Bitcoin has outperformed U.S. stock markets and Warren Buffett’s portfolio, averaging a yearly return of around 104%, making it a standout investment.

When comparing the returns of Warren Buffett’s portfolio—which includes Apple, Bank of America, American Express, Coca-Cola, and Chevron Corp. as its top holdings—with the compound annual growth rate (CAGR) of BTC, which is BTC$69,386—it becomes evident that the two have very different risk-reward profiles and performance over various periods.

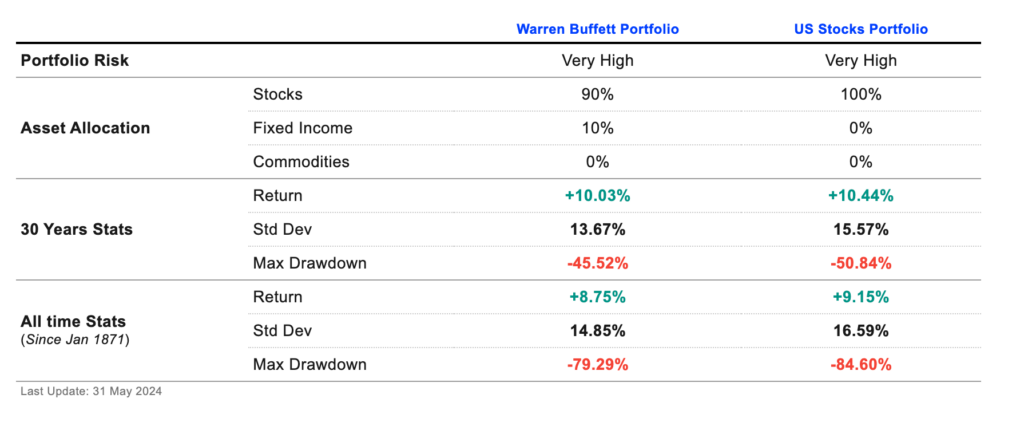

The Warren Buffett Portfolio: same rewards as stocks but with less risk

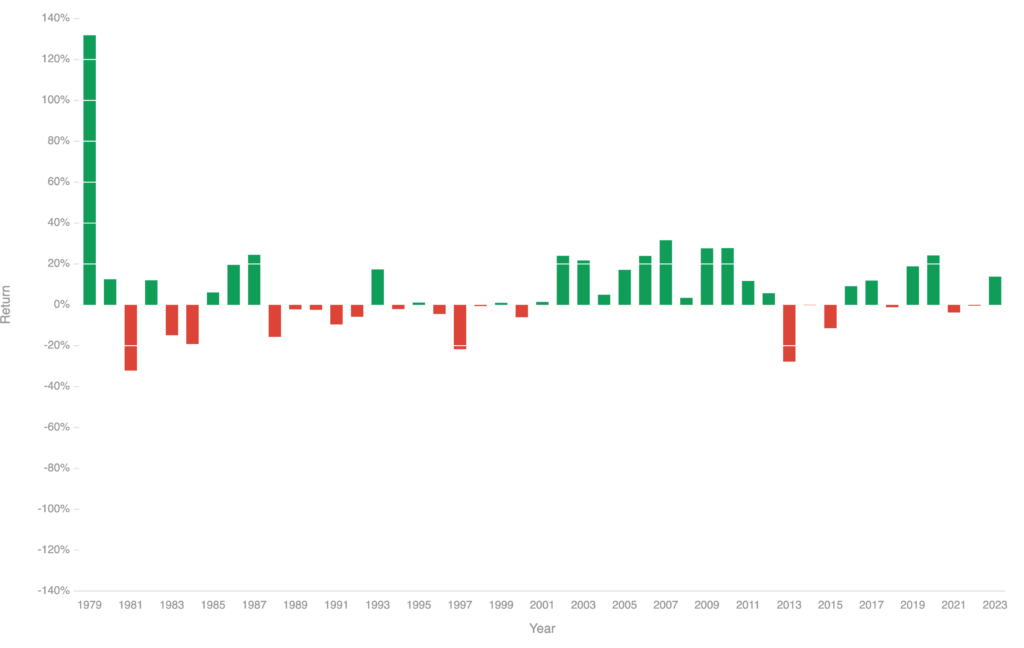

For example, during the past 30 years, Warren Buffett’s portfolio has returned 10.03% CAGR with a 13.67% standard deviation, per the data site Lazy Portfolio ETF. Comparatively, portfolios of stocks from U.S. companies have generally produced comparable returns, albeit with a more significant standard deviation.

Put another way, even if the Oracle of Omaha’s portfolio is less risky or volatile than U.S. stock portfolios, it has produced remarkable returns. His investment philosophies center on sensible risk management, long-term value investing, and a preference for companies with excellent fundamentals.

Bitcoin beats Buffett’s risk-averse portfolio.

