US Bitcoin ETFs acquired nearly as much Bitcoin as they did in May during the first complete trading week of June.

Spot Bitcoin, exchange-traded funds (ETFs) in the United States, acquired the equivalent of approximately two months’ worth of the cryptocurrency’s mining supply during the first week of June.

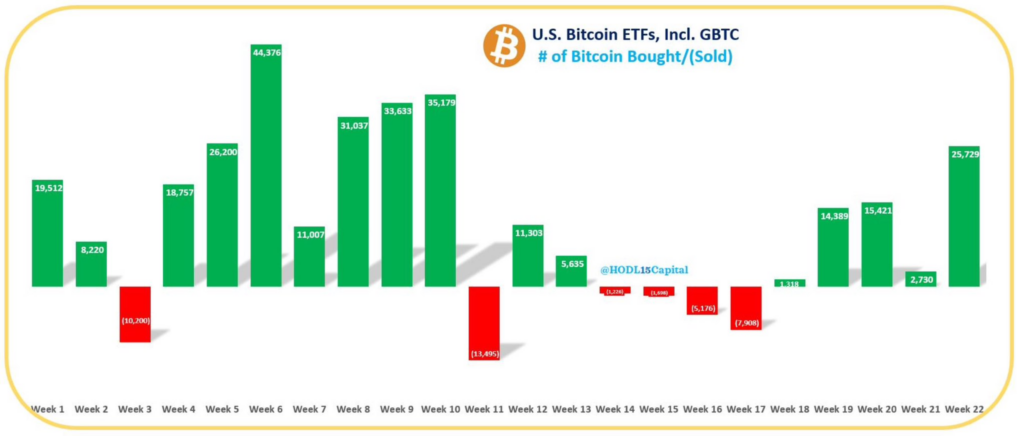

According to data from HODL15Capital, the 11 ETFs acquired 25,729 Bitcoin during the June 3–7 trading week, which is approximately $1.83 billion. This amount is approximately eight times greater than the 3,150 new BTC mined during the same period.

The total amount of Bitcoin obtained in the week was nearly equivalent to the entire month of May, with 29,592 BTC, according to HODL15Capital’s count. This marks the most significant week of buying since mid-March, when Bitcoin reached its current all-time high of $73,679.

Since their January debut, the 11 ETFs have experienced $15.69 billion in net inflows, which includes $17.93 billion in net outflows from Grayscale’s fund. The total assets under management (AUM) of the 11 ETFs is approximately $61 billion.

Bitcoin advocates have long referred to cryptocurrency as “digital gold” due to its inherent scarcity mechanism, which predicts that only 21 million BTC will ever be issued.

Nate Geraci, the president of the ETF Store, observed in a June 9 X post that the AUM of Bitcoin ETFs is approximately 60% of that of gold ETFs in the country, even though gold ETFs have been in existence for 20 years and Bitcoin ETFs have only been trading for five months.

According to Cointelegraph Markets Pro, Bitcoin reached a high of $71,093 on June 5 due to the significant increase in funds flowing into U.S. Bitcoin ETFs. This marks the first time the asset has surpassed $71,000 since May 21.

According to “Radar Bear,” the co-founder of the crypto exchange, the cryptocurrency has encountered difficulty surpassing its current high due to its price being “more heavily influenced by macroeconomic factors and geopolitical events” (Cointelegraph, June 7).