Bitcoin may experience another parabolic increase, with a price goal of $260,000 by the end of 2024.

Although the price of BTC crossed $62,000 for the first time in August, it is finding it difficult to sustain its positive momentum. However, according to one researcher, Bitcoin may be ready for a breakout that could see values reach six figures.

In Q4, Bitcoin is expected to have a “steepest kind of ascent.”

Independent technical expert Gert van Lagen, it seems inevitable that the current Bitcoin price action, currently at $62,403, will have a spectacular result. Van Lagen draws attention to the development of a parabolic curve in an X post from August 27. BTC has been rising in a step-like pattern since then.

Additionally, the weekly chart shows how a unique cup-and-handle (CnH) pattern formed. Since October 2021, or about three years, the pattern has developed.

A parabolic rise can be initiated by a successful breakout from a CnH pattern, which, during its development, establishes a trend bottom and then a higher sideways consolidation.

According to the renowned trader and founder of Thepatternsite.com, Tom Bulkowski, the success percentage of a CnH pattern is likewise very high, at 95%.

Base one was formed in the parabolic curve at the bottom of the market in November 2022. Base 2 was validated by a rally from the market bottom at $15,460 to $25,290. Base 3 resulted from BTC’s sideways consolidation between $30,000 and $25,000 between April 2023 and September 2023.

As time passed, Bitcoin had its first parabolic ascent of 198%, hitting a new peak in March 2024 of $73,737.

The last stage of the parabolic curve, base 4, has been formed on the BTC/USD chart over the previous few weeks. Base 4 is the “handle” portion of the concurrently approaching breakout CnH pattern.

The analyst predicts “the steepest kind of ascent BTC has ever witnessed,” or a blow-off-top surge, after BTC breaks over base 4.

The price target is above $260,000 by the end of 2024, a 312% increase over the present price of BTC.

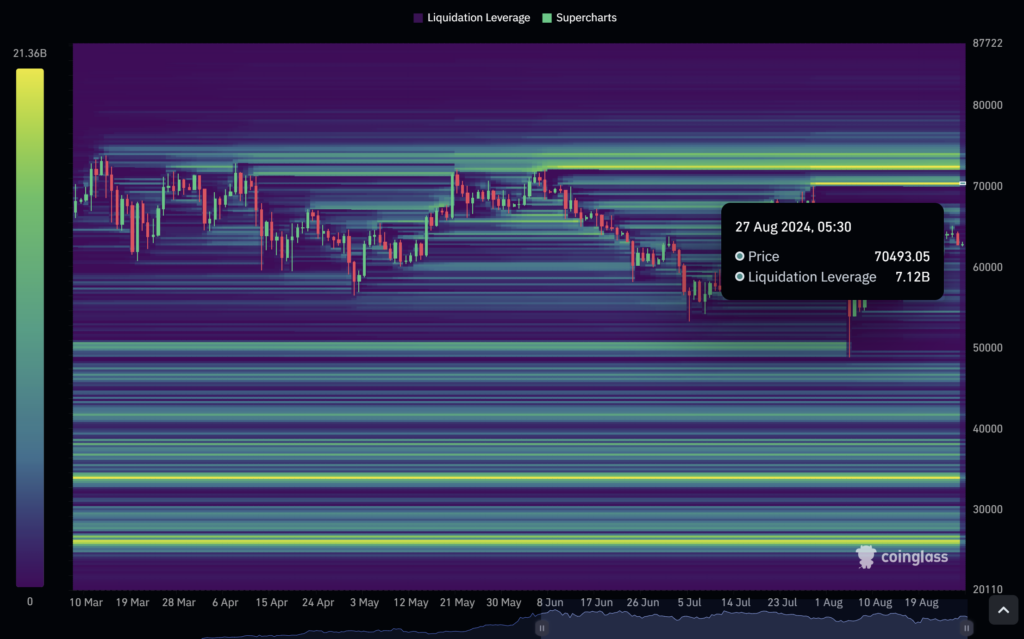

$7 billion worth of shorts will be settled at $70,500.

The bitcoin price, which broke above $70,000, its previous all-time high range, will not be without some ramifications for futures traders. CoinGlass data predicts a significant liquidation event after BTC hits $70,493.

As can be seen, as of August 27, short liquidations totaled $7.18 billion at that price. Similarly, another $6.54 billion in short positions will be liquidated at $72,581, indicating that bullish and bearish traders are still well-positioned in the futures market.

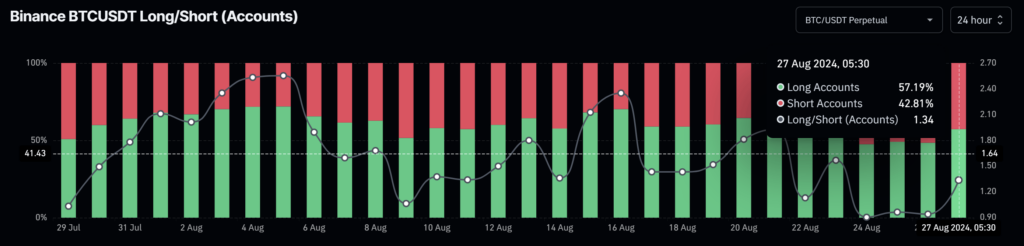

Despite the decline in the price of Bitcoin over the last day, the long and short accounts have become highly positive.

According to the data, 57.19% of the accounts are currently lengthy. However, as the long/short ratio held steady at 1.01, the taker buy/sell volume for both long and short traders was nearly equal.

Bitcoin is about to enter the batshit season

Another analyst made a similar prognosis about Bitcoin, which Cointelegraph reported. This analyst thought it would reach as high as $150,000 by the end of 2024.

Real Vision expert Jame Coutts praised a well-known tone, predicting that the price movement of Bitcoin will enter the “banana zone” or “batshit season.”

Thebatshit season is characterized by a parabolic rally in which there is a notable increase in both price and volume. This leads to heightened market interest and a further extension of the exponential climb.

Furthermore, researcher Smithson With on Bitcoin also released a study that accurately predicted the peak of Bitcoin from earlier bull cycles. While With’s pricing targets changed throughout 2025, $164,173 is the lowest anticipated price by January 1 of that year.

These forecasts often follow the same trend, indicating that it will move quickly once Bitcoin breaks its prior all-time high.