Bitcoin price rises up to 2% in recent days due to the anticipation of investors in the return of money printing.

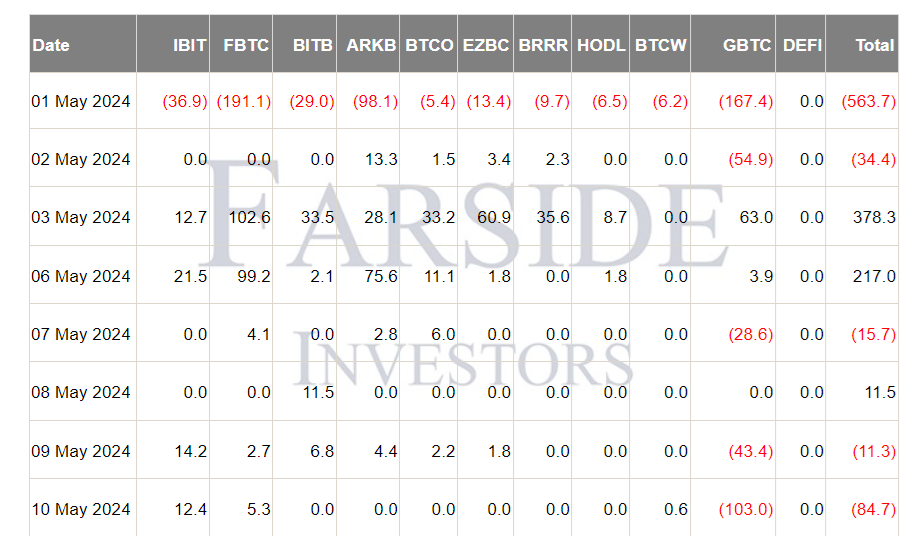

Bitcoin recovered after two days of difficulty, surpassing the $61,500 resistance, and gained 2% over the past twenty-four hours. The ongoing ascent above $62,500 indicates that Bitcoin remains susceptible to favorable price fluctuations, notwithstanding the $100 million net outflows from U.S. spot Bitcoin exchange-traded funds (ETFs) over four days.

The positive outlook on cryptocurrencies can be attributed to a number of factors, starting with China’s declaration that it would issue long-term bonds worth $138 million to stimulate the economy. Although this was anticipated since the March announcement, it reaffirmed that governments are recognizing the heightened risk of recession. This was in response to data indicating that, for the first time in seven years, China’s aggregate credit decreased in April.

Reuters was informed by Zou Wang, an investment director at Shanghai Anfang Private Fund Management, that the market is now anticipating additional liquidity infusions from the People’s Bank of China, which could potentially involve interest rate reductions. Implementing such measures would further compound problems due to the U.S. Federal Reserve’s (Fed) recent expansive policies, which resulted in the first increase in the U.S. monetary supply in two years in March.

Increasing money injections into the economy may appear advantageous initially, but they can eventually lead to higher inflation, particularly if businesses and individuals postpone investment and spending. As investors in fixed-income securities realize their returns are struggling to keep pace with the escalating inflation rate, scarce assets such as Bitcoin may gain in appeal.

Investors are presumably making preparations for an ongoing pattern in which governments will be obligated to continue supplying liquidity to avert economic crises. Although one could contend that the primary advantage of increased liquidity would be for the stock market, companies are adversely affected by high interest rates, which raise their capital expenditures. Refinancing any debt issued within the last sixteen years will incur substantially higher interest rates.

Yahoo Finance reports that Fed officials indicated last week that interest rates could remain elevated for an extended period. Notably, Fed Chair Neel Kashkari of Minneapolis stated, “I believe it is far more probable that we will simply remain here for a longer period than anticipated.” Fed Chair Austan Goolsbee of Chicago remarked, “I believe we should now wait.” This approach, which may oppose the objective of increased liquidity, is deliberately crafted to postpone the onset of inflationary forces.

The fundamental purpose of the actions taken by the U.S. central bank is to incentivize increased financing by corporations and individuals to bolster the labor and consumer markets. The Fed cannot predict, however, the proportion of these borrowed funds that will be invested in scarce assets as an inflation hedge instead of being used to stimulate the economy. Even though it is premature to conduct a comprehensive assessment of these risks, Bitcoin investors are apprehensive regarding the Federal Reserve’s potential for a gentle landing.

Furthermore, an unforeseen element affected the value of Bitcoin on May 13: the reappearance of social media influencer “Roaring Kitty,” a former marketer whose contributions were crucial to the 2021 GameStop (GME) stock upswing. After nearly three years of inactivity on the X social network, the Bitcoin community appears optimistic that this individual will exert extraordinary influence.

In anticipation of a favorable transition in perception towards digital assets, cryptocurrency investors are propelled by an increasing lack of confidence in conventional finance and banks, particularly given recent government interventions such as the rescue of Republic First Bank, headquartered in Philadelphia. As a result, these investors anticipate that more individuals will adopt cryptocurrencies.