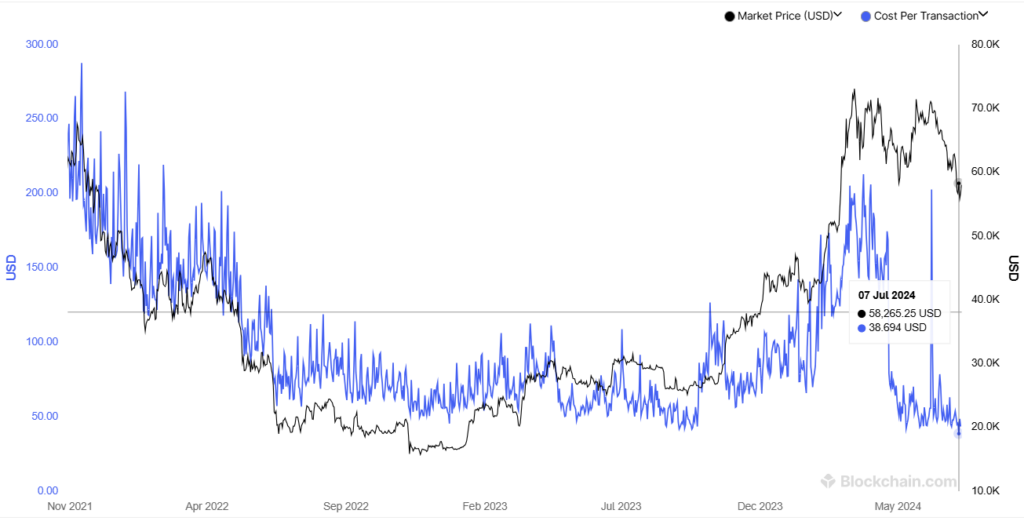

Bitcoin transaction fees hit a 4-year low, falling to $38.69. Miners remain profitable due to reduced network difficulty and lower computational power needs.

On July 7, the average fees associated with each Bitcoin transaction reached their lowest point in four years, at $38.69. This figure was last observed at the height of the COVID-19 pandemic 2020.

The revenue of the miners and the total number of transactions processed determine the cost per Bitcoin transaction for the day. As a result of two critical factors, decreased demand for block space and data volume, transaction costs decreased on July 7, when Bitcoin was trading above $58,200.

Bitcoin miners maintain profitability amid lower fees

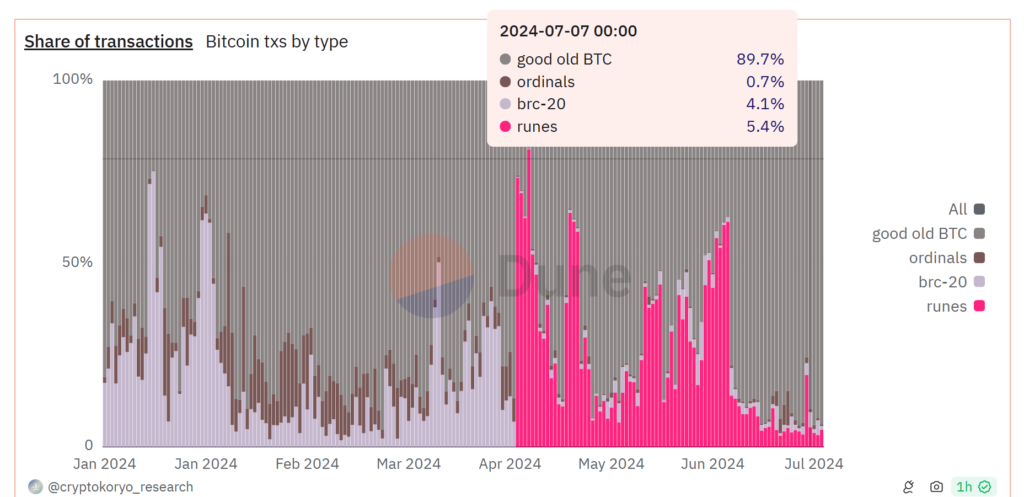

According to data from Ycharts, Bitcoin miners executed 673,752 transactions over the Bitcoin network on July 7. BTC accounted for 89.7% of the transactions, while the remaining bandwidth was allocated to other protocols, including Ordinals (0.7%), BRC-20 (4.1%), and Runes (5.4%).

The average proportion of Bitcoin miner revenue over the past six months was 1.14% of the daily transaction volume. Miners could process transactions with a comparatively lower computational capacity due to the reduced network difficulty despite the lower average transaction costs.