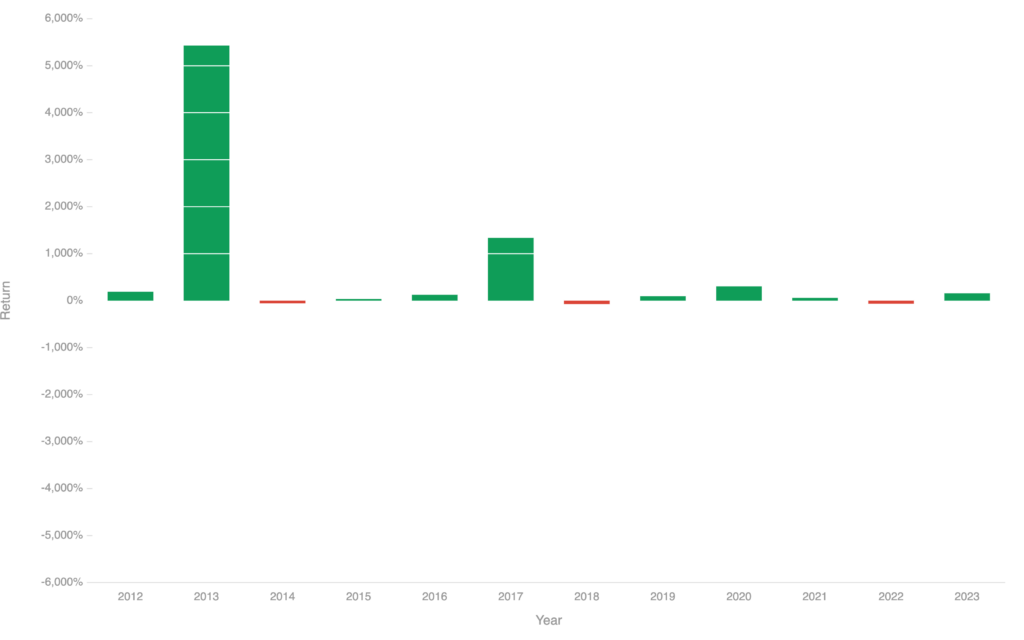

In contrast, BTC has had an awe-inspiring performance. Bitcoin has had a startling average yearly return of about 104% since it began trading in 2011. On average, over the last 13 years, this number has easily outperformed the returns on U.S. stock portfolios and those of Warren Buffett.

In comparison, gold has returned an average of 6% a year during the same period, a far lower rate of return than Bitcoin, the safe-haven alternative. This indicates that even though U.S. stock portfolios have outperformed the Warren Buffett portfolio in compound annual growth rate, risk-averse investors may want to refrain from participating due to their higher volatility.

Given its modest 6% average annual return over the previous ten years, gold has been a hedge against economic downturns and provides relative stability.

Many traders and investors regard Bitcoin as “digital gold,” a hedge against inflation and the depreciation of currencies.

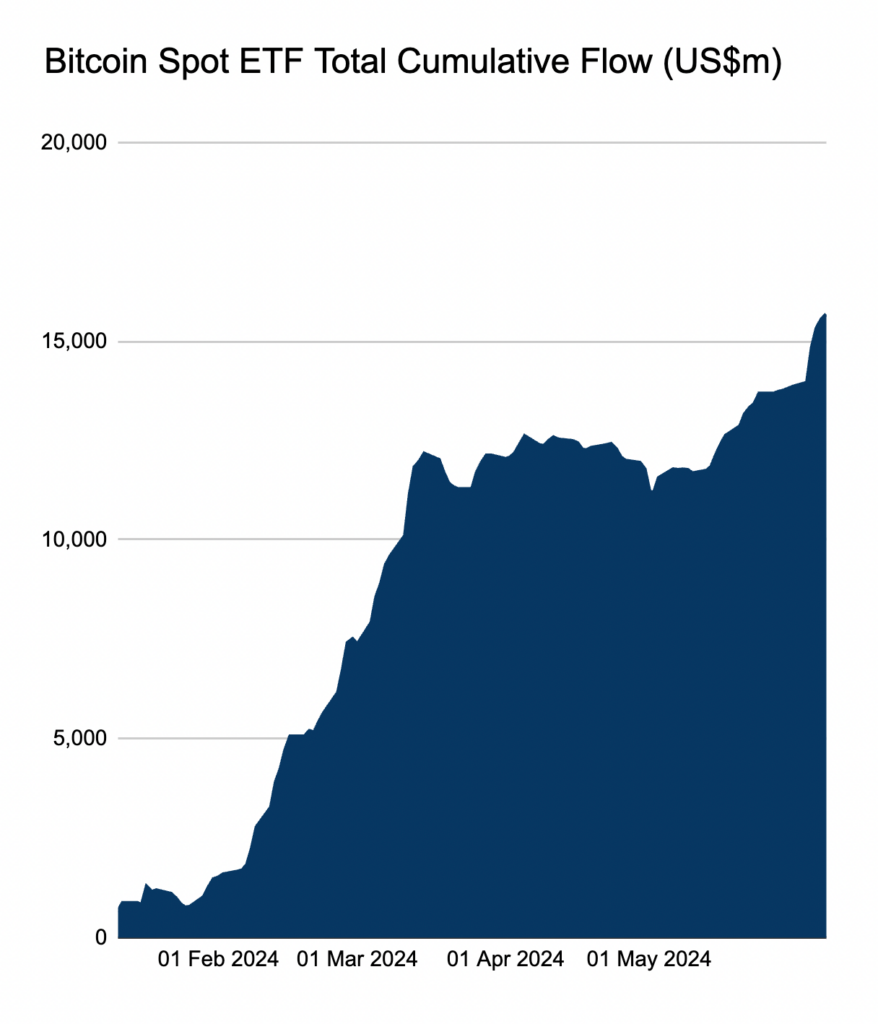

Over time, this impression has increased its allure as a benefit. Several American businesses have added Bitcoin to their reserves, including MicroStrategy and Tesla. This was followed by the introduction of exchange-traded funds (ETFs) that track spot prices of Bitcoin, which further cemented the cryptocurrency’s standing with institutional investors.

That said, in contrast to Warren Buffett’s portfolio’s consistent returns, Bitcoin’s price is still very volatile and is prone to significant swings. Bitcoin has been less volatile recently than several S&P 500 equities, such as Tesla, Meta, and Nvidia.

Despite its exposure to Nu Holdings, a pro-crypto neobank, the Warren Buffett Portfolio is a more conservative, long-term approach with steady returns and controllable risk.

In comparison, over the previous 13 years, Bitcoin has yielded far better profits despite severe volatility and multiple significant downturns.