Bitfinex whales hold 58,595 BTC long positions, showing optimism despite Bitcoin’s price drop to $57,000. Short interest also sees a minor increase.

The 58,595 BTC long positions held by Bitfinex whales show optimism despite the drop.

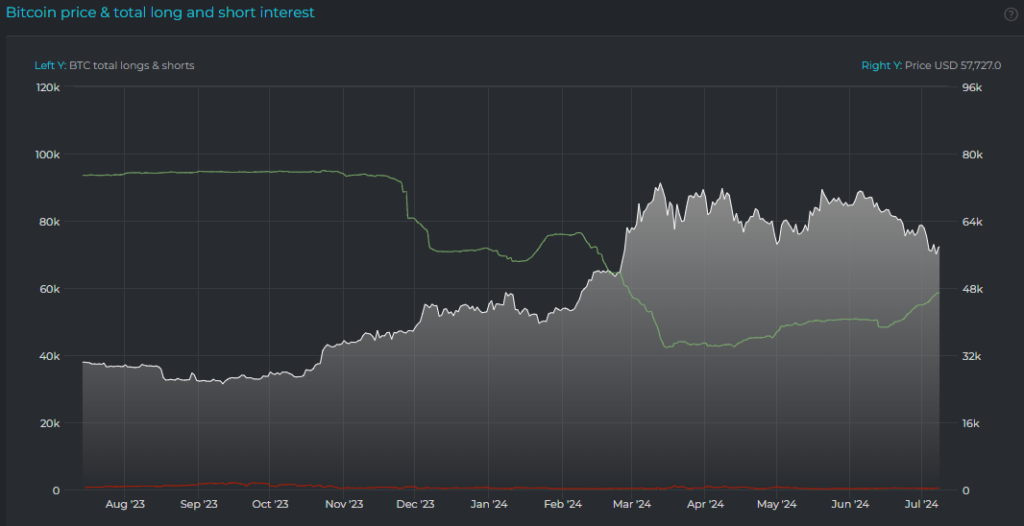

As it continues its consolidation cycle, the price of bitcoin is hovering around $57,000. Whales on Bitfinex have notably boosted their long-margin positions; they currently own 58,595 BTC. Since June 13’s low of 48,455 BTC, when the price of Bitcoin was $66,000, there has been a gain of 10,000 BTC. When Bitcoin reached its all-time high on March 1, and whales deliberately sold BTC at the peak, this level of long-margin holdings was last observed.

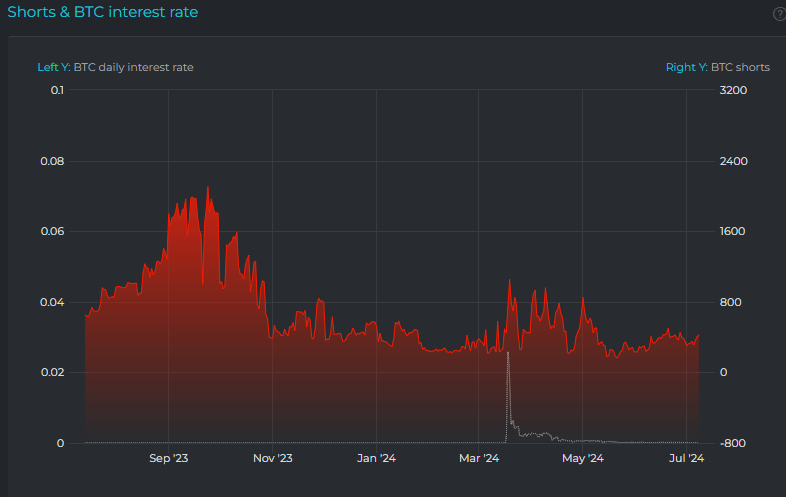

Meanwhile, short interest has marginally grown since the slump started on June 7. Approximately 423 BTC are on short interest margin as of July 8, up from 250 BTC on June 7. The minor increase in short interest indicates that traders are still considering betting against Bitcoin during this downturn, indicating a cautious mindset in the market.

While the little increase in short interest margin suggests some traders are bracing for more downward pressure, the overall increase in long positions held by Bitfinex whales points to optimism about a possible resurgence.