Amid recent market fluctuations on July 9, 2024, Bitcoin sees significant gains following $300M in ETF inflows

The German government entity received over $200 million worth of the asset back from various exchanges late in the U.S. day, which helped revive sentiment, resulting in Bitcoin finding some stability above $57,000 following Monday’s decline to $55,000. A wallet address belonging to the German Federal Criminal Police Office (BKA) sent over $900 million to various other addresses, spooking traders.

Latest Price

BTC was trading at approximately $57,400 during the European morning, a 1% increase in the last 24 hours. On Monday, it had declined to $55,000. Arkham data indicates that the entity received refunds from Kraken, Coinbase, and Bitstamp within 12 hours. This suggests that the assets were sent to these exchanges but were not ultimately traded.

On Monday, spot bitcoin ETFs experienced a net inflow of nearly $300 million, the highest since early June, when the cryptocurrency traded above $70,000. BlackRock’s IBIT was the most active buyer, with roughly $180 million in net inflows. Fidelity’s FBTC was the second most active buyer. Grayscale’s GBTC, notorious for its outflows, amassed more than $25 million in purchases.

CoinShares, an investment firm, stated in a report released on Monday that certain investors may perceive the decline in the price of bitcoin as a purchasing opportunity. July is anticipated to be a generally bullish month for the crypto market, as it has historically experienced a median return of 9%, and traders anticipate that this trend will persist.

Bitcoin’s mining difficulty decreased from 83.6 TH/s to 79.50 TH/s on June 5, according to data monitored by Coinwarz. This level was last observed in March, one month before the halving. CryptoQuant observed that this is one of the most significant difficulty reductions since the collapse of crypto exchange FTX, which resulted in a more than 10% decline in bitcoin prices within a week.

A proportional decrease in the network’s mining power results from downward adjustments. A decrease can be advantageous for smaller miners and result in profits for farms forced to close due to their inability to maintain costs. In June, miners were a significant source of pressure on the price of bitcoin, with over $1 billion worth of BTC sold over two weeks, as prices fluctuated between $65,000 and $70,000.

Today’s Chart

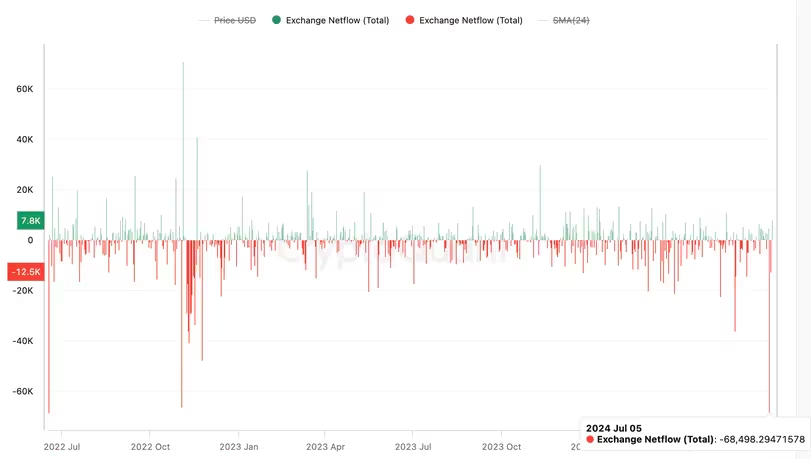

The daily net inflow of BTC into wallets associated with centralized exchanges is depicted in the chart.

The greatest net outflow of over 68,000 BTC since late 2022 was observed on exchanges on Friday.

Investor prejudice is assumed to be represented by outflows in the context of a long-term holding strategy.