Ethereum bucks the trend with $13.1 million in inflows, while overall cryptocurrency outflows reach $13 million, led by significant Bitcoin withdrawals.

According to CoinShares’ most recent weekly report, there has been a noticeable change in the cryptocurrency investment products market, with the industry seeing its most significant outflows in three months.

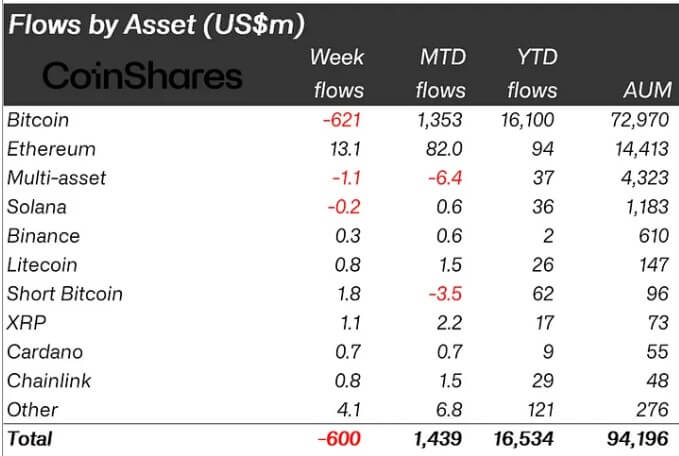

Investors withdrew $600 million from the market last week, with Bitcoin goods suffering the most with $621 million in withdrawals.

In the meantime, around $2 million was invested in short-Bitcoin instruments, which reflected the pessimistic outlook.

The head of research at CoinShares, James Butterfill, ascribed these changing opinions to a “more hawkish-than-expected FOMC meeting.” The US Federal Reserve’s Federal Open Market Committee decided last week to keep interest rates at their present levels, which many experts predicted indicated there would only be one rate drop this year.

According to Butterfill, investors have been compelled to lessen their exposure to assets with a fixed supply, such as Bitcoin. He continued, saying:

“These outflows and recent price sell-off saw total assets under management (AuM) fall from above $100 billion to $94 billion over the week.”

In the meantime, other nations were affected by the negative trend in the US. $15 million, $24 million, and $15 million were removed from Canada, Switzerland, and Sweden, respectively. Conversely, minor inflows of $1.7 million, $700,000, and $17.4 million were observed in Australia, Brazil, and Germany.

Furthermore, last week’s trading volume for cryptocurrency ETPs was only $11 billion, a substantial decrease from the $22 billion weekly average. Despite this, 31% of all trading volumes on major exchanges comprised these products.

Altcoin is still seeing inflows.

Even if Bitcoin was trending downward, most altcoins had a good week and attracted a sizable amount of capital.

With an extra $13.1 million in inflows, Ethereum’s upward trajectory continues, bringing its total to $82 million for the month. The widely anticipated introduction of spot Ethereum exchange-traded fund (ETF) products in the US, which analysts say will improve market accessibility for the developing industry, is responsible for its recovery.

While Litecoin, Chainlink, and other assets witnessed moderate flows, other altcoins like Cardano and Lido received more than $1 million.