave the way for new all-time highs.

In a post on June 5, Woo addressed his 1.1 million followers:

“Tapping $72k is the fuse set to start a liquidation cascade. $1.5b of short positions ready to be liquidated all the way up to $75k and a new all-time high.”

Bitcoin increased by 3.15% in the 24 hours preceding 8:05 am UTC on June 5 to trade at $71,124. CoinMarketCap data indicates that the weekly chart of the world’s first cryptocurrency is up 4.8%.

Bitcoin price at $72,000 would liquidate $800 million worth of leveraged shorts

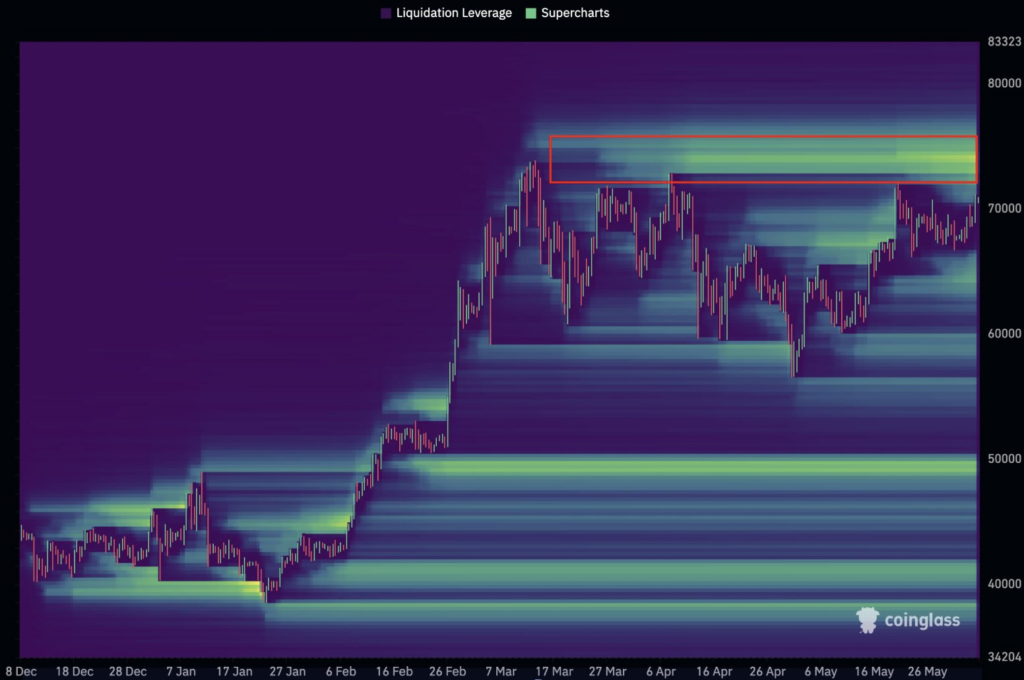

The $71,500 and $72,000 thresholds substantially resist the Bitcoin price.

CoinGlass estimates that a prospective increase in price above $72,000 would result in the liquidation of $800 million in cumulative leveraged short positions across all exchanges.

Leveraged short positions valued at $800 million would be liquidated if Bitcoin reached $72,000.

The $71,500 and $72,000 thresholds substantially resist the Bitcoin price.

Over $1.2 billion in leveraged short positions will be liquidated if Bitcoin surpasses the $72,500 threshold. Bitcoin has experienced a 3.4% decline from its previous all-time high of $73,740, achieved on March 14.

According to Rekt Capital, a prominent crypto analyst, Bitcoin’s “danger zone” following the halving of its distribution concluded on May 6, when it decisively surpassed the $60,000 reaccumulation range.

It has been confirmed that the post-halving danger zone has ended, as Bitcoin’s price has increased by more than 12.5% since May 6.

Bitcoin breaks two-week downtrend

In an X post, Rekt Capital reported that the Bitcoin price emerged from a two-week downtrend on June 3.

“Bitcoin broke its two-week downtrend today. However, we have seen upside wicks beyond this downtrend before. Which is why a Daily Close later today is needed to confirm this breakout.”

According to Rekt Capital, Bitcoin must still convert the $72,000 resistance into support to enter the “parabolic phase” of the bull cycle.