Reduced mining operations

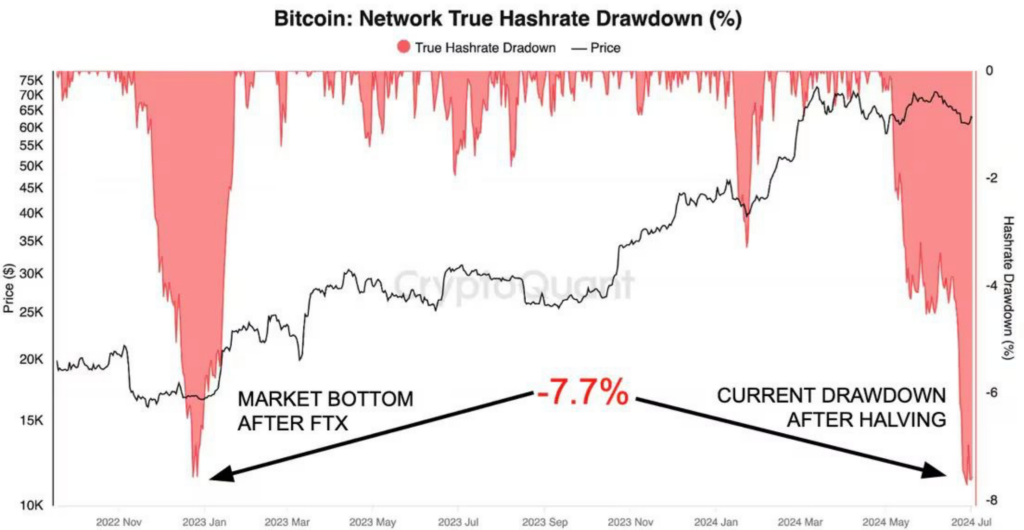

CryptoQuant, a market intelligence firm, has reported that Bitcoin miners are exhibiting signs of “capitulation” as profit margins constrict in the post-halving climate and the price of BTC continues to decline, approaching $50,000.

Miner capitulation is reducing operational costs or selling a portion of Bitcoin earnings to maintain financial stability during uncertain market conditions.

Over the past month, CryptoQuant analysts have identified numerous indications of capitulation, including the substantial decrease in Bitcoin’s hashrate.

“Bitcoin Miner capitulation mirrors December 2022 levels with a 7.7% hashrate drop, similar to post-FTX collapse conditions. Such declines often signal potential market bottoms.”

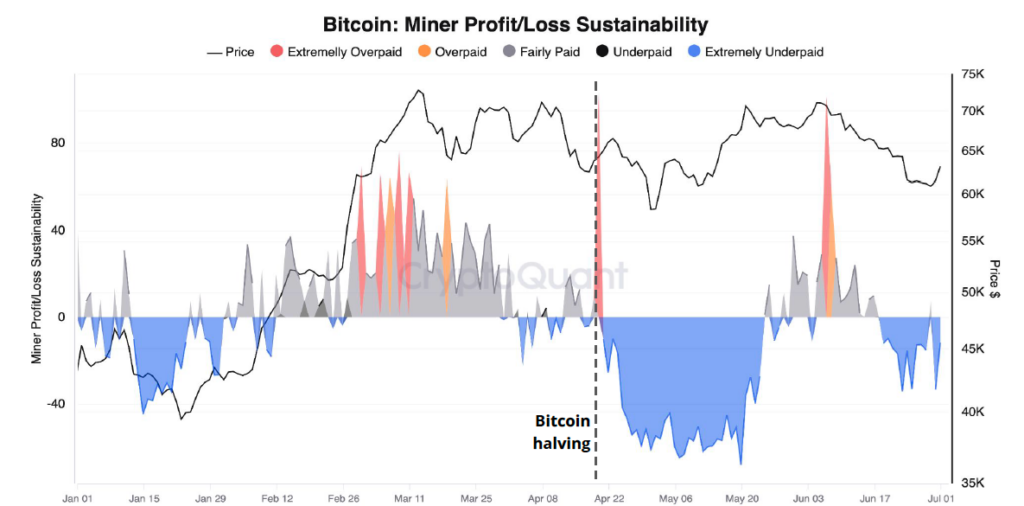

The CryptoQuant report also observed that miners have been “extremely underpaid,” as demonstrated by the miner profit/loss sustainability indicator for most of the period since the halving, as illustrated below.

Consequently, miners have experienced a 63% decrease in daily revenues since the halving of Bitcoin’s essential block rewards and transaction fee revenue.